Tech companies and real estate developers are racing to acquire a hotly contested asset: land that can accommodate the data centers powering the AI boom.

Every day, businesses and individuals enter millions of prompts into AI platforms. These commands are routed to data centers, where graphics processing units (GPUs)—thoroughbreds of the computing world—enable AI models to send back answers and analyses in real time.

The companies involved include cloud computing behemoths known as hyperscalers, specialized data center firms, and real estate developers. As they look for land to build data centers, they’re turning to an enterprise technology known as geographic information system (GIS) software.

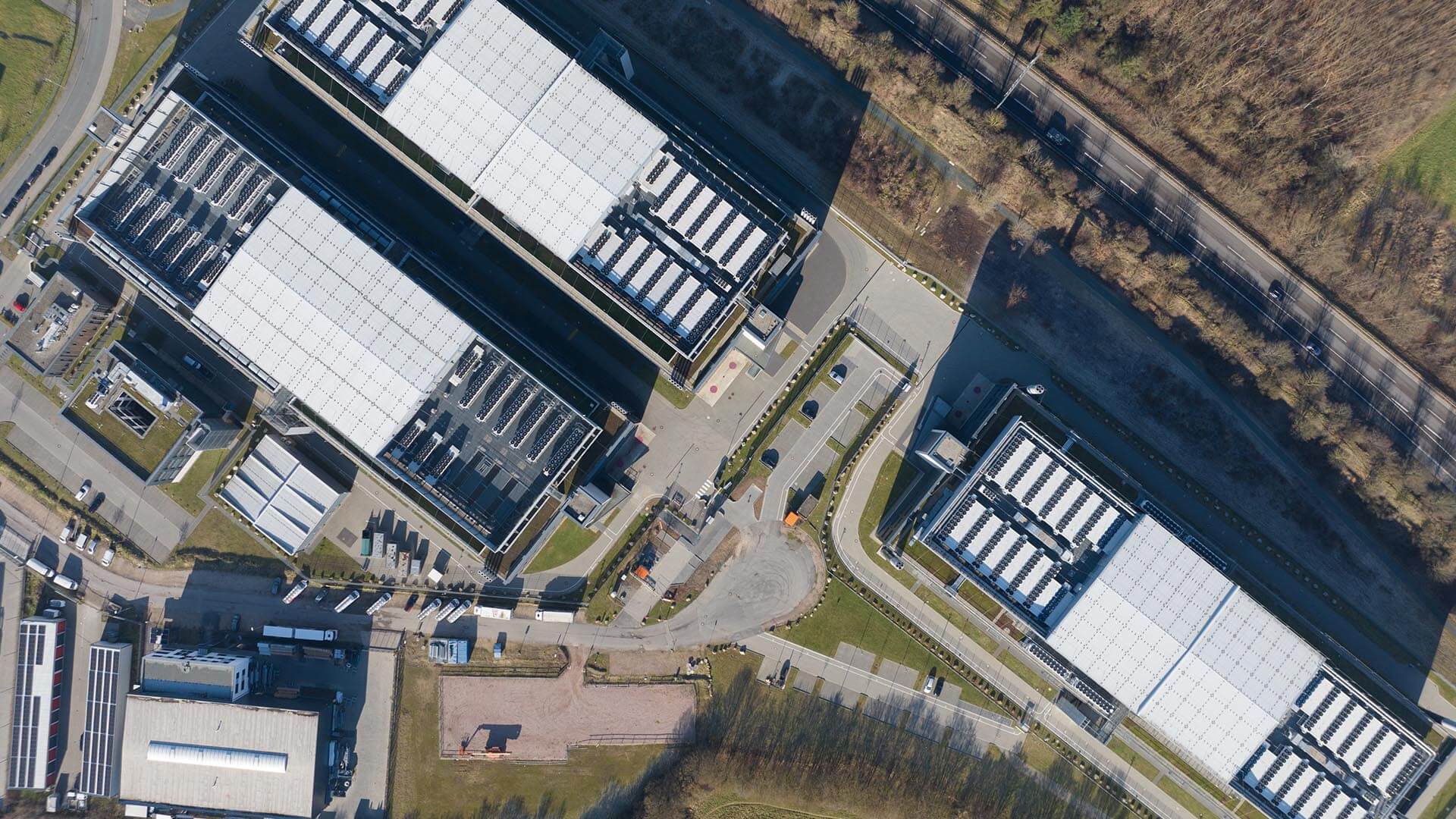

Data centers have a unique profile. They require access to abundant stores of energy to maintain servers and high volumes of water to cool equipment. They must be near fiber-optic networks, critical infrastructure, and skilled workers—while meeting zoning laws and environmental standards. You can find them in the suburbs outside of DC, in the Nevada desert, or in a small town in central Oregon.

Some have suggested that the pace of data center buildouts may be moderating, but others say demand remains strong: During the first six months of 2025, they note, investment in generative AI eclipsed that of full-year 2024.

By real estate firm CBRE’s reckoning, just 2.8 percent of data center space in North America is unoccupied, a vacancy rate that underscores the intense competition for such sites. The advantage goes to those who can scout, evaluate, and plan the quickest.

“Speed to market has been so critical for data centers,” says Sony David, a principal at the engineering and environmental services firm Langan, which has advised hyperscalers, major financial firms, and colocation developers on data center projects.

Langan’s data center team uses tools built with GIS technology to help clients find prime sites and prototype facilities faster, outmaneuvering the competition. “We see it as having a competitive edge and providing our clients with missing tools in the space,” David says.

We saw that you could leverage GIS tools to quickly find information. It’s something that a lot of our clients have been really receptive to because it opens a new door to find new sites that can be developed.

GIS: The Tech Fueling the Hunt for Data Center Space

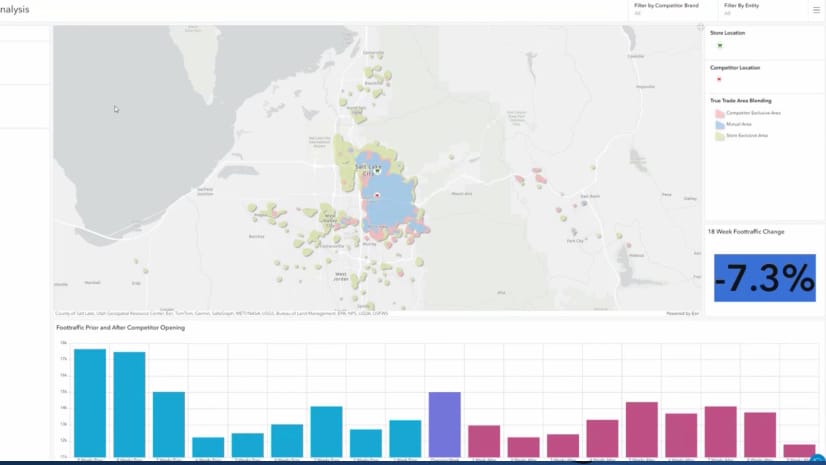

In the hunt for data center property, cloud hyperscalers and other large firms may dedicate their own staff to site selection, hire AEC or corporate real estate firms as advisers, or rely on a mix of both. However they proceed, GIS is often the common denominator, helping firms gauge the value of parcels and scenario-plan for the build process.

Location software can narrow thousands of potential sites to a ranked short list of properties that meet a client’s specifications. At Langan, GIS tools have shrunk the time needed for this analysis to three or four minutes from several hours, according to David. GIS even helps developers discover off-market opportunities and avoid bidding wars.

The applications do this by analyzing a plethora of parcel variables—substrate conditions, flood zones, opportunity zones—on maps that can be shared with clients, civil site engineers, geotechnical experts, and other stakeholders.

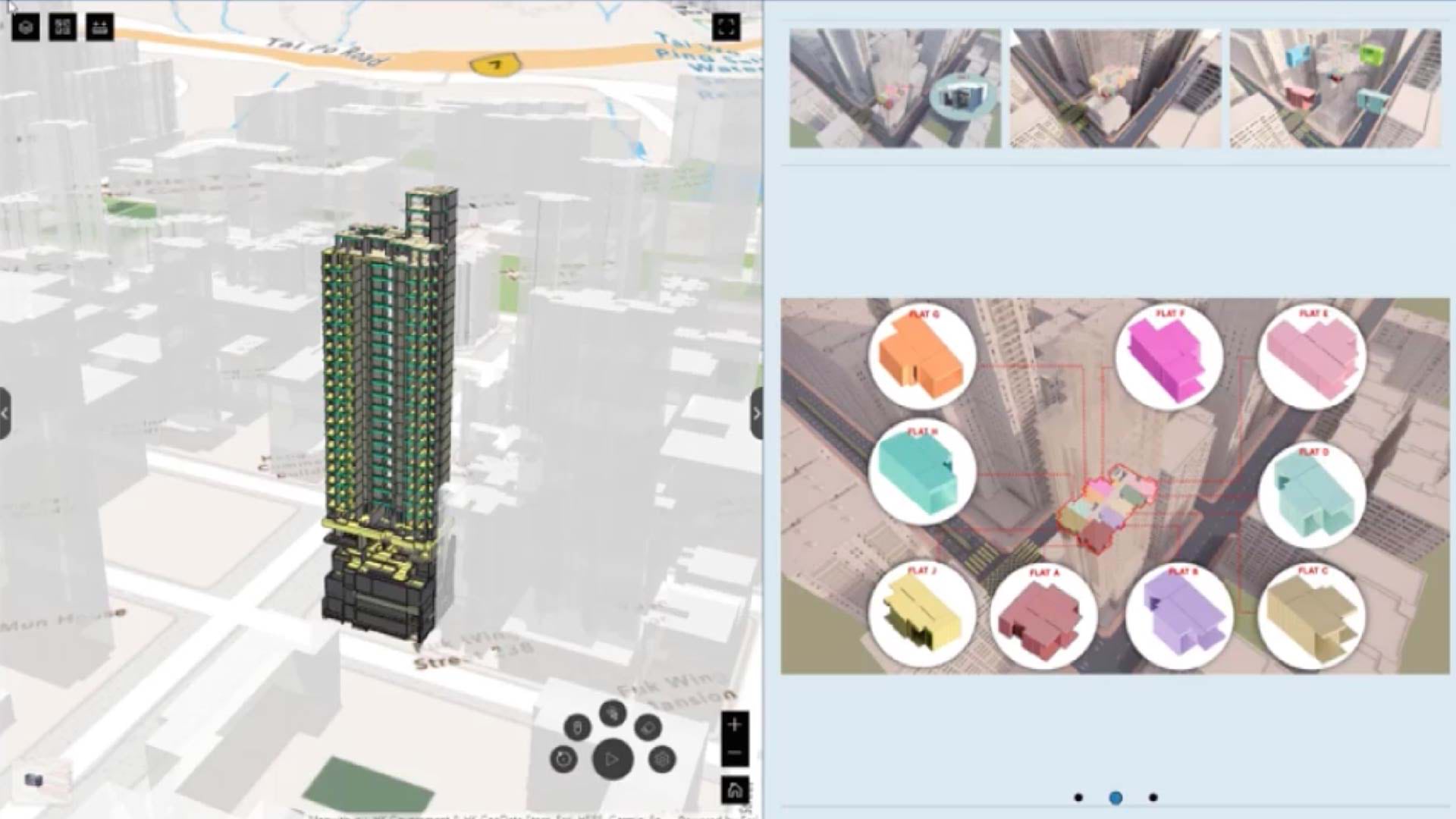

Data center advisers also use GIS-based 3D digital twins to visualize facility layouts on a parcel, allowing designers and project owners to experiment with trade-offs such as:

- How will additional parking affect the site circulation and building coverage?

- Can mechanical equipment go on the roof?

- Will the mass grading and site earthwork require additional investment?

“Now I can sit with the client and spin the building around and change your configuration and say, ‘If you make your [server rack] four feet shorter, you could squeeze a whole other building on this site,’” says Eric Wittner, a senior product manager at Langan who helped build GIS tools for data center site consulting.

Getting to ‘No’ Faster

A few years ago, a 50-acre site for a data center might have been considered large, and a gigawatt (GW) of electric power capacity seemed far-fetched. Now, Amazon is building a sprawling Indiana facility on a 1,200-acre site that will consume over 2 GWs of energy for a partnership with AI company Anthropic. Meta, Google, and OpenAI are pursuing data center projects of similarly epic proportions.

As the land race for data centers heated up, David and his team at Langan found an ally in GIS technology: “We really saw the need to implement some type of digital solution strategy that will allow us to look at these sites quicker,” he recalls.

At the start of a search, a smart map might be covered with thousands of yellow dots indicating potential sites. As a user begins filtering for things like desired acreage, mileage to nearest highways, or risks of landslides and other hazards, the number of dots shrinks, enabling a deeper examination of the most viable contenders.

Adding data to the map can sharpen the analysis. Visualizing soil types might eliminate a site with poor soils, for instance, which could add significant cost to walls and foundations. A client looking to power a data center with low-carbon, reliable energy might prefer proximity to a nuclear power plant. A property near a developed urban center could entail more stringent emissions regulations.

Location analysis can also uncover opportunities such as brownfield sites—old thermal power plants or retired manufacturing facilities strategically situated near water treatment facilities and communities with skilled workers.

At Langan, David and team even use GIS tools to reverse engineer the site selection process, analyzing common factors from successful projects and applying them in subsequent analyses.

It became just as important to say ‘no’ as it was to say ‘yes’ because it was a waste of people’s time and focus if you were evaluating 10 sites when 3 could have been crossed off in the first five minutes.

Future-Proofing Data Center Plans with Location Analysis

It’s not only the site selection process that’s accelerating—even the way data centers are built is rapidly evolving.

“You really have to stay close to what’s going on because it changes literally month to month in terms of the types of [data center] buildings that are being constructed,” David says. “People are looking at very advanced technologies and prototypes and things that they’ve never done before.”

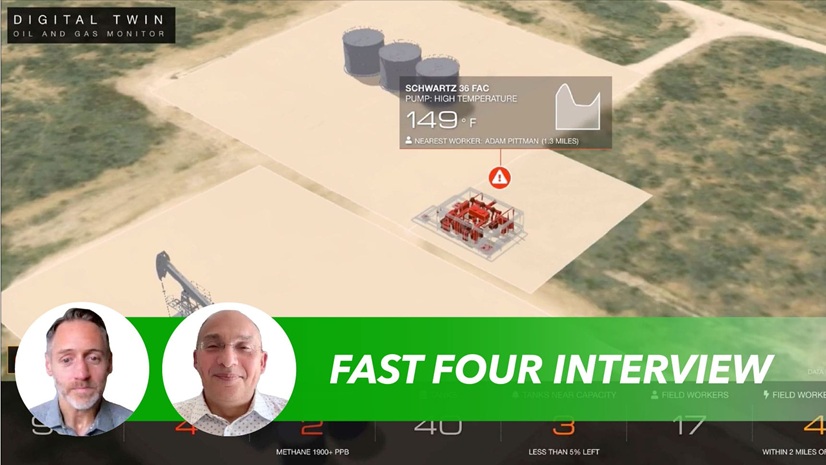

With a GIS-generated digital twin, or interactive 3D model of a building and environment, developers can test the viability and cost of plans before committing to construction blueprints.

Soil, for instance, can be one of the greatest cost factors in building a data center. With a digital twin, the Langan team can help contain costs by creating a grading plan that requires the least amount of earthwork movement across a site.

Security is a major concern for data center owners, given the critical functions these facilities support for some of the world’s biggest technology providers. With a GIS 3D digital twin, an adviser can visualize the trade-offs involved in adding double fencing around a data center site. By peeling off 25 to 50 feet from the edge for fencing, “whatever is remaining is what’s buildable, and that can create all kinds of constraints,” Wittner explains. “You’re significantly reducing the interior area, so it pushes up your size requirements.”

A data center developer can click on and slide certain features—like a stormwater basin or an electrical substation—to different parts of a building to compare the benefits or drawbacks.

In the past, these processes might have taken weeks to examine. Today, David and his Langan colleagues might resolve them during a call with the client, using GIS simulations in real time. Within a couple minutes, David says, “I can give them a very high-level understanding of, ‘Do we want to pursue this, or do we not want to pursue this?’”

In today’s land race to lock up data center capacity, that’s the ultimate advantage.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

November 18, 2025 |

January 6, 2026 |

September 23, 2025 |

July 25, 2023 |

November 24, 2025 | Multiple Authors |