Some businesses are temporarily closed, some permanently. Some have scaled back, and some have modified operations. Many companies will recover, and many will look different than they did before the novel coronavirus (COVID-19). Unemployment is at its highest level since the government has been tracking it. This all has an impact on property values – commercial, industrial and residential properties, and in different ways. We’re entering an uncertain time with property values and, as a result, uncertainty with county revenue from property tax.

Property tax pays for the things that make our lives safe and enjoyable – police, fire, emergency response, roads, schools, parks, etc. But what happens when property values drop, and there is inadequate property tax revenue to provide the services we enjoy? In many parts of the country, raising taxes isn’t an option. So, what to do? Your GIS (geographic information system) can help.

Five Things Your County Can Do Right Now to Shore Up Revenue

Get It All on the Roll

When you can’t raise taxes, the first thing you can do is to make sure that all taxable property is on the tax roll. Assessors are mandated to provide a complete tax roll: an inventory and detailed information on real property and in many jurisdictions, personal property. Your GIS can help with this. It provides purpose-built tools to efficiently map parcels to ensure all taxable land parcels are in your system. You can use imagery and other data integrated into a single view in your GIS to be sure all improvements are captured and valued. Many taxing jurisdictions connect their deed registry and permitting systems to their GIS to have a clear view of what is happening and going to happen in their jurisdiction.

Get Property Values Right

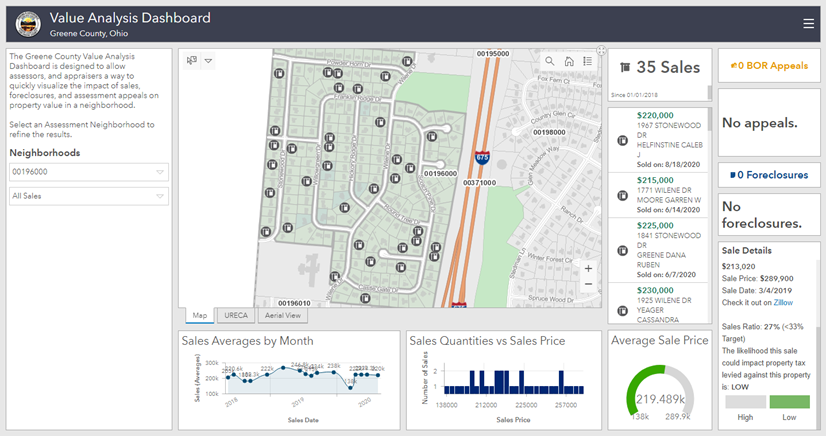

Valuing all properties at the highest defendable or mandated level is the second thing you can do. Many property tax jurisdictions and states have a legislated sales ratio that they need to comply with. A sales ratio is the assessed value divided by the actual sale price from a fair market value transaction. If these sales ratios fall below the legislated rate or values in the assessment system are not well modeled, then some properties are undervalued, and there is lost potential tax revenue.

Maps displaying cost per square foot, sales ratios, and valuation model validation parameters help to understand the quality of proposed assessed values, quickly identify outliers, uncover data errors and deliver easy-to-use infographics to help better defend assessments against appeals.

Tax What Can Be Taxed

Taxing what is currently not taxed is the third action counties can take. One might think all things taxable are currently being taxed, but that’s not always the case. For example, New York City is working on developing a 3D tax map so they can map air rights. Air rights are a 3D parcel – they have defined boundaries, specific rights and restrictions, and they can be bought and sold. Because they can be bought and sold, they have value. Because they have value, they can be taxed. This isn’t a fit for a lot of smaller jurisdictions, but in communities where there are valuable views, there are valuable, taxable rights.

Play Nice – Work with Regulators

We’re all in this together. Cooperation and proper oversight of property tax systems is a must. The local assessor works to ensure that assessed real estate values are fair, equitable, and uniform in their jurisdiction. But what about adjacent jurisdictions and jurisdictions across the state? Maybe one county overvalues, and the neighboring county undervalues. This is usually the job of the state department of revenue to equalize and ensure that valuations and local property tax are fair across boundaries, as well as ensure that state dispersed funds are equitably distributed. Participating with your state revenue helps fairness across jurisdictions.

The Secret Sauce – Modern Public Communication

Lastly and perhaps the most important is to communicate with taxpayers and the public. Posting the tax roll and values once per year may meet the legal requirement in many counties, but that’s not the public expectation anymore. The public expects information to be accurate, current, easy to find, and easy to use. Open data websites have gone a long way to deliver information to the public, but they are still more likely to provide data than information. Hubs, such as the ArcGIS Hub initiative Equitable Property Value, are one-stop-shop, self-service points of information – they deliver a combination of data and insight in the form of maps and apps. Hubs are the location for what you want to communicate to the public: tax and property information, maps, calendars of assessment activities, appeals information, explanations of how property is assessed, and more.

Equitable Property Value is an ArcGIS Hub Initiative template that can be deployed by property assessors or appraisers. This destination can then be used by taxpayers, real estate and title professionals, and potential property owners to access essential property information and learn more about the valuation process. Explore the "Try-It Live" site below.

Transform how you deliver valuable property information to taxpayers today. Visit go.esri.com/HUB4Assessors to learn more.

GIS Delivers Value to Your County, Now

Property values will be impacted by the coronavirus. No one knows how much and for how long. But we do know that revenues for many businesses and industries will be heavily impacted – restaurants, hotels, and vacation destinations especially. Many office workers will continue to work from home. Income from commercial real estate will be impacted. Real estate values and property tax revenue will be impacted.

As we enter this dynamic real estate market, it will be difficult to keep up with everything that needs to be done. We cannot change the market, but we can work more efficiently and use our GIS to provide current, accurate and complete data for fair, equitable and uniform assessments. We can up our game with how we communicate with the public. Dynamic property values require a dynamic response. We can use our GIS right now.