Business resilience involves a series of complementary strategies—everything from corporate security to enterprise risk management to business continuity planning. Collectively, they strengthen a company and bolster shareholder value. But for too long, says Esri’s Alex Martonik, these functions have been viewed as cost centers and not value creators.

The twin impacts of the COVID-19 pandemic and a volatile climate are shifting the mindset. Companies with the wherewithal and tools to weather these disruptions—one of which has faded while the other has grown—have found ways to gain market share. They are the industry leaders, and they accelerate when others flounder.

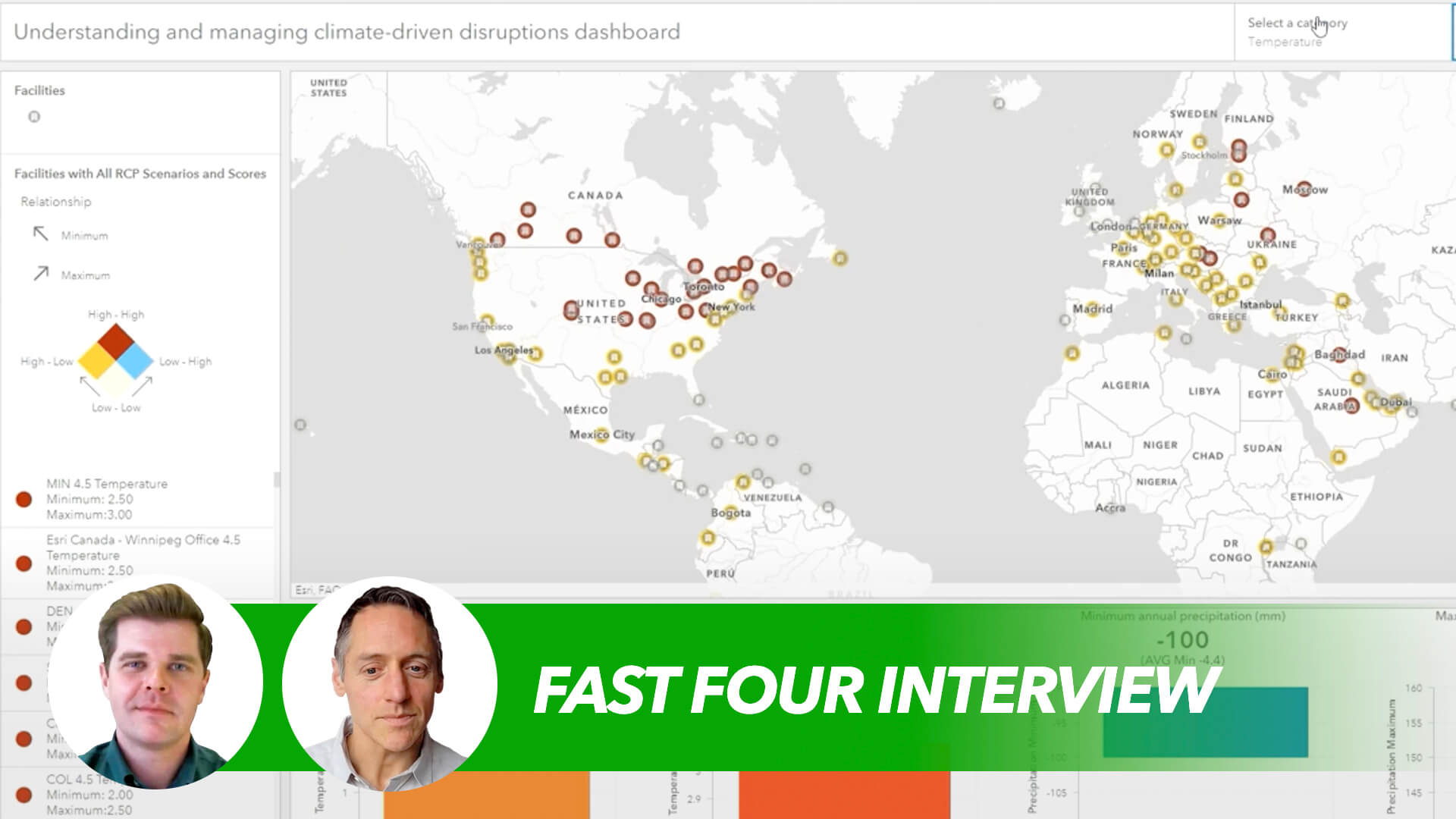

In this WhereNext Fast Four interview, Martonik explains how leading companies deliver on customer expectations in the midst of climate volatility. They have done more than overcome a technology challenge, he reveals—they have embraced a new approach. In this short video interview (the transcript for which appears below), Martonik shares a fresh perspective on resilience.

Chris Chiappinelli: We are back with the WhereNext Fast Four, and we’re talking today about risk. Alex Martonik brings a unique perspective to this. He has spent his career focused on the topic, and these days he’s actually thinking about risk management as a business advantage. Alex, welcome. I want to hear a lot more about that idea, but why don’t we start with some of the basics up front: What is the situation that companies are facing when it comes to risk?

Alex Martonik: Absolutely, and great to be back, Chris. Recently Reuters highlighted that, over the past 30 years, the average annual cost of natural disasters has hovered around $57 billion. But when you really look at the data, you see this trend line is flat, year over year for many decades, and now is suddenly increasing. To put it in context, in 2023 alone, Munich Re reported that global insured losses surpassed $95 billion. And this really highlights that climate change is intensifying natural disasters, and it will continue to impact every business sector. But despite understanding the economic ramifications of climate change, very few companies are addressing their exposure at scale.

We recently worked with Forrester and commissioned a study to explore this topic. And what we found was 97 percent of companies reported being negatively impacted by a critical risk event over the past 24 months, many of which said it directly impacted their profitability. Despite this, though, only 50 percent say they’ve devoted enough resources to managing those risks. That divide creates a very unique competitive advantage based on enterprise risk and resilience.

Chiappinelli: Interesting opportunity there. So what has changed recently in that equation?

Martonik: Well, executives now understand that brand loyalty goes out the window when necessity is knocking at the door. And the inflection point really is the COVID-19 pandemic. Because business leaders understand there are global events outside of their control, things they can’t avoid that can directly impact their business operations, they need to be prepared to fundamentally shift how they go to market. And we saw this in that first year: Hundreds of thousands of companies in the US went out of business. Others were producing record-breaking profits. It’s because they had resiliency at the forefront of their core functions. They were able to dynamically react to the situation, and they could grow when others were going out of business.

Chiappinelli: Yeah, that makes sense. In this big equation of resilience and risk, where does location intelligence factor in?

Martonik: It’s more than just technology or data. When we’re talking about resilience, it’s a fundamental shift in mindset that location intelligence can help facilitate. So when you look at security operations, enterprise risk management, business continuity planning, these are business functions. What’s the purpose of any business function? To drive growth.

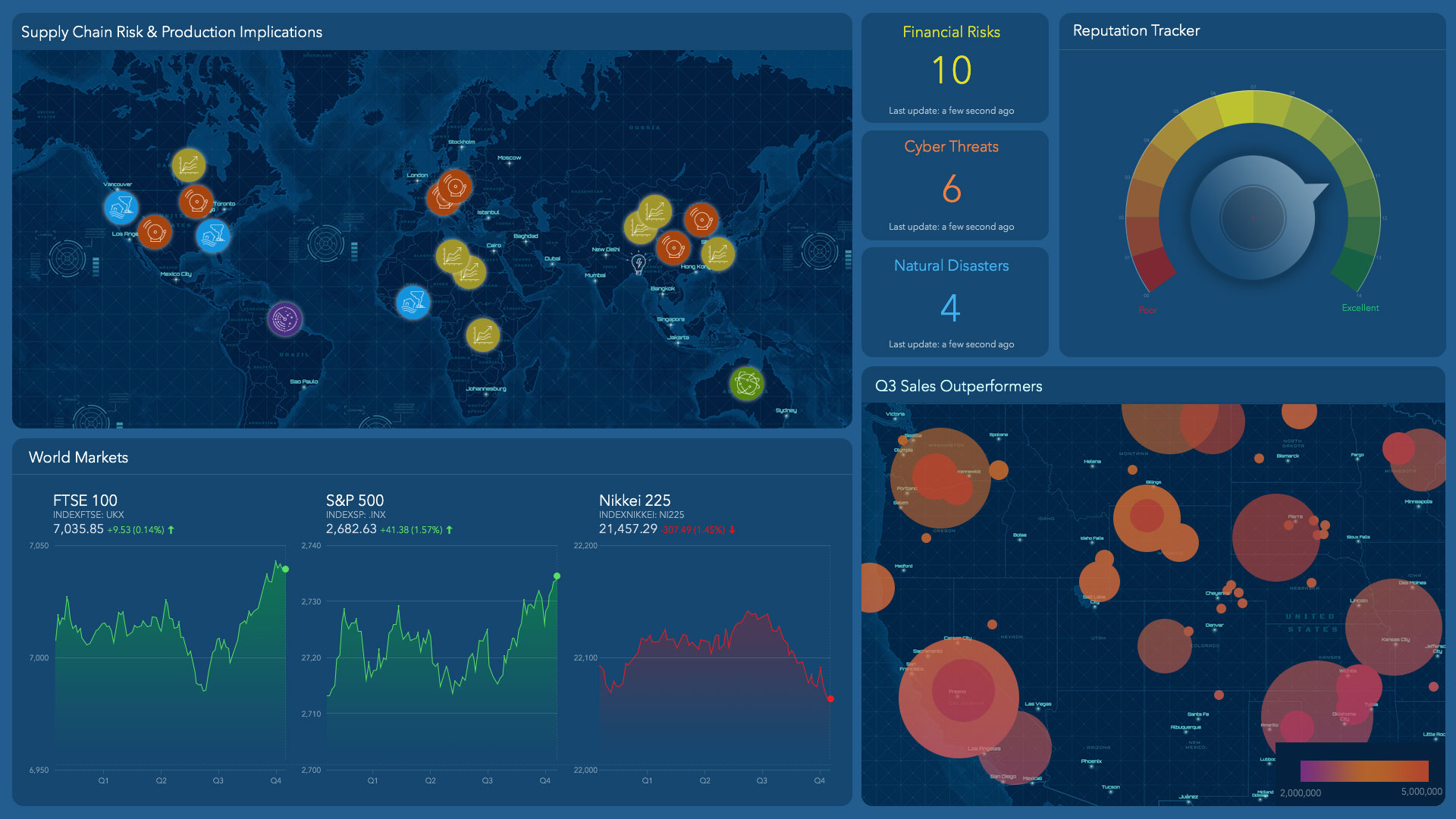

Location intelligence helps these professionals create what we call an operational basemap. This is a dynamic digital twin of core business functions where then you can overlay risks, rewards, opportunities. What’s your exposure to climate change? What does that look like to you as a business in context? And where are the opportunities to divest from areas where you’re over-concentrated or create new robust supply chains? We’ve seen this in action across almost every industry vertical, including one of the largest hotel chains in the world, which uses it for security operations, sustainability, looks at how to safeguard guests, employees, facilities, and their financial investments alike.

Chiappinelli: Interesting. So this is becoming more of an enterprise-level function. What are some of the results that companies get from approaching risk this way?

Martonik: Absolutely. It has to be an enterprise approach. I was recently asked, “Well, who owns climate change?” Everyone owns climate change. Every part of the company is going to be impacted by it. That’s where a framework like location intelligence and that operations basemap brings together all of the core functions of a business.

How can market planners, before they buy real estate, understand the exposure to climate change to those markets? How can supply chain managers understand what their network looks like so that if a port suddenly closes, they reroute their goods to still execute on market demands and their brand promises?

And at the end of the day, what is the state of the entire enterprise as it relates to those disruptions? Again, they’re outside of any executive’s control. What they can control is how they respond. Location intelligence facilitates that.

Chiappinelli: That’s really good perspective on a challenge that a lot of companies are facing. Thank you for your perspective, Alex.

Martonik: Absolutely happy to be here.

Chiappinelli: And thank you in the audience for joining us. As always, we have placed a link on the video that’ll give you a little bit more information on the topic, and you can also get to that through the article. I’m Chris Chiappinelli with the WhereNext Fast Four. We look forward to seeing you next time.