Arizona’s copper belt is dotted with dormant mines that date back more than a century, remnants of an era when the state became synonymous with US copper production. Today, those legacy sites are drawing fresh attention as demand for copper surges with the country’s push toward greater electrification.

Miners are keen to answer that demand, but opening a greenfield mine typically requires a comprehensive environmental review and can involve extensive community outreach. Timelines can stretch beyond a decade.

By contrast, reopening a closed mine can take as little as two to four years and typically draws less public scrutiny.

This has mining firms considering new approaches to old mines. The Wall Street Journal reports that some companies are recovering copper from piles of waste rock left at mines closed years ago. The process, called bioleaching, uses acid and microbes to surface usable copper.

The appeal is easy to see. Not only is reopening a closed mine faster; if the roads and facilities are still in good condition, it requires less capital investment. According to the WSJ, if bioleaching works, companies plan to scale it at sites where favorable geology and existing roads and facilities shorten the path to new production.

Taming Variables for Mine Site Selection and Adjacent Projects

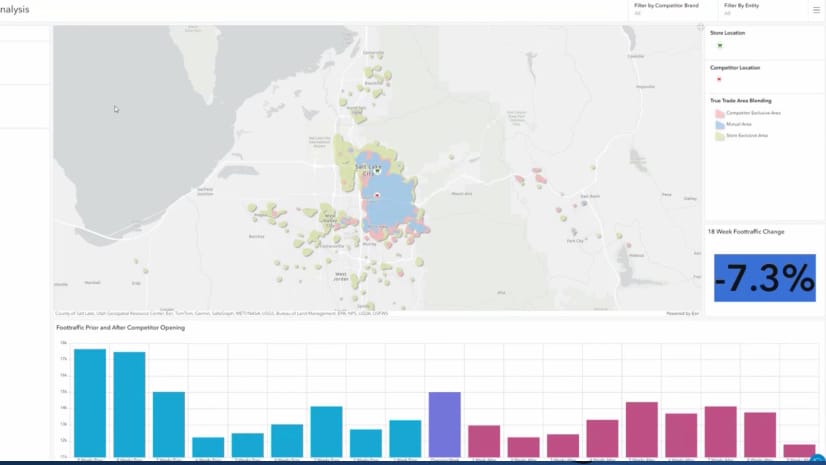

Mining companies and other natural resources firms have long faced site selection challenges that demand sophisticated analysis. Top companies solve these challenges with geographic information system (GIS) technology, using it to gauge investment risks, evaluate potential ROI, and speed up business decisions.

Consider the race to build AI data centers. Competition for land is fierce, and site requirements are exacting. A data center needs access to reliable power, water for cooling, fiber connectivity, and a skilled workforce—all in a location compatible with environmental regulations. Tech companies often team up with engineering firms, using GIS analysis to quickly narrow thousands of possibilities to a handful of high-potential sites.

Getting to “no” quickly can provide a competitive edge, since companies that eliminate unsuitable sites can focus resources on a shortlist of candidates. Decision makers can inspect GIS maps for risks and opportunities, identifying where a soil type might pose a structural risk and which areas have the labor pool required for a given operation.

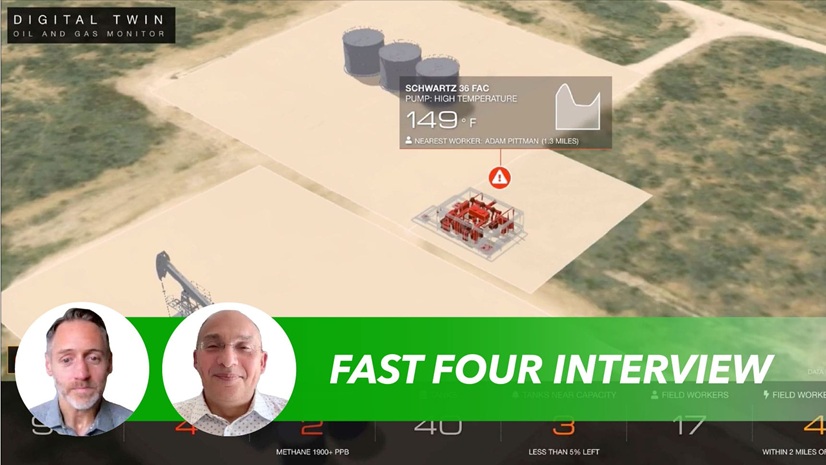

With a GIS-generated digital twin, or interactive 3D model of the land and its environs, developers can test the viability and cost of plans before committing to a project—whether that’s a greenfield site or a dormant operation. On interactive maps, planners can collaborate on cost assessments, design choices, and construction workflows.

Aligning Demand to Capacity on a Map

Energy producers face challenges similar to those of miners—especially when it comes to deciding where a resource can be developed profitably. In both cases, industry leaders routinely make their business case with the help of location analysis.

Like miners evaluating old operations for possible restarts, wind energy firms already know where their resource is—GIS maps show where conditions are right to harness the power of airflow. The trick is identifying the site with the best energy distribution potential. For one industry leader, that means reviewing maps showing high-voltage transmission lines near wind-rich areas. As the firm’s VP of development told WhereNext, “These insights provide real-time information that helps us make smart investments.”

For a copper miner searching for second-life sites, location analysis might focus on infrastructure and compliance. Smart maps answer questions like, What’s the capacity of nearby roads? What is the site’s power profile? Is this area water-stressed, and what are the biodiversity requirements of operating here?

Across industries, the challenge of bringing an operation online follows similar patterns. Progress depends on the ability to analyze all variables in a location, and do so quicker than the competition. When so many options seem possible, successful firms rely on location analytics to determine what is profitable.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

November 18, 2025 |

July 25, 2023 |

September 23, 2025 |

January 6, 2026 |

November 24, 2025 | Multiple Authors |