Amica Mutual Insurance Maps Real-Time Data, Providing Better Service to Policyholders

Storm Chaser

Because many Amica Mutual Insurance policyholders owned homes or other property in the path of Hurricane Irene, the company wanted to ensure that it had adequate resources to provide services when these people needed them most. Amica, a provider of personal insurance for autos, homes, and boats, is headquartered in Lincoln, Rhode Island. Known in the industry for its high standard of customer service, the company has been awarded several J.D. Power and Associates customer satisfaction awards.

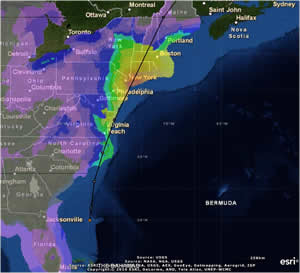

Amica used ArcGIS to track Hurricane Irene and view forecasted wind speeds from the National Oceanic and Atmospheric Administration's NowCoast Web Map Services. This map displays the storm one day prior to making landfall in North Carolina.

Amica monitored Irene last summer as the hurricane moved up the East Coast of the United States, using real-time weather warnings from the National Oceanic and Atmospheric Administration (NOAA). This information, which included live radar loops focused on the strongest parts of the storm, was brought into Esri's ArcGIS Online as map services, a standard way to view location-based information on the web. By viewing live data streams and comparing them with internal policy data, Amica personnel were able to watch the storm in real time and quickly identify which areas were likely to generate the most claims.

Before their eyes, the path of destruction passed through North Carolina, Virginia, and all the way up the East Coast. "Our exposure along the forecast track was significant, and we immediately knew this would be a big event for us," said Adam Kostecki, a claims examiner in the Property Loss Division at Amica Mutual Insurance.

When tracking Irene, Kostecki combined real-time event tracking and geocoded policy locations displayed in ArcGIS. Taking a NOAA map service that forecasted wind speed and creating it as an ArcGIS web mapping service (WMS), Kostecki was able to input where Hurricane Irene was moving in real time on a map, along with Amica's plotted policies. He and other personnel drew lassos around policies in the areas they were interested in. The lasso Select tool allowed Amica staff to select multiple policies in contiguous areas without being restricted by administrative or geographic boundaries. Combining both datasets—wind speed high enough to cause damage plus policies in the area—Amica found out the number of policies that might be at risk.

By viewing the policy locations along with the area of impact, Kostecki could find out exactly which policies were in the path of the event and generate reports for claims adjusters quickly. "Simply by viewing and exploring the data in ArcGIS, I simplified and improved the accurate identification of customers in Hurricane Irene's impact area," said Kostecki.

For insurers, knowing precisely where damage has occurred is paramount in developing a timely and appropriate response. The quicker an insurer can respond to claims, the faster people can rebuild and continue on with their lives. Being able to determine exposures in different areas, as well as knowing the likely severity of the damage, allowed the Amica claims department to proactively plan for potential claims volume. "Once Irene passed, we plotted claims as they were reported," said Kostecki. "Waiting days for first-responder reports, damage models, or even post-event aerial imagery just isn't an option anymore when responding to catastrophes."

Knowing how many policyholders might be affected helped Amica better determine how many adjusters were needed and where they should be sent after Hurricane Irene passed. From the information gathered in ArcGIS, the staff was able to generate a quick summary and export the information into a report. This information provided a better picture of how many claims Amica might need to respond to in a certain geographic area.

"We had a much better idea of what our claim potential was going to be after this event," said Kostecki. "And even better, we had this information ready to go hours after the storm."

Amica implemented the use of GIS in claims about five years ago, in order to better estimate the company's exposure after a catastrophic event such as a hurricane, earthquake, wildfire, or tornado. Knowing this information helps Amica ensure that it is appropriately staffed to handle the volume of claims that might be reported. Since implementing GIS technology, Amica has realized that pushing this technology to the front lines could have a profound impact on the way it services its policyholders. Kostecki explained, "It's a technology that our staff embraces—because it makes their jobs easier, and it allows them to be more efficient."

For more information, contact Adam Kostecki, examiner, Property Loss Division, Amica Mutual Insurance (e-mail: akostecki@amica.com), or to learn how ArcGIS is used in the insurance industry, visit esri.com/insurance.

Related Podcast

Helping Insurance Companies Understand Where Risks Are

Nigel Davis discusses eNCOMPASS, a cloud-based risk analysis solution based on ArcGIS. Listen to the podcast. [17:00 | 16 MB]