ArcUser Online

Summer 2011 Edition

Localization, Not Location

Web and smartphone apps support winning retail strategies

By Simon Thompson, Esri Commercial Business Industry Manager

This article as a PDF.

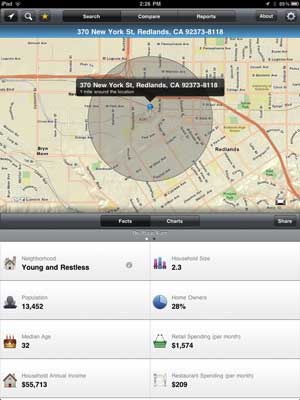

Access key demographic and market facts about any location in the U.S., using your iPhone, iPad, or iPod touch with the free BAO for iOS app.

For many of us, the world changed forever on September 15, 2008. On that day, the current global financial crisis began when Lehman Brothers filed the largest bankruptcy petition in United States history. The ensuing recession has turned much of our thinking about how we run successful businesses on its head and created new realities.

Three years after the onset of the greatest recession in modern history, there is a new kind of normal. We have new consumer behavior, revised expectations, innovative ways of doing business, and different opportunities. GIS is one of the technologies that has helped organizations survive and thrive in the face of all this change.

By finding new strategies and a better understanding of different drivers in local markets and the global economy, the retail industry is empowered with more accurate information and is forging in new directions.

The Consumer Is King

Today, consumers are holding the cards. It's no longer a case of "build it, and they will come." Overinflated expectations of store numbers, profit margins, and gross revenues during the boom years have been replaced with conservative management, controlled build-out, and revised business strategies. Every aspect of driving success and maximizing return on investment is location dependent. Localizing merchandise and correctly configuring sites to maximize profits based on the profile of the people in an area and their needs are significant challenges in today's economy. This is where GIS is helping.

Localization is the mechanism for balancing market opportunity with supply and demand. To do this, owners and managers need to be able to apply a range of geographic analysis, models, and know-how. Chain operators seeking growth and profitability from fewer, better-located stores require better techniques for accurately modeling potential.

Customers Are Their Locations

Markets are not uniform, nor is their potential. Markets vary based on what is already available; what can be supported economically; the types of people in the catchment; and the predominant flavor, lifestyle, or culture of the area. Physical infrastructure such as roads and transit networks—together with transportation barriers—limits access and defines whether intersections and destination points are attractive.

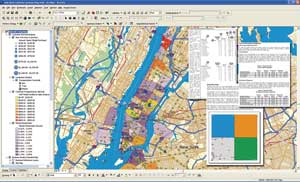

Pueblo County GIS consultancy service helped a local web-based business improve its market penetration nationwide. This map shows market penetration areas in and around New York City.

Cities can change many of these factors by modifying transportation networks and building new roads, but retail developments are often organic. Retailers are not part of a master plan; instead, they compete against each other for locations, often pitting neighborhoods against each other.

The traditional approach to defining markets based on a primary trade area is out-of-date. Anyone analyzing actual customer data struggles to find that elusive boundary where a customer chooses one store rather than another.

GIS can help. Reviewing demographic reports by geography gives business owners and operators a much more accurate picture of the landscape. As an enabler of marketing insight, GIS provides a detailed view into the potential performance of a business under different market conditions and economic factors.

It's almost impossible to consistently predict sales using primary trade areas, but business owners have become so used to them that they are willing to put up with the failures.

Or are they?

Where customers live or work is not necessarily where they buy something. Purchasing behavior and shopper frequency are driven by convenience. Organizations need to capture and understand shopping habits, not just buying habits. It's no longer acceptable to use the distance from a store to model changes in sales potential or increased competition. The distributions of sales for real-world stores are too divergent and diverse to continue with this historic technique, because today, overbuilt means overexposed.

Bring the Store to the Customer

Given the varying demographic profiles of customers, how does one individualize the store, restaurant, or service center to provide the one-to-one, personalized experience consumers now demand? In a world where cheap is chic and coupons are cool, how does a franchise succeed with fewer loyal, value-oriented customers and customers who are trading down but expecting much more?

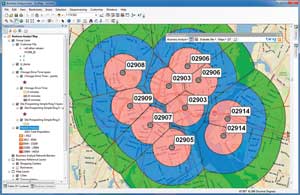

The traditional approach to defining markets by primary trade area is outdated. Finding that elusive boundary where a customer goes to one store rather than another is challenging. GIS can help.

Business owners need to understand not only whether a business is in the right place but also whether it's a suitable business for that market. This is where local owners and operators are so important. Owners and operators are the front line in any neighborhood. They care about the local area because they live there too. They know neighborhood and customer tastes and have daily exposure to habits and changing behavior.

Investing personal assets to create and maintain a business ensures that owners and operators of franchises think long and hard about every decision. Smart organizations are using location analysis to empower local operators to use profiles of the people in an area to localize merchandise and correctly configure stores to maximize profits.

From beverage selections to localized price promotions and location marketing, getting the product and service mix right affects the bottom line every time. This can mean configuring the format and size of the store to different market needs, providing product choices, and sometimes even moving to a new location to reduce competition and optimize revenues.

The Circle of Life

Today's GIS technology embraces the modern, consumer-oriented world. Through iPhone apps and web-based applications, businesses can use GIS without training and with minimal financial outlay. Market research; customer analytics; and the creation of extensive demographic, spending, and income reports let anyone in the franchise industry understand surplus and demand in specific locations and create forward-looking plans.

A wide range of analytic techniques and sophisticated models have been published by experts. These resources are readily available. Ranking and scoring a market or franchise territory are now easier than ever. Because this data is continually updated, businesses stay current with market changes and variations in economic factors.

However, benefits don't stop there. GIS is applicable throughout the entire business life cycle. Initially, the technology helps in site selection and market planning by helping owners and operators match opportunities with budgets and expectations. As a retail network matures, GIS helps optimize the growth strategy and maximize returns from investment by creating more efficient systems and optimal store placement. Using GIS, businesses can not only understand where and how they should expand but also better manage the scale, format, and pace of expansion.

As an enabler of marketing insight, GIS provides a detailed view into the potential performance of a business under different market conditions and economic factors. Using these tools, many franchises have outperformed other industry sectors during the recent recession. Better insight into changing income and age profiles, house valuation, disposable incomes, lifestyles, spending patterns, and consumer habits has helped companies tune their franchises to match consumer demand. By doing so, many have enjoyed increased gross margins, reduced inventories, and enhanced customer loyalty. This has resulted in much healthier balance sheets than many analysts predicted.

Don't Just Get Answers—Get Answers That Matter

Even in an economy that has slowed, GIS helps business owners and operators understand their long-term potential, manage the bottom line, and align operations with opportunity. Better business decisions are made by asking the right questions. With GIS, franchisees and franchisors get answers that matter. The technology helps test hunches and investigate scenarios with real-world data using insight gained from information and experience. Whether it is used to look at the possibilities for one location or develop growth strategies for an entire store network, GIS can unlock the market potential of areas and reveal what the expectations are for each.

For more information, visit esri.com/business.