A few years ago, executives at a large North American property insurer faced a dilemma rarely encountered in the C-suite. They needed to shrink the company’s client base.

For an insurance company, too many customers in a given geographic area can create business risk, especially if the area consistently suffers heavy losses. A large number of people purchasing insurance policies could also signal that policies are priced too low.

Between 2010 and 2015, the firm’s senior executives had taken steps to reduce market share in certain areas. Spreadsheet data was useful, but it did not help executives visualize where and how changes occurred over that five-year period.

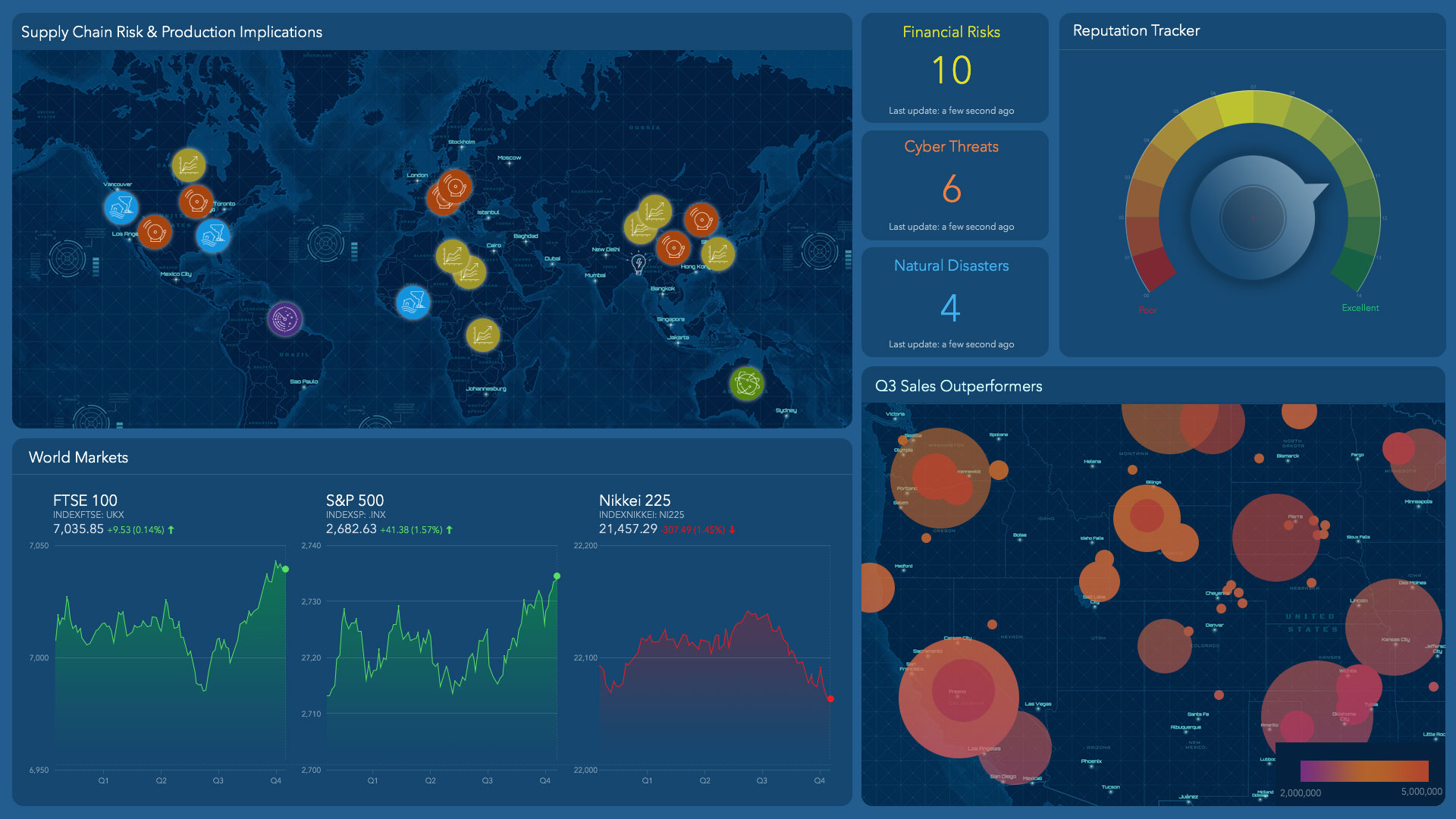

What they needed was location intelligence—a way to see the data in its geographic context. The company enlisted a geographic information system (GIS), which revealed patterns, trends, and predictions on dynamic maps. The technology also captured relevant information on dashboards, empowering executives to examine data from all perspectives—combining, layering, and isolating information as needed.

Visualizing Growth

At headquarters, executives mapped and compared customer concentrations in 2010 and 2015 to see areas of growth and contraction.

The process produced more location intelligence than expected. They could clearly see a decline in policies in certain areas, and large increases in customers in other regions of the country—especially the West. From that, executives deduced where risk was high and policies underpriced, then built a plan to reduce exposure.

The company’s GIS coordinator says executives appreciate seeing the data and analysis in a geographic context. The visual display leads to rapid understanding, he says. “That’s the most powerful part, is [they] can take a quick look at something and they say ‘aha!’”

Now, company leaders routinely use location intelligence technology to gain insight on the business. If there’s flooding in Florida, for instance, the GIS coordinator might get a call from the CFO about watercraft policies. With a few clicks, he can surface the relevant data and give the CFO a view into business risk and customer needs. As executives grow accustomed to using GIS software, they call on the analysts less.

Decisions Driven by Insights

Members of the C-suite, faced with strategic decisions that carry enormous implications for their company’s future, need reliable data. They also need a way to organize that information. Since most data is tied to a location, industry leaders see incorporating location intelligence as critical to their decision-making.

James McCormick, a Forrester analyst who studies digital transformation, argued at a recent industry conference that a strategy involving data and analytics—including location—must include every segment of a company, but especially the C-suite. “It’s something the CEO needs to understand,” he said. “It needs to be among the top three things that keep her up at night.”

Forrester labels companies as “insights-driven” when they use sophisticated data analysis at the C-level to make decisions, but estimates only 7 percent of companies reach that category. Whereas it’s common for companies to employ data analysis within certain departments, “the 7 percent have a top-down strategy that brings it all together,” McCormick says. It’s no accident that within that select group, a large majority—81 percent—employ location intelligence capabilities.

As retail industry analyst Brian Kilcourse recently observed, the big-picture analysis that location intelligence provides—from supply chain to a customer’s purchase—is precisely what CMOs crave. “You can find patterns in huge datasets that a human can’t [otherwise] see,” he said.

An Executive Perspective

Location intelligence also provides executives with the opposite of a big picture, letting them explore relevant data with useful granularity. At the property insurer, executives can examine a floodplain’s contours with 100-square-meter resolution. Rather than price policies by ZIP code, the industry norm, the company can now price certain offerings based on floodplain proximity.

In another example, senior executives at Emerus, a healthcare company that operates neighborhood hospitals, recently used location intelligence to gain a better understanding of its presence in one Texas city.

Neighborhood hospitals operate in a very specific niche within the healthcare system. They offer many of the same services as traditional hospitals—including emergency medicine, lab services, imaging, and inpatient care—but usually maintain just 8-10 in-patient beds. The cost of treatment at a neighborhood hospital is usually greater than that of an urgent care facility, but significantly less than that of a traditional hospital or emergency room.

The business model depends on the needs of a local community, so neighborhood hospital services vary. To be successful, each requires a close understanding of the surrounding area. Above all, success depends on maintaining a high patient volume, which helps ensure compliance with government programs like Medicare and Medicaid.

For those reasons, choosing the right location is crucial. Emerus executives use GIS to conduct careful demographic research before deciding where to open a neighborhood hospital. Based on that location intelligence, the company can hyper-target each facility, says Daniel Probasco, Emerus’s vice president for strategy and development. “When we do an analysis, it’s for a very specific, patient-derived trade area in one location. We do that for every location, and every one of them is different.”

Emerus decision-makers assess a proprietary blend of demographic and health characteristics to determine where to place each neighborhood hospital—to best serve patients and operate profitably. Although those characteristics vary across locations, there is one commonality: accessibility. Probasco says the typical patient should live within a 15-minute drive of an Emerus neighborhood hospital. GIS-based maps reveal that potential population for each prospective location.

The ultimate goal for our business is to be very consumer-centric, so having that location analytic perspective is key. You can't do it without that.

A View across Time Yields Competitive Insight

In San Antonio, which saw its first Emerus neighborhood hospital open in 2011, careful planning appeared to work. Over the next several years, Emerus opened six more hospitals there. But last year, volume began to decline in one area of the city.

The problem was difficult to diagnose at first. But a creative use of location intelligence allowed executives to grasp the situation and take action. As it does for the insurance provider, location intelligence gives Emerus executives a means to observe changes over time in a way that a static map—or even a series of maps—could not provide.

The trick, according to GIS specialist Colleen Pulsford, was to “animate” the data for the Emerus executive in charge. “It was eye-opening for him to understand what the impact of new competitors actually was,” she recalls. “Seeing that between 2014 and 2018 there was an explosion of competitors, he could start to understand why our market share was being eaten away little by little. He hadn’t seen the data do that before.”

The map-based animation helped Emerus executives “see” the evolution of healthcare over five years in that area of San Antonio. With that location intelligence, they created a plan to respond to competitors.

Refining the Model for High-Level Decision-Making

As the company expands its presence throughout the US, Emerus continually adds data to GIS to improve its location intelligence. That includes data on patient volume at specific neighborhood hospitals, as well as analytics on visits, health conditions and outcomes, which communities patients live in, and how they reach Emerus facilities. This creates a feedback loop that helps executives assess the results of placing new facilities in certain locations. Over time, the increasing amount of data makes the program even more valuable.

Across industries, digital transformation and IoT data continue to make our world smarter, more connected, and more data-driven. By using GIS to turn that data into location intelligence, senior executives can understand current conditions while becoming better equipped to plan for the future.

“What you know to be true today will evolve and change, and you have to be willing to evolve with it, and not get stuck thinking your first solution is always right,” Probasco says. “The companies that continually evolve and change—those are the ones that are the most successful for the long term. And that’s where we want to be.”