First Magnus Financial Corporation Gets a Clearer Picture of Coverage Using BusinessMAP from Esri

Largest Privately Held Mortgage Bank Analyzes the Business of Loans with Desktop Mapping

Growing from a small company to a large corporation in commercial business is no easy feat, especially in the competitive mortgage banking industry.

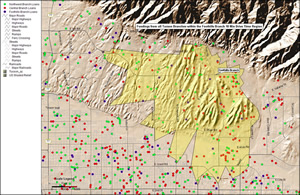

Using BusinessMAP, First Magnus found that branches outside of the Foothills Branch trade area were originating more loans in the 10-minute drive time region than the Foothills Branch. |

One organization, First Magnus Financial Corporation (FMFC), headquartered in Tucson, Arizona, knows this firsthand. Starting out as a small retail mortgage bank in 1996 with only a handful of employees, FMFC has grown into the largest privately held mortgage bank in the United States and ranks in the top 20 of the largest mortgage bankers overall.

Today, with more than 5,500 employees serving all 50 states in multiple channels of loan origination, including retail, wholesale, joint ventures, and Internet lending, FMFC continues to stay at the top of its industry.

First Magnus understands that a relationship exists between geography and business growth; it is important to provide service near the people who need it. Over time, Charter Funding (renamed to First Magnus Home Loans in December 2006), the Arizona retail division of First Magnus, established multiple branches throughout Tucson to make it convenient for customers to do business. Though it quickly established itself as one of the top mortgage banks in Tucson, First Magnus wanted to improve coverage even more. Management set a new goal to eventually provide branches and/or satellites within a 10-minute driving distance from the city's primary population areas of Tucson.

First Magnus also wanted to learn what percentage of borrowers were within a 10-minute driving distance from the branch that originated their loans. If a branch originated most of its volume beyond a 10-minute driving distance, the company wanted to find out if it made sense to reduce costs by closing the branch and distributing operations among one or more of the other branches. As part of this analysis, First Magnus also had to consider whether the adjacent and, in some cases, overlapping 10-minute driving distances of surrounding branches were close enough to provide adequate service in the vacated region of the closed branch.

After carefully reviewing the software packages available, the Arizona division chose Esri BusinessMAP to help view and analyze its business. "The deciding factor for us was that BusinessMAP provided better desktop mapping tools than other solutions on the market," says Michael Gaylord, Special Projects, First Magnus.

An affordable out-of-the-box mapping application, BusinessMAP lets FMFC see its business information on maps, giving the company a better understanding of its customers and competitors.

Introducing computerized mapping and analysis into FMFC has been easy because complete datasets are included with the software. There is no need for First Magnus to find additional geographic or demographic data. Datasets such as street maps for the United States and Canada, census demographics, and business locations come with the software and make it easy to begin mapping right away.

Thanks to the BusinessMAP Drive-Time and Ring Study analyses, First Magnus now uses more sophisticated analysis tools. First, FMFC geocodes its branches on the map. Then, a drive-time zone is created around each location. A drive-time zone shows how many households can visit a particular location within certain time constraints such as 5- or 10-minute drive times. Next, loans are geocoded based on their property addresses. Management can quickly see where branches are located in relation to these addresses. They are also able to see if there are areas in Tucson that are not included in any of the branches' drive-time regions.

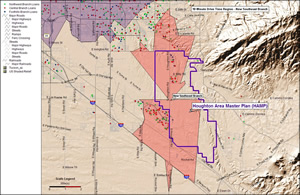

Using the Free Hand drawing tool in BusinessMap, First Magnus was able to draw in boundaries of a proposed development and successfully analyze opening up a new branch to service the area. |

To make it easier for staff members who are not familiar with mapping to better understand the information, FMFC uses shaded relief maps. Once part of the optional datasets which can be purchased such as Europe and U.S. topographic maps, the shaded relief data is now included in BusinessMAP.

For instance, a drive-time zone for a Tucson branch spreads northwest, southeast, and south, but not north or northeast. Looking at the shaded relief of this location, the site was found to be butted up against the south/southwest edge of the Catalina Mountains.

In another scenario, the company was considering opening a new branch in southeast Tucson. The initial analysis showed that it might not be a good site since the drive times were restricted by an Air Force base to the west and what appeared to be vacant land to the east. However, First Magnus was aware of a major development under way, the Houghton Area Master Plan (HAMP), on the vacant land. HAMP is a 17-square-mile planned community where several thousand people will eventually live. Although the drive-time region did not extend east on the map since construction was just beginning on the infrastructure, First Magnus decided to open a branch inside the development to provide service to the people who would be living there. Using the Free Hand drawing tool in BusinessMAP, First Magnus later drew the boundaries of HAMP, which revealed that the new branch being opened was right in the middle of the development. For future new housing developments, First Magnus will draw the boundaries first to increase the probability of selecting a strategically located site every time.

After using BusinessMAP to analyze the proximity of the primary population areas to the 10-minute drive-time regions of the Tucson retail branches, First Magnus found that they blanketed most of the metro area but were short on coverage in the far northwest, far east, south, and southwest.

Using BusinessMAP to see how well branches are performing has also been insightful. This analysis has revealed not only that one of the branches originated a large percentage of its total volume outside its 10-minute drive-time region but also that the two nearby branches originated more loans within it. Providing justification to close a high-cost, lower-volume branch was achieved using maps displaying loan originations, location of alternate branches in the area, and housing density. The analysis led to the conclusion that because of low housing density in the region, the branch in question could be closed without losing coverage in the area.

FMFC is just beginning to delve into the many advantages of desktop mapping. "BusinessMAP has been a tremendous tool for us to analyze our current business strategy in southern Arizona," says Gaylord, "and we are excited about utilizing this tool on an expanded basis."

For more information, contact Michael Gaylord, Special Projects, First Magnus Financial Corporation, at 520-818-8120, or e-mail michael.gaylord@firstmagnus.com.