An emerging real estate trend called wellness communities is capturing the interest of developers and investors. These master-planned neighborhoods provide a range of homes, services, and activities that aim to support residents’ physical, emotional, and even spiritual needs. Psychographics can play a prominent role in helping real estate developers and investors identify potential markets and locations for these communities.

A recent Fast Company article, “Utopic Wellness Communities Are a Multimillion-Dollar Real Estate Trend,” summarizes the growth and capital behind this movement, citing a report by the Global Wellness Institute that sizes the North American market for wellness real estate at $52.5 billion, with 6.4% annual growth. The global industry is worth $134 billion, according to the institute, and is projected to reach $180 billion by 2022.

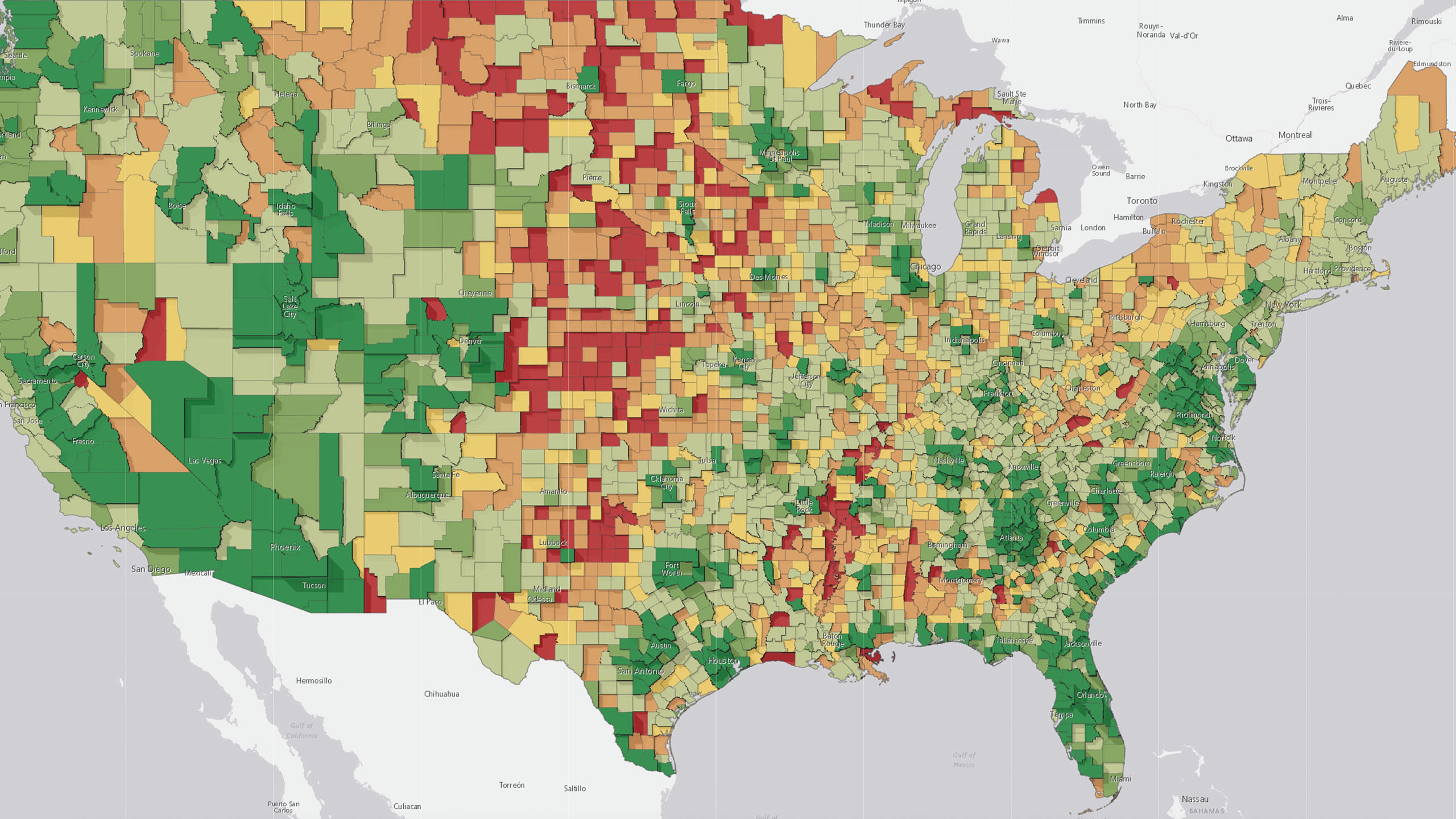

Health and wellness are broad categories, and developers are beginning to cater to specific subgroups. To identify niche groups, leading developers and investors analyze psychographic information. Psychographics reveals the lifestyle preferences of potential customers—from preferring alternative medicine to supporting environmental causes to being a member of a certain social club. Understanding how popular those preferences are in certain geographic areas can help investors and developers decide which kinds of communities to build and where.

Paying for Premium

A driving factor behind developers’ interest in wellness communities is the capital they’re attracting. Already, Fast Company reports that buyers are paying 10 to 25 percent markups on homes in wellness communities.

As early as 2014, a study by the Urban Land Institute found that wellness communities exceeded the expectations of real estate developers on several key measures: how quickly the properties were purchased or leased, the premium that buyers and renters paid to live in them, and the number of buyers and renters on their waiting lists.

While many wellness communities (like Atlanta-based Serenbe) are in rural areas and surrounded by nature, they represent a broad spectrum of customer values.

Psychographics broadens the demographic scope from focusing on who a person is, to what that person believes in.

Since a diverse array of people share the fundamental desire for wellness, there is potentially a wellness community suited to many customer segments. Farm-to-fork, arts-focused, and luxury wellness communities are manifestations of psychographic interests, and forward-thinking developers are seizing on these interests and segments to cater to new customers.

Niche Goes Mainstream

What started in quiet rural locations is rapidly gaining worldwide traction. There are about 350 wellness communities in development just in North America, according to Fast Company. Steve Nygren, founder of Georgia’s Serenbe, told the publication that real estate developers, civic commissioners, and financiers regularly visit his community to learn its practices.

In this growing industry, location intelligence drawn from psychographic insights is a go-to tool for developers and investors hoping to locate the next wellness destination. The power of location intelligence lies in its ability to unite an understanding of customer segments with the geographic knowledge necessary to plan the real estate developments that answer their wellness needs.

Photo courtesy of Park Dasol.