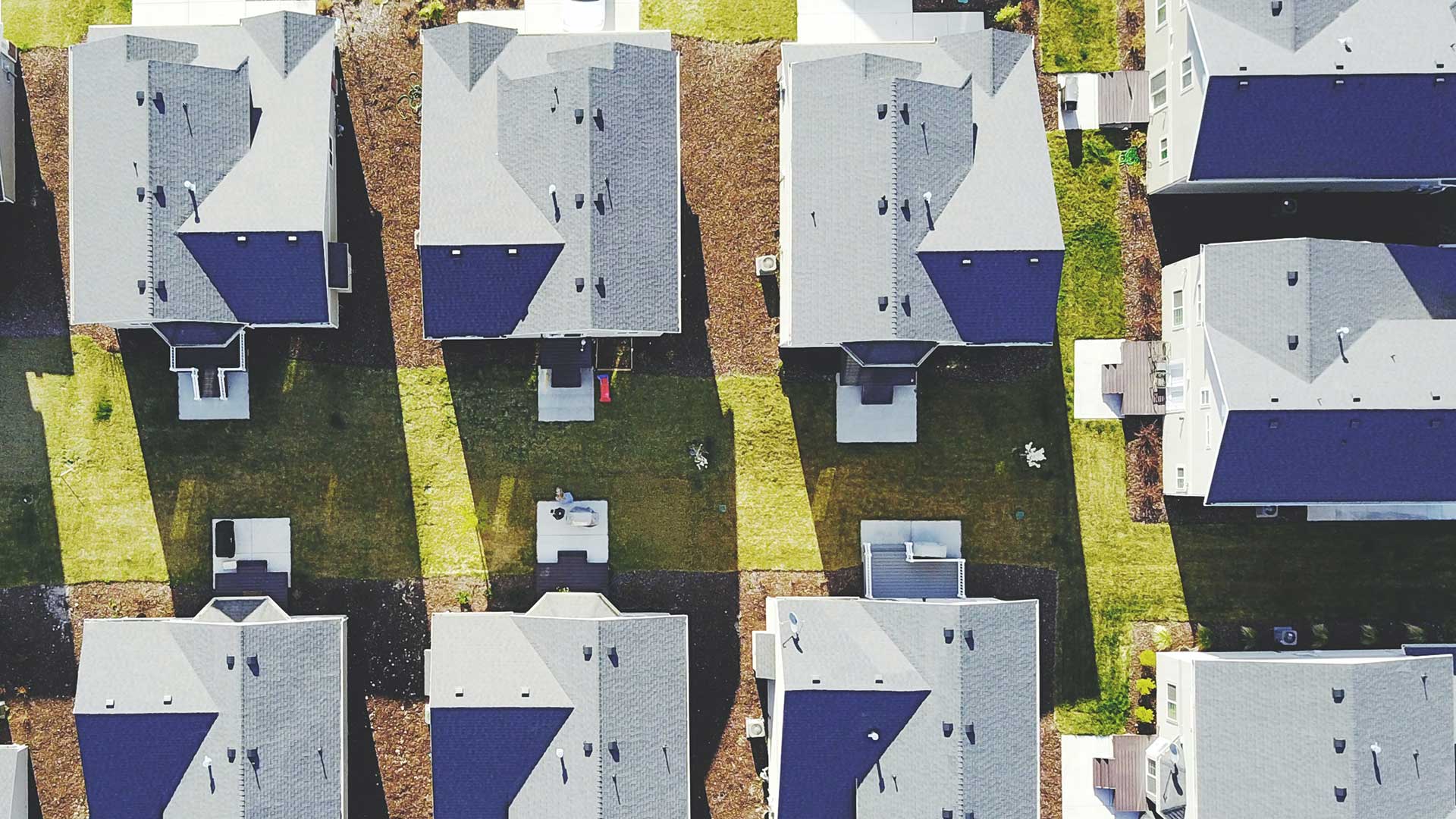

Chatham County, North Carolina, had more than 46,000 parcels that needed to be properly and accurately assessed for tax purposes. The county created an all-in-one solution for its tax department’s recent real property tax reappraisal process using GIS.

Counties are required to regularly undertake general reappraisals. This involves a tremendous amount of tax administration and appraisal work. Once properties have been assessed, value notices are provided to property owners. Property owners have the right to appeal the county’s assessed valuation and request a reappraisal. Reappraisals can be a major public relations issue.

To effectively deal with requests for reappraisal, Chatham County decided to provide property owners who disagreed with valuations easy-to-use tools for exploring real estate data. County appraisers also needed a comprehensive appeals management platform to efficiently navigate the appeals process.

Rethinking the Appeals Process

To generate the best solution for managing appeals, the tax department reached out to the county’s GIS department for a comprehensive solution to visualize, track, and manage comparable sales and appraisal information for its internal appraisal process. To improve government transparency, it was important that this solution was readily available to property owners after the county’s tax office sent change-in-value notices.

The GIS department used ArcGIS Online extensions to implement a solution for collecting photos of properties, creating a dynamic online tax appeals form, an operations dashboard, and a comparable sales application.

The first step was the creation of the Fieldwork Photo Collection tool using ArcGIS Survey123. It would be used by contract reappraisal staff for collecting current property photos. The tool also helps staff organize multiple photos for parcels. To capture parcel ID and property address information, more than 100,000 photos were taken in the field. The photos were used to validate data entry and identify errors.

Assessors needed current photos of each property to support change-of-value notices. Having all the photos in one place made it easier to keep an accurate record of the property reappraisals and improved overall field efficiency.

Each year, following the countywide reappraisal process, all property owners receive a change-of-value notice, which provides a new assessed value. This new value can be challenged by the property owner, who makes a tax appeal. The tax appeals form was created online using ArcGIS Survey123. One advantage of adopting this online form was that forms can be filtered to identify duplicate submissions and find errors.

Typically, the valuation appeals process is lengthy. With the new system, an appeals form is automatically sent to assessors so they can immediately start working on it, which speeds the process. Submitted appeals forms populate a dashboard application that appraisal staff use to centrally manage the appeals process. With the appeals dashboard, the tax department can view appeal submission information, assign appeals to appraisal staff, and update the status of appeals in real time.

The Comparable Property Sales mapping application (https://bit.ly/3XgBQSy) was launched in 2021 just before change-of-value notices were sent. Using this tool, a property owner could easily find sales of similar properties to support a request for reappraisal. This interactive comparable sales application provides easy access to meaningful sales information.

Improving Productivity and Transparency

Within a few years, Chatham County has been able to leverage GIS technology to better serve its residents and optimize its internal processes. The appeals form and dashboard have improved customer service and tax department efficiency. Many property owners have expressed satisfaction with the new appeals process.

The Comparable Property Sales mapping application has improved tax department transparency to property owners. The ArcGIS Survey123 appeals form has reduced redundant appeal submissions and saves time during the appeals process.

“The process designed by our GIS department using Esri products provided a visual map outlining the parcels with appeals and the status of the appeals. Staff were able to track all comments and attach all the documents to each parcel, which resulted in time savings when processing appeals. We also experienced a reduction in paper since the appellants were able to upload all documents and complete the online application form,” said Jenny Williams, tax administrator, Chatham County.

Chatham County continues enhancing the tax department solution for real property to make it more efficient. The county is taking steps to develop a public tax reappraisal hub site that will work in conjunction with the tax department. The site will promote awareness of the improved transparency in the tax reappraisal process.

“GIS technology empowered tax department [staff] to take ownership of their data and allowed them to take it to the next level,” said Nick Haffele, MIS and GIS director for Chatham County.

Chatham County’s solution can be easily replicated by other county tax departments that are looking to streamline the appeals process. The county has also been encouraging other departments to use GIS to improve their work.

In response to the success Chatham County had with the Real Estate Appraisal division, the Personal and Business Property divisions have requested an online appeals system for their operations. The GIS department is currently in the process of developing similar solutions for them according to Lucian Stewart, applications solutions engineer at Chatham County.