One of the most common questions I get as a technology strategist is, How do we communicate the value of a new solution or promising technology…especially to executives who don’t necessarily “get” technology?

The question usually comes from a frustrated manager or salesperson who has tried—and largely failed—to secure a budget for a significant technology investment because the (seemingly) irresistible force of a tech-centered sales pitch met the immovable object of the executive team’s results-obsessed mindset.

Selling technology on its capabilities as opposed to its business value are two very different things. The manager’s attempts to woo the executive audience with features and functions had undeniably fallen flat. In some cases, executives became downright angry, leading to incredulous responses such as, “You want us to invest how much? For this!?”

While I sympathize with these folks, the fact is they usually have themselves to blame. They’re guilty of breaking the golden rule of persuasive communication—speak to your audience’s interests. In this case, they failed to address the key question every executive team asks when evaluating a proposal: What is the business value of this technology?

I want to address this issue by looking at a simple and structured way of communicating the business value of technology.

Dual Factors

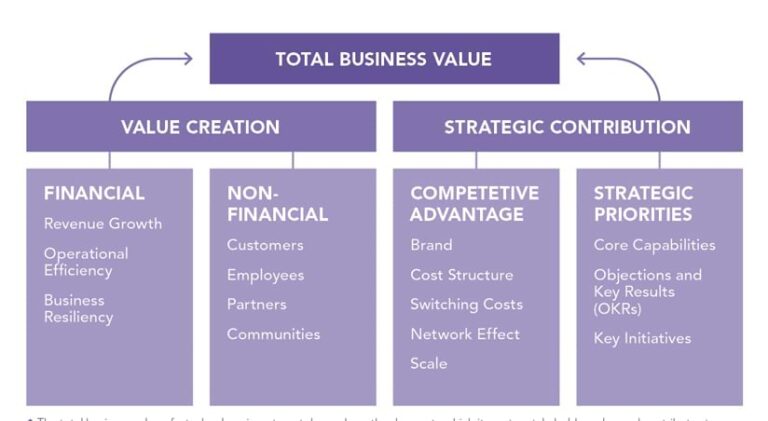

When an executive team asks what the business value of this technology is, they’re really asking, How does this technology benefit their stakeholders, and how does it contribute to their business strategy?

The first question relates to value creation—specifically, stakeholder value and the ability of the technology to generate positive returns for the individuals and groups that have an interest in the organization. This can include financial benefits—delivered primarily to the organization’s owners and shareholders—and non-financial benefits impacting anyone who intersects with the organization, including customers, employees, partners, and society as a whole.

The second question is about strategic contribution. This refers to the degree to which a technology strengthens the organization’s competitive position. To be clear, this is different from value creation. With strategic contribution, we’re focused on where and how an organization uniquely competes. Technologies that provide a competitive advantage or underpin an organization’s strategic priorities have a high degree of strategic contribution and are prized by executive teams.

The key is to avoid looking at value creation and strategic contribution in isolation and consider them in combination, as a matched pair. Unfortunately, too many proposals focus on one or the other. They either fixate on the stakeholder benefits and ignore the strategic contribution—leaving executives wondering how it helps their long-term mission—or they focus on specific strategic priorities and fail to mention anything about how stakeholders will benefit.

In some cases, a one-sided approach might work. It depends on your audience. But in my experience, you’re better off covering your assets—and the best proposals do just that. Let’s look at value creation and strategic contribution in turn. We’ll start with the value side.

Value Creation

For convenience, I separate value creation into two groups: financial and nonfinancial. I do this mainly so that nonfinancial value isn’t ignored. In practice, questions like, “How much money will we save?” tend to dominate executive sessions, and I want to make sure we consider benefits other than the economic ones.

Financial Value

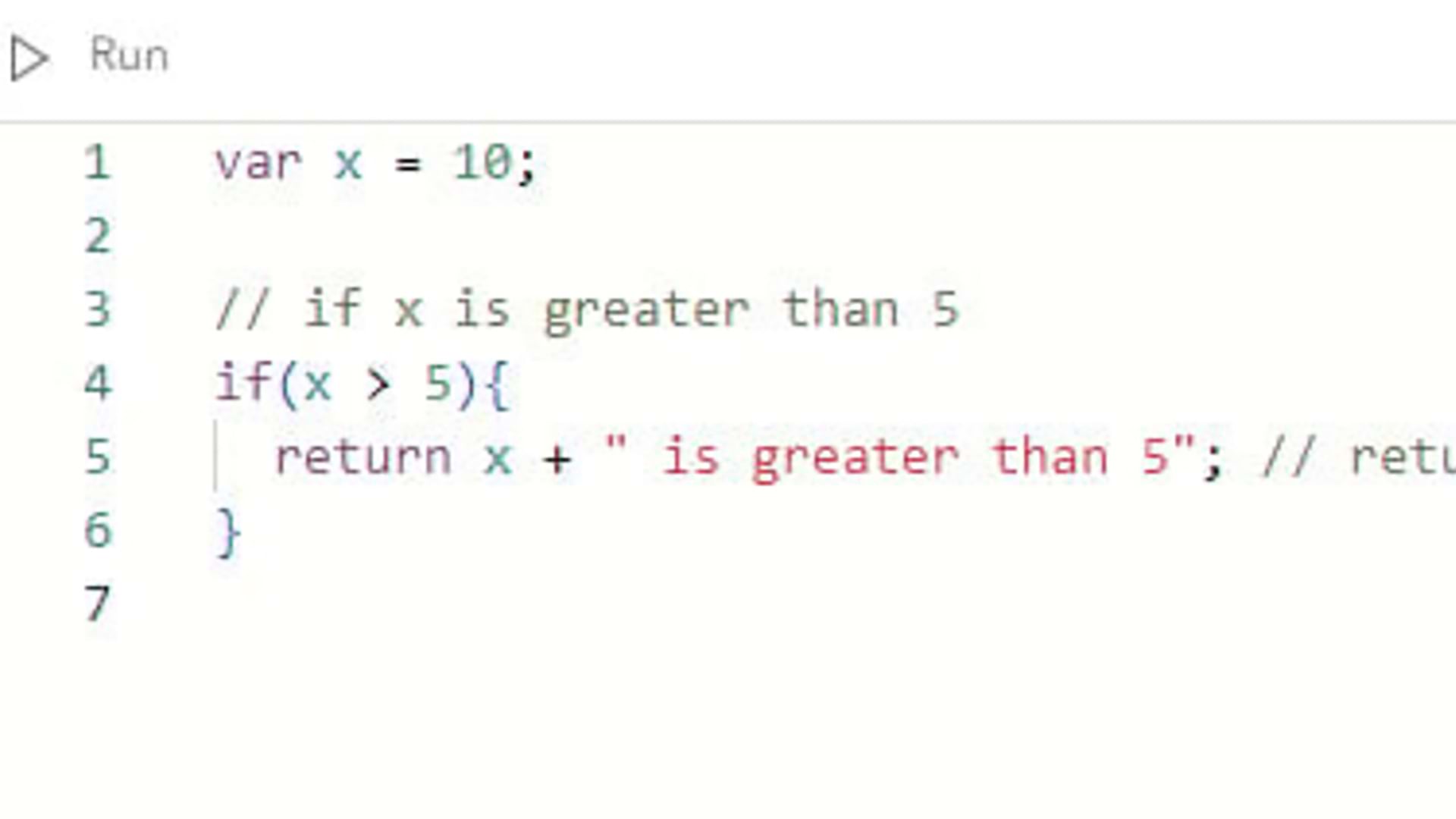

On the financial side, I look at three value drivers: revenue growth, operational efficiency, and business resiliency—in other words, how money is made, saved, and protected. Your job is to explain how your innovation contributes to these drivers and, if possible, quantify the contribution.

For example, let’s say you’ve developed a way to use non-fungible tokens (NFTs) to automatically mint any corporate communication so that the source of the communication can be instantly verified—virtually eliminating the risk of tampering as well as providing greater confidence in the origin and receipt of any communication. The financial value of such an innovation could be tremendous, but we need to get specific when explaining its value. We need to describe how and where value is created across each economic driver. Here are a few examples:

- Revenue—NFTs could reduce customer churn and the revenue lost from customers who are dissatisfied over suspect or lost communications.

- Operational efficiency—NFTs could reduce costly follow-up and tracing efforts required in the event of tampering.

- Business resiliency—Faster and more verifiable communications tracing enabled by NFTs could protect the company brand (and revenue) in the event of a communications hack.

Breaking it down like this is much better than simply saying it provides financial value. In fact, to make an even stronger case, you should try to quantify the contribution. This takes work and data, but numbers have a significant impact. In some cases, you might be able to get away with a purely qualitative (no numbers) description of financial value, but in my experience, providing even a ballpark estimate makes your case much stronger.

Nonfinancial Value

With nonfinancial value, we’re focused on how the technology benefits stakeholders other than the organization’s financial beneficiaries. This includes customers, employees, partners, suppliers, communities, and even society as a whole. We want to make it clear how these groups benefit from your proposed tech innovation. Continuing with the NFT example used previously, these are nonfinancial benefits.

- Employees—NFTs could increase employee job satisfaction by reducing the number of irate customers calling customer service.

- Partners and Suppliers—NFTs could increase confidence in the chain of custody because materials and products are automatically signed and verified as they move across the supply chain

- These aren’t direct financial benefits (although they could indirectly benefit the bottom line) but they’re just as important to highlight. They show how the whole stakeholder ecosystem is affected.

Like financial benefits, quantifying nonfinancial benefits makes an even stronger case. A statement like “20 percent fewer irate customers” is better than simply “fewer irate customers”—so make it measurable. Focusing on the tangible benefits delivered to all stakeholders—not just the owners and shareholders—demonstrates that your innovation has organization-wide value.

Strategic Contribution

If you’ve sold the executive team on the value of your innovation, you’re halfway there. Well done! However, you can’t stop here. Value creation is a necessary but often insufficient component of your sales pitch. You need to address the strategic contribution.

Most likely, the executive team is considering many different investment options, and yours is just one of them. And more than likely, all these investments claim to provide some level of value. You need to differentiate your sales pitch from the rest. The best way is to show how it helps the organization from a strategic perspective.

I call this strategic contribution, and—similar to value creation—I separate it into two categories: competitive advantage and strategic priorities.

Competitive Advantage

A primary concern of an executive team is how to establish or grow a competitive advantage. This refers to the factors that allow a company to produce its goods or services better or more efficiently than its competitors. And the more sustainable the advantage, the better.

A concept I like for understanding sustainable competitive advantage is economic moats. As described in “Profit Is Less About Good Management than You Think” by José Antonio Marco-Izquierdo in the Harvard Business Review, “an economic moat is a structural, durable competitive advantage” that protects market share by creating barriers to competitors.

Moats generally come in two flavors: revenue moats and cost moats. Revenue moats protect the top line and include things like brand perception, switching costs, and network effects. A loyalty program is one example as it creates switching costs for customers considering leaving the program (i.e., you lose your points).

A cost moat creates favorable cost conditions and is associated with things like superior processes, favorable location, and scale. Walmart built a deep cost moat by managing inventories across its network of stores, allowing the company to limit stock in a given store and share management expenses across the network.

Returning to the previous NFT example, let’s say you work for a food processing company. Verifying the safe handling of food as it passes from the grower to the processor to the distributor to the end retailer is critical to running a sustainable business. Mishandling could result in lengthy and costly contact tracing and a major hit to the company’s reputation. Companies that excel in this regard have a distinct advantage in minimizing the cost of contact tracing and protecting their brand.

Your NFT innovation is promising in both regards. It lowers the cost of tracing efforts since the blockchain that underpins the NFT is automatically and almost instantly traceable. It also speeds up the response time in the event of a contamination, preventing a large outbreak and the ensuing public relations fallout. It could be a significant source of competitive advantage.

Strategic Priorities

The other side of strategic contribution relates to how the technology supports the business’s strategic priorities. With competitive advantage, we were focused on general strategy or how your technology helps build economic moats. With strategic priorities, we’re focused on unique aspects of your organization’s strategy and business model.

- Core capabilities—These are the combinations of people, processes, and technology that support a core function of the business.

- Objectives and key results (OKRs)—OKRs summarize the organization’s stated goals and desired outcomes.

- Key initiatives—These are the high-impact, high-profile projects or programs that are essential to the organization’s business strategy.

As before, your job is to articulate how your proposed technology impacts these strategic priorities. In the food processing company example, the organization might have a high-profile public relations initiative to showcase the safe and reliable handling of food across the supply chain. The company might also have a stated objective to achieve industry leadership in food safety. Your NFT innovation has a role to play in both. The key in this section is to make explicit the link between your proposed technology and the organization’s stated priorities—priorities that the executive team likely had a direct hand in creating.

Tips and Guidance

The total business value of a technology will largely determine if the leadership team is on board with your idea. Individuals might have their own bias toward value creation or strategic contribution, but your best play is to focus on both sides of the equation.

Do that, and you can comfortably say you’ve communicated the true business value of your tech innovation. The following are some additional tips and guidance to sell your technology.

If you’ve successfully communicated the value, the next obvious question is, How much does it cost? You’ll need a price at the ready as the focus shifts toward affordability and return on investment (ROI). This is really a discussion about opportunity cost—that is, is this investment more worthwhile than other investments? Assuming the price tag isn’t completely out of the question, focus your cost comparison against other investments considered by the leadership team. Highlight the total business value as it relates to the alternatives.

If you’ve convinced your audience of the business value and the cost, the last question will be about risk. How difficult will this be to implement? How will it impact our people’s day-to-day work? Be transparent about the risks and the change impact. Have a risk strategy ready. Identify the major risks or success barriers and describe your mitigation plans. Show that you’ve anticipated these problems and have a plan to address them should they arise. This can make all the difference in the world in getting your proposal across the finish line.

You can use the total business value approach for a specific solution, but you can also use it for a whole portfolio of solutions or a set of projects. You can even use it to position an entire technology strategy. Value creation and strategic contribution are concepts that are relevant at many scales.

Communicating business value isn’t always easy, but it can be easier with a bit of structure. Use the accompanying chart to verify whether your proposal highlights both the value creation capabilities and the strategic contribution of your innovation. If it focuses on just one, think about how to incorporate the other dimension. Everyone wins in the process.