Telecommunications

What You Need to Know to Prepare for the FCC 600 MHz Auction

The Changes, the Challenges, and the Complexity of Readying Your Spectrum Bid

By Randy Frantz, Esri Telecommunications Solutions Director

Mark your calendars. The Federal Communications Commission (FCC) is gearing up for what promises to be the most exciting and complex spectrum auction ever attempted, beginning March 29.

So what’s all the hype about? For starters, wireless penetration in the United States passed 100 percent in 2012 and demand for high-speed services will continue to grow for the foreseeable future. In addition, about 56 percent of all mobile traffic is data-intensive video, which is expected to grow sixfold by 2018. More smart devices—coupled with consumers’ insatiable appetite for new, high-bandwidth apps—are increasing the demand on the limited radio spectrum and crowding the airways. Carriers have been asking for years for additional mobile spectrum. With the upcoming 600 MHz auction, they will get their wish—at least partially.

Traditional Versus Incentive Auction—Why Is This Auction Different?

The FCC has been conducting wireless auctions for decades, and while demand continues to surge, there is a limited supply of spectrum available. What makes this auction so interesting and complex is that it will be composed of two components: the traditional spectrum auction, which the FCC has conducted every few years since the inception of mobile services, will be preceded by an incentive auction.

In 2012, Congress authorized this innovative process to repurpose spectrum that was already being used by other licensees. The incentive auction is designed to encourage current licensees—primarily broadcasters—to relinquish their spectrum. By voluntarily participating in this incentive auction, licensees share in the proceeds generated by the sale of vacated spectrum. The entire process is designed to benefit both the current license holders and the companies that want to license more spectrum. All parties win, but the auction will be a much more dynamic process this time around.

The Players—What’s Their Next Move?

The availability of spectrum up for bid, in terms of both geography and frequency, will depend on the willingness of current license holders to participate in the process. Broadcasters need to make tough decisions regarding their existing spectrum. They can elect to participate in the auction and relinquish their broadcast rights, or they can opt out of the process. In addition, investors who have purchased broadcast stations over the past few years expect to turn their spectrum rights for a profit.

All participating stations have the option to cease operations, remain on the air by sharing a channel with another broadcaster, or move to a different open channel. Broadcasters’ and investors’ decisions will affect the location and availability of licenses for the traditional auction.

What’s Up for Grabs—and Where?

Spectrum is licensed geographically, and the 600 MHz auction will be no different—well, almost.

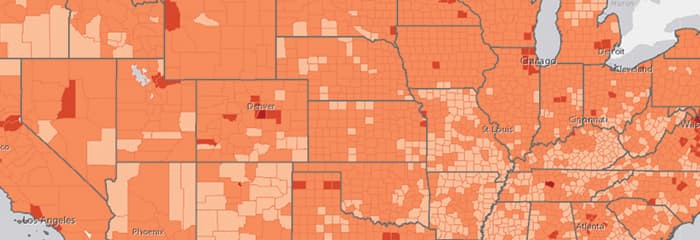

Instead of selling licenses based on the traditional geographic areas used in the past—such as Major Trading Area (MTA), Basic Trading Area (BTA), or Cellular Market Area (CMA)—the FCC created 416 new geographic divisions for the auction called Partial Economic Areas (PEAs). The FCC named each PEA using the largest city within its area. However, the PEAs will not correspond to the boundaries of any previous geographic designation.

For wireless companies planning to participate in the auction, understanding these new areas and which spectrum will potentially be available is crucial to developing a winning strategy. In contrast to previous auctions, information on the availability of spectrum by geography will not be possible to get far in advance. Wireless carriers need to be adept in processing real-time opportunities as they emerge during the auction.

What’s Next for Developing a Winning Strategy?

Fortunately, the FCC has provided a preliminary list of PEAs and spectrum that might be available for bidders, including potential values. The full list won’t be available until the completion of the incentive auction, which increases the complexity of the analysis for any bidder. In addition to not knowing exactly which spectrum will be available, companies face the challenge of understanding the demographics, existing capacity, and competitors in PEA where they may want to bid.

Due to the dynamic nature of this auction and the number of variables that companies need to consider for each and every bid, this promises to be a very exciting auction. Fortunately, with the advancement of geographic information system (GIS) tools for planning and analyzing information geographically, companies can get a grasp on all these variables and gain a competitive edge in the auction. See how the Esri mapping platform can help you prepare your smartest auction bid—visit esri.com/spectrum.