PepsiCo’s recent rebrand, reported by Fast Company and other publications, emphasizes what the company has become through acquisitions: a global portfolio of more than 500 brands. The beverage and snack giant has expanded by targeting specific consumer segments, from its trademark colas to its health-conscious offerings. Every acquisition raises the same question: Where do you launch products and invest marketing dollars to reach these new customers?

For companies pursuing growth by acquisition—whether a fast-fashion retailer buying a sustainable clothing startup or a financial services firm absorbing a fintech aimed at Gen Z investors—identifying new customer segments and understanding where they live and shop determines whether the investment pays off.

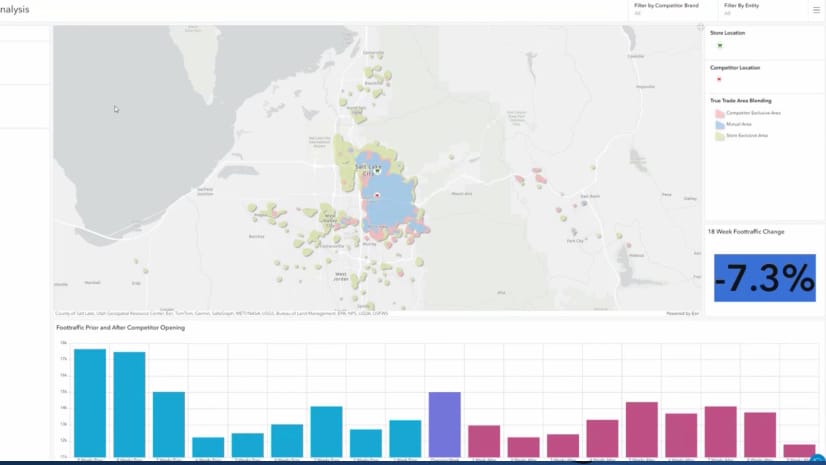

To gain that insight, many consumer brands rely on mapping and analysis from geographic information system (GIS) technology for market planning and development.

A Smarter Lens on Growth by Acquisition

Breaking into unfamiliar markets demands a nuanced understanding of would-be customers. A GIS analysis of psychographics often leads the way.

Psychographic data on consumer lifestyles, behaviors, and beliefs becomes powerful when enriched with location data—combining insight on what anonymized groups of consumers care about with where they live, shop, and socialize.

Viewing psychographic customer segments on a map allows market planning executives to spot clusters of consumers with affinity for their brands. This analysis shows where expansion efforts are likely to succeed and where they are unlikely to deliver meaningful returns.

Customized Experiences Through Precision Analysis

At a major apparel company that has grown by acquisition, executives need more than basic demographic data to inform their market strategy. In a metro area with a high concentration of consumers making $150,000 a year, decision-makers rely on GIS analysis of psychographic data to understand which high earners are likely to shop which brands—and thus identify where the company should open new stores.

A home-improvement retailer with thousands of stores uses GIS to analyze consumer preferences around its existing locations, customizing store layouts, product assortments, and even in-store music to match local tastes.

This location analysis gives business executives actionable insights about where to go—and how to connect with customers in each market.

For business leaders integrating an acquired brand, opening stores in new locations, or entering new markets, understanding customer locations, behaviors, and beliefs isn’t optional. It is the foundation for strengthening returns and building market presence.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

November 18, 2025 |

July 25, 2023 |

September 23, 2025 |

January 6, 2026 |

November 24, 2025 | Multiple Authors |