I was talking with my colleague in California a few weeks back, and he was once again donning his rain suit and boots to prepare his home for an imminent deluge.

All around communities like his, residents were filling sandbags, stocking up on groceries, and preparing to stay off the roads as another atmospheric river quickly approached from the west. I’m sure that’s not what he expected when he moved from Tacoma, Washington, to “sunny” Southern California, but it’s becoming clear that volatile weather events are just the new normal—and not just for the folks out west.

Across the United States, communities are being impacted by increasingly frequent and severe weather events. The latest flooding across California is just one of many recent examples. In mid-February, a winter snowstorm in the northeast led to a sudden, massive snowfall that shuttered much of New York City. These storms are threatening the safety of residents, disrupting business operations, and increasing losses for insurers.

Many carriers are already reeling from the rising trend in severe weather events across the country, which directly impacted profitability in 2023. Reuters highlighted that over the past 30 years, the average cost of these critical risk events was approximately $57 billion annually—a concerning trend that is growing rapidly. In 2023 alone, Munich Re reported that global insured losses surpassed $95 billion.

In the face of these rising challenges, one organization is striving to empower US-based carriers with trustworthy insights to make decisions before, during, and after storms.

Playing from the Same Sheet of Music

You may not be familiar with the Property & Liability Resource Bureau (PLRB), but you would undoubtedly recognize many of its 1,000 member companies, which cover about two-thirds of the insurance premiums collected in the US. As a not-for-profit trade association, PLRB strives to empower property and casualty (P&C) insurers with authoritative data, tools, and expertise—including geospatial data around perils.

PLRB’s president and CEO, Bryan Falchuk, says, “The dedicated people of the insurance industry are the frontline experts standing by those in need when they suffer a loss. At PLRB, we aim to be the definitive resource for those experts to help them in delivering coverage to the individuals and businesses that turn to them for help.”

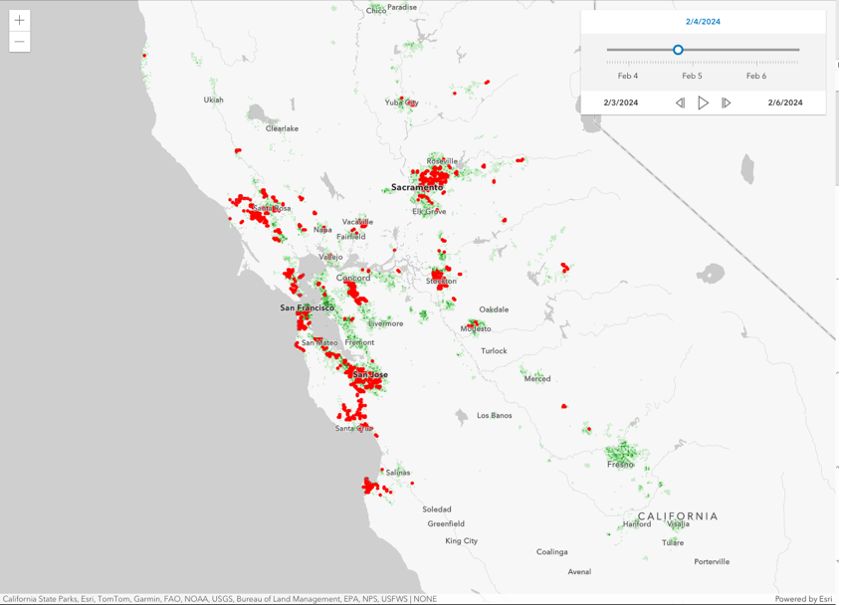

Andrew Louchios, AVP of catastrophe services, oversees PLRB’s Map Services, a curated repository of several dozen geospatial datasets and services. The repository includes information ranging from historical lightning data to near real-time local storm reports. This effort is about more than just providing data to insurance carriers. Louchios’s work is about creating a common foundation for decision-making across the insurance value chain.

With so many data options available to the insurance industry, it’s easy for multiple carriers to look at the same event with drastically different interpretations. PLRB’s Map Services democratizes authoritative insights to PLRB’s 1,000 member companies to promote greater consistency and transparency. As Louchios puts it, “our members utilize the geospatial historical weather data for informed decision-making surrounding their claims. Members can leverage PLRB’s ArcGIS map services directly into their GIS [geographic information system] platform for spatial analysis with their multiple policy locations.”

If a Tree Falls in the Woods, Who’s Liable?

One area that’s gaining particular attention is examining the impact these critical risk events have on power grid continuity. After one atmospheric river hit the Los Angeles County city of Sherman Oaks, a compromised tree took out nearby power lines, resulting in power loss for hundreds of homes, apartments, and businesses. Recently, my colleague Alex Martonik wrote about his experience in the 2006 Hanukkah Eve windstorm, which left millions of Washingtonians without power for several weeks. These outages are not just inconvenient for homeowners, they can be incredibly costly for carriers.

Many homeowners’ policies offer payouts for food spoilage if it’s the direct result of power loss from a covered event. For example, that tree in Sherman Oaks fell because of a windstorm after massive flooding. As a result, many impacted households could file food spoilage claims, which average around $500 based on coverage. Depending on the concentration of policies in that area, a single carrier could be paying out several thousand dollars for that single tree falling—even though no properties were damaged.

When viewed in the context of several large-scale, concurrent events where millions of households are at risk of power loss, the potential impact to insurance companies is quickly realized. Food spoilage is one of the largest unrealized threats to insurance capital, because it can quickly compound. Widespread outages, like what I experienced during the 2021 Texas power crisis, left many carriers scrambling on how to manage the sheer volume of claims in the first place—opening the door for fraud.

Trust, but Verify

An unfortunate element of these storms is the presence of predatory individuals opportunistically acting in bad faith. According to the National Insurance Crime Bureau, insurance fraud is a major source of loss for carriers, costing $4.6–$9.2 billion dollars a year. This cost is directly passed on to consumers, who have to pay higher premiums as a result.

PLRB’s Weather/CAT Department is helping reduce one avenue for potentially fraudulent claims . Members now have access to Gridmetrics’s Power Event Notification System (PENS), which provides a hyperlocal view of grid continuity across the United States. With near real-time updates from 325,000 sensors, PENS enables insurers to quickly support decisions for food spoilage claims.

Aligning to PLRB’s mission of empowering its member carriers, Gridmetrics’s PENS dataset is available at no additional cost to members. When a policyowner makes a food spoilage claim, analysts can utilize these resources to geocode the address of the loss, query outage data from PENS, and determine if there was a power outage detected by any Gridmetrics sensors in the area of the property. This ability to quickly view power outages across the US speeds payment to policyholders in need, while providing another layer of security against fraudulent activities.

Democratizing Access to Geospatial Intelligence

As the insurance industry continues to wrestle with the volatile and unpredictable nature of severe weather events, organizations like PLRB are leading the way in uncovering innovative solutions to empower their stakeholders. The work that Louchios is managing around PLRB’s Map Services is a perfect example of democratizing geospatial insights to build bridges, both within the enterprise and among competitors.

In an industry where location is the central attribute for all business decisions, PLRB is helping a new generation of insurance professionals leverage geospatial tools and technology to better understand and contextualize complex situations. This access to authoritative, geospatial insights is helping create a common language for insurers to better understand our changing planet.

For more information on how to utilize PLRB resources, insurance professionals can enroll in the service at plrb.org. If your company is a current member, you can register for a free account today.