Small pricing changes can deliver big benefits to a company’s bottom line. Yet some business executives have been slow to reap the advantages of pricing intelligence. Now, access to highly granular, location-specific customer data means executives can no longer ignore pricing strategies.

In the latest installment of the WhereNext Think Tank series, Esri’s Brian Cross talks to John Lenahan, commercial practice lead, about the emerging phenomenon of personalized pricing.

Brian Cross: In this Think Tank series, I’ve talked to thought leaders about the ways location intelligence is changing the business landscape—everything from big data and IoT to companies using new data sets to understand their consumers in hyper-local ways. You’ve worked in a variety of industries—what do you see as the next big frontier for customer data?

John Lenahan: One of the big shifts I see is in the increased data and understanding of the customer. The digital connection that companies have with their customers is definitely providing a wealth of data, whether it’s sales data, information from loyalty cards, or data that companies have collected in their physical stores. There are a number of areas where companies can leverage this data. One that is on a lot of people’s minds, especially with the use of online tools and shopping sites, is personalized pricing. And what’s especially interesting is how location data affects a price that someone might see in a store or while shopping online.

I think the challenge—and the opportunity—is the ability to work with new data streams and inform pricing strategy based on location and where a person is.

We’re seeing organizations use new kinds of location analysis to better understand customer data and create better pricing and engagement strategies. In some markets, it’s a very new concept, but in others, like insurance and retail, it’s evolving quickly.

Cross: I want to explore what’s happening across industries, but why is pricing important in the first place? What’s the big picture for business executives here?

Lenahan: I think most executives understand the importance of pricing, but they might not realize just how much of an impact it has. PwC found that a price increase of 1 percent typically has an 11 percent impact on a company’s profit. Every piece of data that a company can use to get its pricing right—even to get it right for a specific customer—has a big impact on the bottom line.

Pricing Risk with Customer Data and Location Intelligence

Cross: You mentioned that a consumer’s location can change the price of products and services. How is that playing out in the insurance industry?

Lenahan: Insurance companies are good at pricing risk, but they haven’t always been able to see exactly where that risk is. Today, many insurers have more accurate data as well as a digital connection to customers—through telematics, or mobile apps. These data streams give them a new kind of location and risk intelligence. The insurers we work with are using this data in a couple of scenarios.

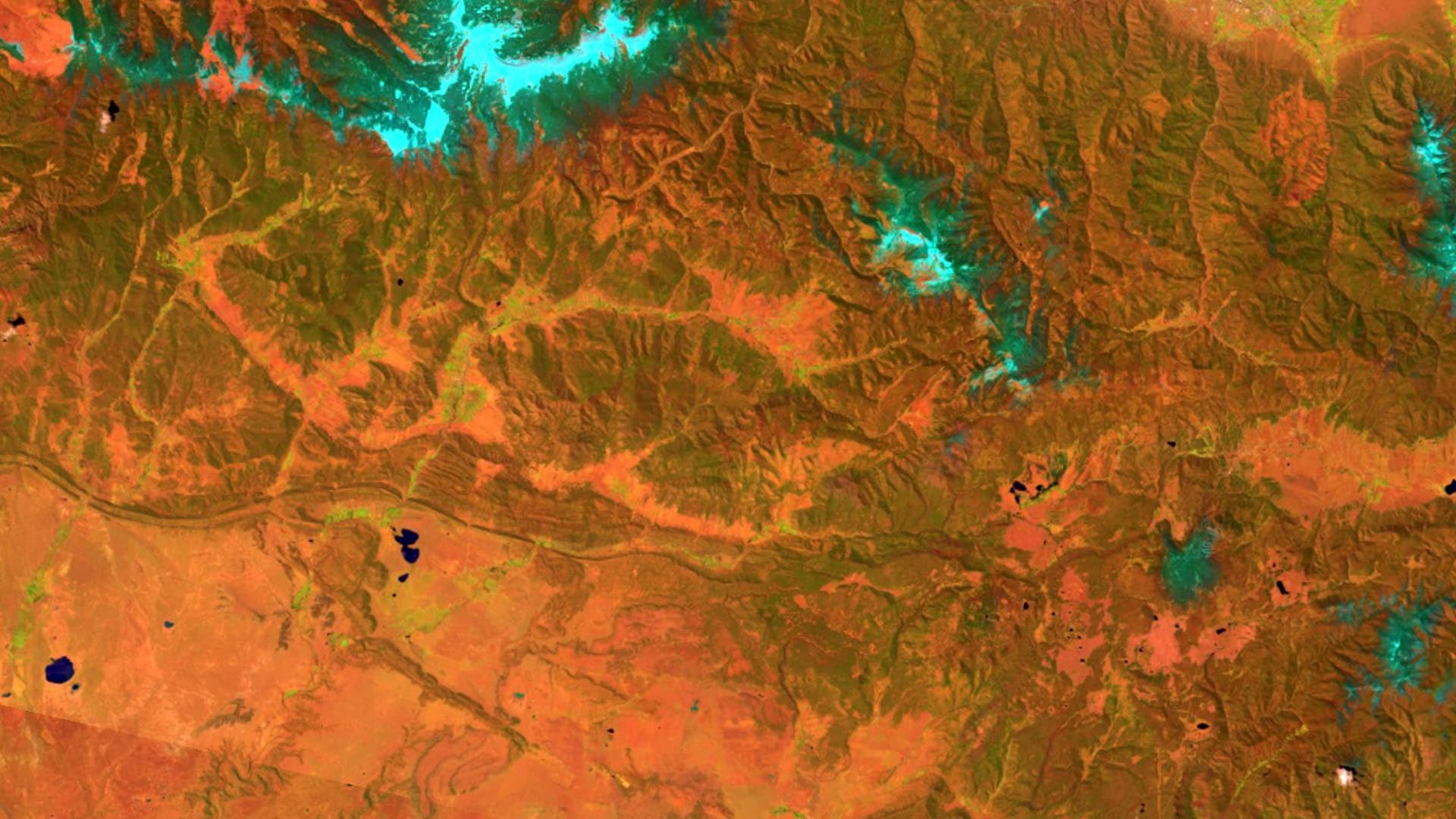

One involves better understanding risks in fixed locations—tracking hurricanes more precisely, more accurately overlaying flood plains, etc. That helps insurers better price homeowner’s policies, for example, because they’re getting very detailed location intelligence about those risks.

Another scenario is the use of telematics to help auto insurers understand how drivers are moving around in space, and analyzing that information to adjust the prices or discounts a driver receives. This is a form of usage-based insurance (UBI), where customers agree to have their patterns tracked and analyzed by the insurance company.

Rolling out any kind of pricing strategy at scale is an expensive investment for a company. And making sure that you capture and understand the efficacy of that strategy is critical.

Cross: When most people think about UBI, I think they imagine tracking behaviors like speeding and distracted driving. But you’ve found an interesting location aspect involved, too.

Lenahan: Right. A person’s risk profile and premiums are based not just on how they drive but on where they drive and which routes they take. Someone signing up for an insurance policy and opting in to be tracked might tell the insurer, “90 percent of my travel is from home to work and back. The other 10 percent I drive to soccer on the weekend with my children, or out to eat.”

But after six months of data collection, the insurance company might see that this person actually drives from work to home 50 percent of the time, and 25 percent of the time, they take a detour to pick up laundry or groceries. The insurer can overlay that information with data on traffic incidents and high-risk corridors and accident clusters—even analysis as nuanced as how often the driver takes left turns. None of this happens without the consumer’s consent—insurers offer these policies only to those who ask for them. But for those who do opt in, this kind of location information will affect the driver’s personal price, because the insurer can define the risk more precisely.

Retail Experiments with Personalized Pricing

Cross: If we move from insurance to retail, how is geography changing pricing in that industry?

Lenahan: Retail executives have traditionally approached pricing at a national level or occasionally one market at a time—they adjust prices based on each market’s demographics and cost of living. But online travel sites, Amazon, and other ecommerce sites have challenged retailers to get more granular. Those websites are very good at prompting an individual to finish a purchase, for instance. They analyze a shopper’s browsing history—or the fact that she looked at a product five times, put it in her cart, and walked away—and the site will deliver customized offers to prompt her purchase.

Adopting those techniques in the brick-and-mortar world hasn’t been easy, but a combination of mobile apps and indoor location technology is making it possible.

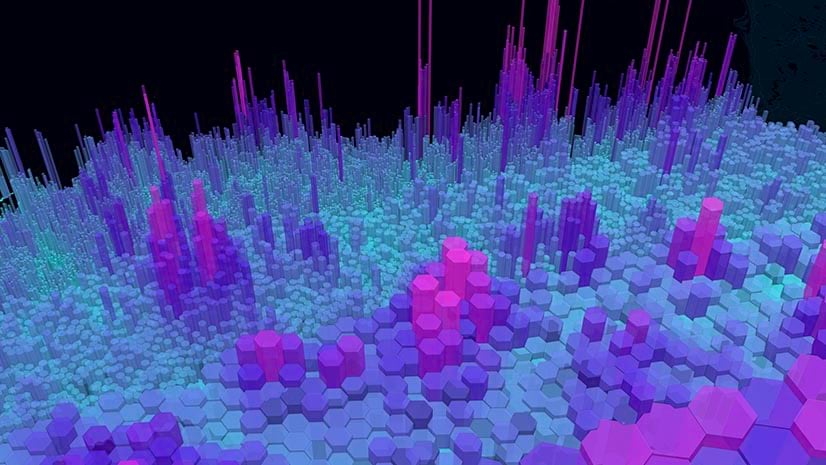

We’re seeing scenarios where retailers are offering variable pricing based on the customer's loyalty, shopping history, and where they are in the store.

Cross: This seems to connect with another trend I’m seeing, which is that mapping is moving indoors aggressively. We’re seeing companies analyzing employee productivity in office spaces, for example. What are retailers doing?

Lenahan: We’ve talked to several retailers that are analyzing in-store travel patterns to adjust the shopping experience and pricing in real time and beyond.

In the real-time scenario, a shopper using a grocer’s mobile app might be moving through the store on a weeknight shopping run. As he nears the end of a particular aisle, the system recognizes that he just passed the gallon of milk he usually buys, and it serves him a coupon, hoping to deliver the price point that will inspire a purchase.

Retailers are also mapping hot spots where people linger in stores—and leveraging that information to offer different prices at one end of the store versus the other end, for instance.

Editor’s note: To see some of these scenarios in action, watch this short video on how retailers use IoT data.

How Human Weather Patterns Affect Pricing

Cross: Stores that sell to consumers have known for a long time where they fit into macro traffic patterns. If I’m a convenience store on the way out of town towards the mountains, for example, I might stock firewood and charge a little more for beer. But today’s data is much more granular. What kind of movement are retailers tracking, and how does that affect pricing?

Lenahan: Some traffic patterns have definitely influenced store pricing for years, but now we’re seeing a lot of mobile data being gathered, especially in urban cores. Retailers can access data that shows precisely how much foot traffic passes through an area, as well as the kind of clients or customers a store might market to. That kind of location intelligence factors into what that store may or may not carry, and what prices they could ask for those products.

The really interesting idea is what role the customer’s location plays on the price that they’re willing to pay at that point in time to purchase a product.

Cross: So a small retail location on a busy walking street in New York City might partner with a data analytics or media company to figure out that its target demographic looks like this, and the store should adjust the price of these particular goods.

Lenahan: And the interesting thing is, it’s not just about where people are; it’s also about when they’re there. The target customer might change drastically from the morning rush to the lunch crowd to the weekend passerby. The business execs who can merge spatial and temporal understanding of traffic patterns to create real-time insight tend to gain an advantage.

Editor’s note: For more insight on the shifts in the retail industry, read the eBook Capitalizing on Retail Disruption.

The Technology behind the Price

Cross: What are some of the enabling functions in the tech world that are actually making this possible now?

Lenahan: There are a few. One is the technology that’s being used to capture the data from phones, cars, sensors, and other kinds of IoT hardware. The second is the compute power that allows retail, insurance, and other companies to process and use this data—many customer data and location records run into the millions. And third is the ease of the tools. For instance, GIS technology is becoming much easier to work with for nontechnical professionals. We’re seeing a lot of organizations that used to enlist consultants to generate this insight switch to staff professionals to create insight on market dynamics and pricing.

Where Next for Personalized Pricing?

Cross: What’s on the road map for personalized pricing?

Lenahan: On the insurance side, I think there’s a recognition that usage-based insurance and telematics are just the beginning. As you look at ride sharing and autonomous vehicles, insurance companies are going to have to become more creative and have a better understanding of how they offer products, based on different driving patterns and different transport patterns. This is the first step into that new frontier.

Regardless of industry, the bottom line is companies that want to use this information to price more effectively need to offer value to the customer. Personalized pricing is only going to take off if the customer sees value from engaging with a company this way. The customer wants to feel a connection—they never want to feel like it’s an intrusion. That’s the balance companies have to strike as they get access to more and more customer data.

But as I said earlier, the challenge—and the opportunity—is the ability to work with new data streams and inform pricing strategy based on where a person is. Location can provide a critical input to pricing strategy and help companies engage with customers and drive bottom-line growth.