Making Place-Based Decisions in the Face of Catastrophe

By Simon Thompson, Commercial Business Industry Manager, Esri

Flames light up the night sky near Oak Glen, California. Photo/Brenda Martinez, Esri |

Late August 2009 brought with it the beginning of a volatile fire season in California. For the last several years, damage to highly developed, densely populated areas has become an unwanted trend. In 2003, the Cedar Fire struck the San Diego, California, area, torching more than 270,000 acres, killing 14 people and destroying approximately 2,000 homes. Wildfire spread again in San Diego nearly four years later, leaving behind 200,000 charred acres, 515,000 evacuees, and approximately 1,500 destroyed homes. The risk of bearing uninsured loss in a disaster today is higher than it has ever been because of increased property values and dense building; think of the hills of Santa Monica. Insurers' financial and regulatory obligations need to be met at the same time their companies' stability is ensured. Customers also expect policy writers to handle claims effectively and make things right. This makes insurance a high-stakes balancing act-a competitive business with little margin for error.

As another blistering wildfire season comes to an end in California, insurers looking for better ways to examine their portfolios and manage losses incurred by their clients found relief in solutions based on GIS. The technology can provide tools to measure many different dimensions of risk and estimate the severity and breadth of potential loss under several scenarios. Insurers can make more informed decisions about the risk they can carry by combining policy information with location-based data such as vegetation density, road access, and maps down to parcel level. Monitoring and assessing a portfolio through its geography helps insurers be better prepared for disasters and quickly confirm they have the appropriate reserves necessary to assist their customers and protect their holdings.

Providing Insurers with Place-Based Decisions

Insurers like Balboa Insurance Group in Irvine, California, which won a Special Achievement in GIS (SAG) award from Esri this year, rely on GIS software to better prepare for disasters. Balboa has been providing risk management and loss mitigation solutions to financial institutions in the mortgage finance industry for more than 20 years. If a collateralized property in a mortgage lender's portfolio is damaged, and the borrower does not have adequate hazard insurance, Balboa provides the lender with insurance that helps make money available to repair the property.

The Catastrophe Manager Website keeps Balboa's financial services clients up-to-date during natural disasters. |

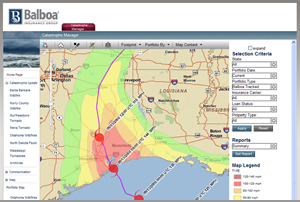

With the help of Esri's ArcGIS Server software, Balboa's financial services clients can view maps of catastrophes and gauge potential risks to their portfolios through a secured interactive application available over the Internet called Catastrophe Viewer (CATViewer). CATViewer allows lenders to see information by viewing loan locations along with the geography of various natural disasters.

Balboa's experienced associates and advanced technology are quickly mobilized after a catastrophe. The company's risk modeling team monitors multiple online and television broadcasts of natural disasters around the country, posting updates immediately to CATViewer and helping the claims department respond to customers 24/7.

One of the most recent examples of GIS helping Balboa respond quickly was during the Station wildfire that struck parts of La Canada-Flintridge, northern San Fernando, Altadena, and many other areas that border the Angeles National Forest. For clients to assess their exposure to the event, Balboa created a map of the then-current fire perimeter for the Station fire. The map showed which loans within the fire boundary should be considered at risk, allowing Balboa's clients to prepare the appropriate paperwork and evaluate their loss potential accurately. Fortunately few homes were lost in this particular fire, but the ability to view the disaster as it was happening and run 'what if' scenarios on potential properties meant the lenders were ready for any outcome.

Balboa enhances CATViewer with geographically based datasets available through ArcGIS Online, a Web-based repository that lets users easily share and find GIS data, maps, layers, services, and tools. The company uses many different datasets from ArcGIS Online, including satellite imagery, topographic maps, and street maps.

The Balboa Catastrophe Modeling Team also monitors specific catastrophes and gets data from organizations such as the National Hurricane Center, National Oceanic and Atmospheric Administration (NOAA), the U.S. Geological Survey (USGS), and AccuWeather.

With this highly accurate data, Balboa's clients can more precisely map where loans are at risk because there's a high probability that the property will be damaged during a catastrophic event. The technology gives Balboa clients the information to begin asking themselves crucial questions:

- How likely is the risk of loss?

- How much overall monetary loss exposure is in the portfolio?

- How many loans are affected by a particular event?

- Does the borrower have enough insurance to cover the damage caused by the catastrophe?

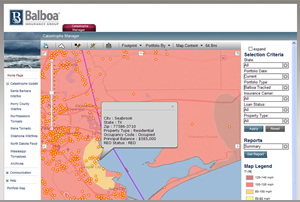

Lenders view data and show results of different property risks including geographic concentrations, property values, and loan values. Using CATViewer, Balboa's clients apply risk and loss calculations for more accurate assessments.

Partnering for the Best Solutions

Clients can view loan locations along with the geography of various events. |

Earlier this year, Esri and First American Spatial Solutions (FASS), an industry leader in geospatial software, natural hazard analytics, and property and tax information, announced the release of Risk Analysis Solution for ArcGIS. Insurance companies can use Risk Analysis Solution for ArcGIS to view and analyze data at the policy and portfolio level, quickly assessing concentration of risk and increasing and improving underwriting decisions.

Risk Analysis Solution for ArcGIS combines Esri's GIS technology with FASS's advanced parcel-based geocoding, natural hazard, and property location data for the United States. FASS's parcel-based geocoding, called ParcelPoint Technology, combines parcel and address information with exact latitude and longitude.

Originally developed for use at FASS to provide extremely precise flood information for lenders and insurers, this dataset now includes 100 million parcels and is available through Risk Analysis Solution for ArcGIS. Using the data will help eliminate inaccurate results obtained when guessing the location of properties by interpolating their positions on a street network.

Risk Analysis Solution for ArcGIS offers a powerful geospatial solution that easily integrates into an insurer's current workflows and rapidly delivers accurate information. Users can assess multiple-peril risks, generate composite risk scores, determine probable maximum loss, understand risk concentration, and generate detailed reports.

Esri Resources

The results of different property risks, including geographic concentrations, property values, and loan values, are viewed easily. |

Esri software, data, and services are used at the front lines of catastrophes, including the recent Station, Oak Glen, and Pendleton fires in Southern California. Tom Patterson, a wildland fire specialist for Esri, went to the command post for the Oak Glen 3 and Pendleton fires to help prepare maps for meetings and ensure that the most comprehensive analysis of the fires could be accessed.

Disaster Assistance—Esri provides resources to agencies, organizations, and businesses that respond to and operate programs to recover from wildfires. Esri provides GIS operations with software, data, imagery, project services, and technical support.

ArcGIS Online—This online repository hosted by Esri includes more than 20 different fire-related datasets and maps created for this online community to share and explore. From historic information on fires to recent fire perimeters, information can be easily and freely accessed. Learn more.

Data Models—Esri works with organizations to create industry-specific data models to simplify project implementations. Organizations representing fire and emergency services (ESF 4) have initiated a project to develop a national GIS data model. The initial phase is available online.

Situational Awareness—Esri Situational Awareness helps organizations fuse, analyze, and disseminate information for optimal decision making.

Visit ww.esri.com/insurance to find out more about Esri's insurance solutions, keep up-to-date on the latest trends and technologies in the industry, and learn how we are working with companies like yours.