ArcUser Online

The size of the sample in Census 2000 was selected to produce reliable estimates for small areas. Given the differences in the sampling rates, is five years sufficient to produce a sampling ratio as reliable as the Census 2000 sample? Figure 2 displays the average number of years necessary to achieve the sample size of the census long form, using sampling rates from 2.5 percent to 10 percent.

For the smallest counties (those with populations under 20,000), at the rate of 2.5 percent annually, it would take an average of 12 years to accrue the same sample base as Census 2000. Even the largest counties would need an average of 6.2 years to achieve the Census 2000 sample base at 2.5 percent annually. The sampling rate must be more than 5 percent to accumulate a sample base that is comparable to the Census 2000 sample in less than five years. Looking at the information displayed in Figure 2, counties with the largest sampling rates in 2000 (Maximum) would need more time. The larger (20,000+) counties with the smallest sampling rates in 2000 (Minimum) would still require three or four years at a sampling rate of 2.5 percent. Unfortunately, few areas show a final sampling ratio of 2.5 percent. Since full implementation of the ACS began in 2005, the initial addresses selected for the samples total fewer than 2.9 million annually, only 2.3 percent of housing units. That ratio decreases dramatically after commercial or nonexistent addresses are removed and noninterviews are subtracted. Final interviews, including occupied and vacant housing units, correspond to about 1.6 percent of housing units. At the state level, the final interviews range from a low of 1.2 percent (Florida) to a high of 2.7 percent (North Dakota) of total housing units. Only three states have a final interview rate more than 2.5 percent—Minnesota, North Dakota, and Vermont.

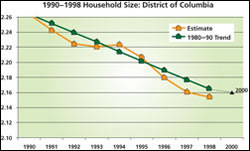

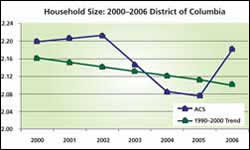

Without an increase in the sampling rate, estimates from the ACS will have larger standard errors, larger confidence intervals, and less reliability than the sample data collected from Census 2000. What does this mean to the data user? The accompanying graphs demonstrate the variability of the survey's estimates with one of the most stable demographic measures, persons per household or average household size. The relationship between the population in households and the total number of households incorporates both population characteristics (age, race and ethnicity, and marital status) and household composition (family, single person, or single parents) and is not subject to erratic changes in value. This stability enables smooth, relatively accurate forecasts of average household size, as shown in Figure 3. The extrapolation of a past trend line, 1980–1990, provides a relatively accurate depiction of the change in household size for the District of Columbia through the 1990s. Using the same technique with a more recent trend line, 1990–2000, the extrapolated change in household size is compared to ACS estimates of household size, 2000–2006, in Figure 4.

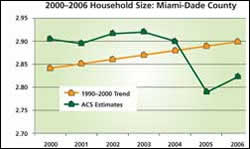

The change in ACS estimates is clearly more erratic than the expected change in household size. Add to this the fact that household population and housing units are weighted by independent estimates, and the variability is more difficult to understand. The District of Columbia is also the equivalent of a state. What happens in smaller states—or smaller areas such as counties? Figure 5 illustrates the same information for Miami-Dade County, Florida. The ACS estimates of household size for Miami-Dade County are more variable than the estimates for the District of Columbia. Although Miami-Dade County is certainly smaller than the District of Columbia, it has a population base of about 2.5 million. The average population of counties with at least 65,000 people (the threshold for one-year ACS data) is much smaller—321,000. The average population size of all other counties is 21,700. Counties with a population less than 20,000 (which requires a five-year estimate of ACS data) represent more than 40 percent of all counties. Given the apparent volatility of estimates for areas with a population base measured in millions, will a five-year average be sufficient for the smallest counties, tracts, or even block groups?

Until 2008, even three-year period estimates will not be available for all eligible areas. The five-year period estimates are scheduled for 2010. However, an assessment of the ACS by the Committee on National Statistics concludes that areas with fewer than 50,000 people can expect "extremely imprecise" data. It has recommended combining not only tracts but also block groups and special tabulations, with eight- to ten-year averages to get "reasonably precise" estimates. One thing is certain now: To use data from the ACS, it will be necessary to incorporate estimates of sampling error. Without the standard error estimates or margin of error (MOE) included with all ACS tabulations, it will be impossible to distinguish change from sampling error. Questions from readers are welcome and can be sent to the author at lwombold@esri.com. About the AuthorLynn Wombold, chief demographer at Esri manages data development for Esri including the processing of census data and the development of unique databases such as the demographic forecasts, consumer spending, Retail MarketPlace, and Community Tapestry market segmentation system as well as the acquisition and integration of third-party data. She is also responsible for custom analysis and modeling projects. With more than 31 years of experience, her areas of expertise include population estimates and projections, state and local demography, census data, survey research, and consumer data. Prior to joining Esri, she worked for CACI Marketing Systems and was the senior demographer at the University of New Mexico. Wombold holds degrees in sociology, with a specialty in demographic studies from Bowling Green State University in Ohio. She has received CACI's Eagle Award for Technical Excellence and Encore Achievers. The author of numerous articles for industry publications, she frequently presents papers on demography. ResourcesNational Research Council (2007). Using the American Community Survey: Benefits and Challenges. Panel on the Functionality and Usability of Data from the American Community Survey, Constance F. Citro and Graham Kelton, Editors. Washington, D.C.: The National Academies Press. [A free executive summary of this report is available online at www.nap.edu/catalog.php?record_id=11901. This document may be read at no charge.] |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||