Another NRF is in the rearview, and it somehow keeps getting bigger. Forty thousand people packed into the Javits Center (it felt like at least ten thousand of whom were in line with me at Starbucks at any given moment). After 18 years of attending—half as a retailer, half as a solution provider—I still love the chaos. For three days, Hell’s Kitchen on the Hudson becomes the center of the retail universe.

The Buzz

NRF loves buzzwords, and 2026 was no exception. A few years ago, it was the metaverse. This year – agentic AI. You couldn’t walk 10 feet without seeing the word “agentic.” But what mattered wasn’t the marketers’ line—it was what providers were actually showing and what retailers were genuinely talking about.

Agentic AI was everywhere, and for good reason. I’m a true believer in the power of AI. The technology is profoundly changing this industry, enabling retailers to expose more discrete access to insights, automate processes, and put data directly into the hands of people when and where they need it.

Imagine a customer asking whether a pair of hiking boots meets a specific technical specification. Instead of the associate leaving the floor to “check the back,” they ask an AI agent. The agent confirms the specs and lets them know a matching pair is being unboxed on the loading dock right now. That’s a game changer.

But this is retail, and fundamentals drive success. Winners have strong value propositions, clear differentiation, meaningful innovation, and great design. Technology amplifies those strengths; it doesn’t create them.

Here’s what really stood out at the Javits Center this year.

Localization

Retailers continue to recognize the importance of precision in execution. Most aren’t opening hundreds of stores a year anymore, but they still need sustainable growth—larger baskets, more frequent trips, and new customers.

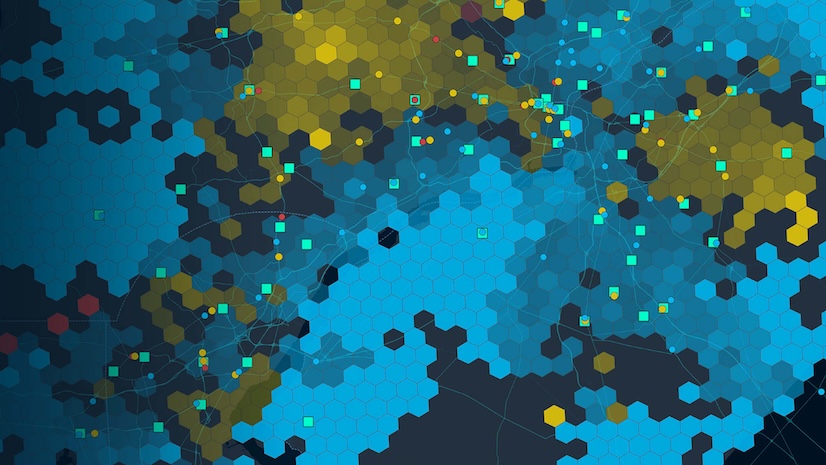

This requires understanding what this neighborhood needs versus the one 10 miles away. The challenge is scale. For retailers operating across dozens or hundreds of markets, these nuances are incredibly difficult to manage centrally. Location intelligence provides the tools to manage localization effectively, allowing retailers to analyze all their locations with a local, spatially enabled lens.

Frictionless Commerce

This is an area I’m pretty bullish about. At this year’s NRF there were great examples of cutting-edge tech that I believe will be table stakes in the next couple years. The goal is removing barriers between wanting something and getting it—in-store, online, pickup, delivery, walk-out checkout, mobile pay, whatever works.

But “frictionless” only works when you can answer where questions in real time: Where is the inventory? Where is the customer? Where’s the closest fulfillment option? The infrastructure that makes commerce feel effortless is fundamentally spatial.

Optimizing Execution Across the Enterprise

The biggest challenge in retail is that every strategy you deploy is immediately visible and easily copied. Retailers must constantly adapt based on what’s working, where it’s working, and why. That means understanding why a tactic succeeds in one geography and fails in another—and how to scale success or mitigate risk across the network.

Speed without accuracy will always fail. Accuracy without speed gives your competitor the opening.

Managing Uncertainty

The past year has brought unprecedented chaos. Supply chains were disrupted, policy changes created volatility, and consumer confidence wavered in ways even sophisticated forecasts struggled to predict. Many solution providers showcased new tools designed to help retailers navigate uncertainty through modeling and improved forecasting.

But these models are ineffective without a geographic lens. Tariffs, supply disruptions, and demand shifts don’t impact all markets equally. Retailers need to model how different scenarios play out across their store networks, trade areas, and supply chain footprints.

Retail Media Networks: A Story Still Being Written

One topic that generated serious conversation was retail media networks. One large retailer was quoted as getting 30 percent of their marketing profits from their retail media network. I strongly agree with the prognosticators that this will be transformational from a revenue and customer engagement perspective.

But we’re early. In-store media is a tiny fraction of retail media spend, even though the physical store audience dwarfs the digital. Massive revenue is sitting on the table.

Extending digital success to the physical store will require retailers to bring a geospatial lens to their network strategies: Which stores carry which brand advertising based on trade areas? Where in the space do you maximize impact? How do you prove ROI when the journey happens in real space, not clicks?

Wrapping Up

NRF is always overwhelming. It’s easy to get lost in the noise and buzzwords. But having lived through multiple retail cycles, I’m always surprised how familiar many of these challenges are—even as the technology evolves.

Strip away the agentic AI signage and vendor pitches, and the themes come through clearly: localization, frictionless commerce, operational precision, managing uncertainty, and retail media networks. Every one of these trends has a critical spatial component at its core.

Location intelligence isn’t competing with AI or other technologies. It’s the foundation that allows those technologies to work in the real world—where customers shop, stores operate, and revenue is generated.