Editor’s note: WhereNext’s Growth Insights series examines several dimensions of business growth. We begin with an article that explores market planning among midsize companies, and the fine balance of science and data that helps businesses—whether they’re midsize or large caps—expand intelligently. We’ll follow with articles on the direct-to-consumer phenomenon, how to spot consumer trends years in advance, the supply chain implications of growth, and more.

Data and intuition are a business leader’s boon companions, guiding decisions that can fuel company growth in the best possible markets. Ask some CXOs in confidence and they’ll say they favor their intuition. But their faith in data—especially smarter data—is rising.

Dale Sanford pursues growth for a living. As vice president of development and integration at Mortenson Dental Partners, he works with other company executives to expand a business that began in Kentucky and has expanded to nine states, providing general and specialty dental services for more than 100 communities.

For the past decade, the company has maintained a blistering growth rate, acquiring, starting up, and expanding practices across the country. Fueling that growth is a mix of executive intuition and analytical data. Lately, the role of data has grown, as Sanford, his team, and Mortenson’s C-level executives now regularly consult a geographic information system (GIS) for insight about where and how the company should grow.

Decision-Making in the Era of Digital Transformation

During Jack Welch’s time at General Electric, the much-ballyhooed CEO was often credited with an intuitive management style. Employing the approach he outlined in the book Straight from the Gut, Welch drove GE’s growth from a $13 billion company in 1981 to a $400 billion company two decades later.

Yet, as he has explained, data and intuition mingle more than we might think. “Gut is only pattern recognition,” he explained at a recent conference. “It’s data you’ve accumulated over a number of years that allows you to make a call. . . . I still think you like [to have] as much data as you can get.”

Since Welch retired from GE in 2001, digital transformation has drastically increased the amount of data available to executives. IoT-based sensors reveal the real-time health of critical assets. Data from mobile devices shows patterns of foot traffic in locations around the globe. And modern GIS technology allows business executives to map what-if scenarios for business growth.

But as most business leaders can attest, the perfect blend of science and intuition isn’t always easy to discern. For those responsible for growing a business in the era of digital transformation, the Harvard Business Review may have captured the ideal strategy in its 2017 article “The Best Approach to Decision Making Combines Data and Managers’ Expertise.”

When we find a potential new site or a potential acquisition, one of the first things that we'll do in GIS is pull population counts and existing dentist counts, because that population-to-dentist ratio is very important to us in determining the competitive landscape.

In a 2016 survey, the Smith School of Business at Canada’s Queens University found that 61 percent of senior business leaders “somewhat agree” that important decisions are now based more on data and less on intuition. Still, only 20 percent strongly agreed.

Intuition and Digital Intelligence—Forces for Growth

Sanford falls into the “strongly agree” camp. He is one of the Mortenson executives charged with maintaining year-over-year revenue growth that has topped 20 percent for the past decade. The doctor-owned company—each dentist at a Mortenson Dental Partners location is a full-fledged company owner—is blazing its own growth path while other practices are absorbed by corporations, bolstered by private equity funding, or worse, not surviving the disruption.

From its roots in Louisville in 1979, Mortenson Dental has grown into nine states, acquiring and building dental practices in markets with favorable profiles. Decisions about where to grow have always been a blend of intuition and data, Sanford says, but with the company’s recent implementation of location intelligence technology, the emphasis is now on smarter data.

“We don’t make capital investment decisions for our growth without a full GIS analysis of whatever the opportunity is,” Sanford says. “It’s key to what we do.”

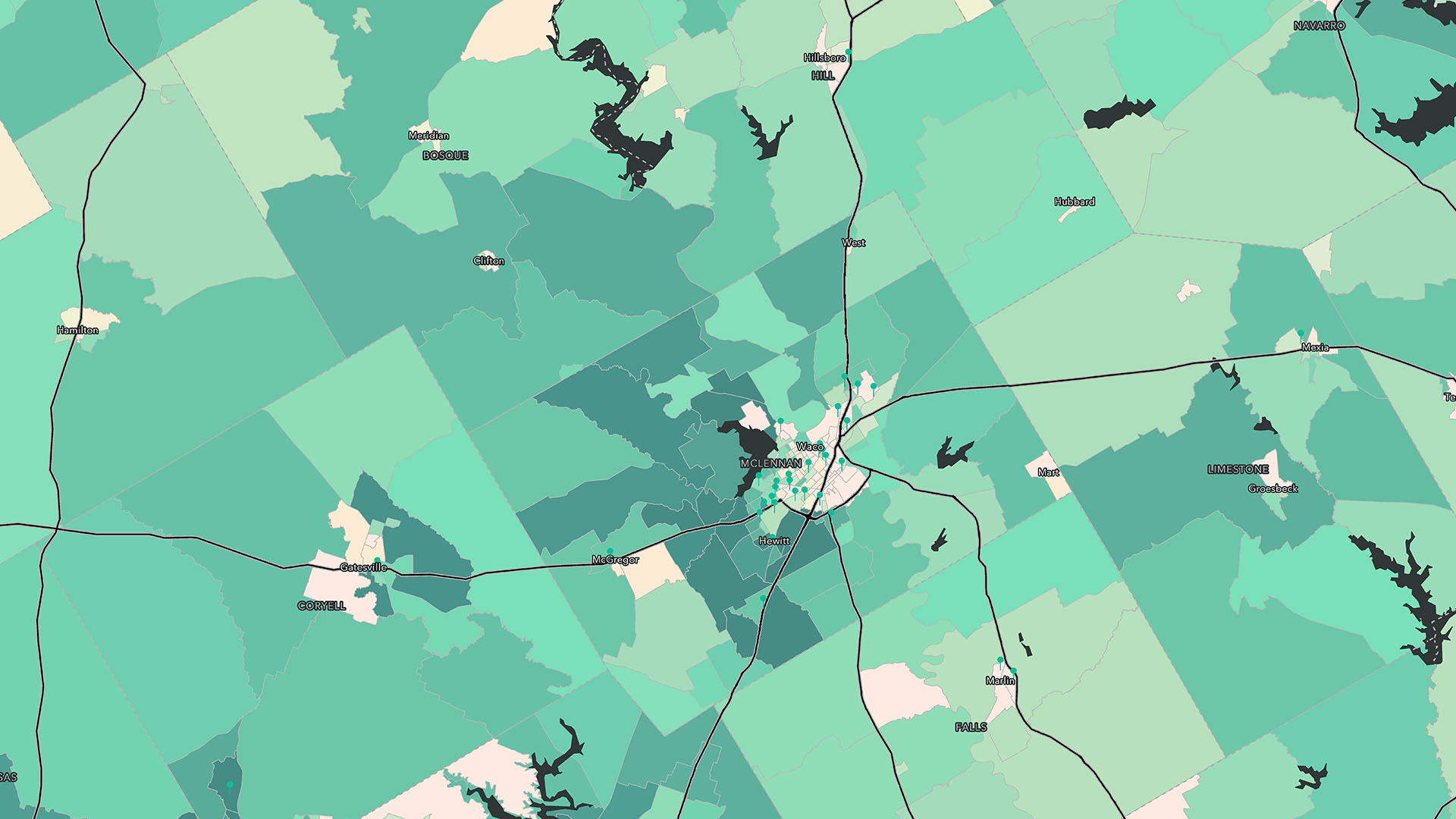

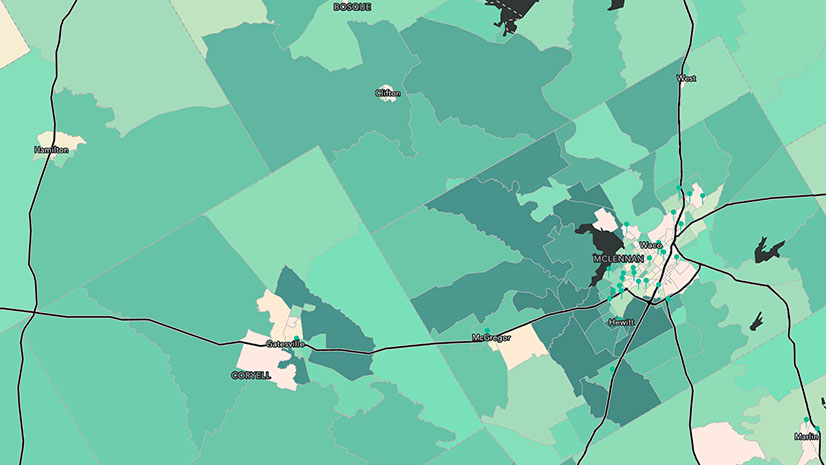

Location intelligence is a form of business intelligence that helps organizations discover relationships, patterns, and insight hidden in their data. Location intelligence technology helps by combining multiple layers of data and business criteria—like market trends, neighborhood demographics, and customer analytics—onto interactive maps and visualizations. The subsequent analysis provides unique insight about opportunities that drive better decision-making for growth—and help a company avoid costly mistakes related to poor location decisions.

The location intelligence gleaned from GIS often confirms the leanings of Mortenson’s executive team, Sanford says. Still, “if the data says one thing, [we] may disagree, but we typically make the final decision based off the data and not intuition.”

How Location Technology Drives Business Growth

Mortenson’s growth is almost equally split among three channels: acquiring practices, starting up new ones, and expanding the practices it already owns. The team uses location intelligence to assess each growth opportunity, and GIS is the main engine. Sanford explains the basic steps:

- New site evaluations—The Mortenson team begins by using GIS to map the competitive landscape around a proposed new location—whether that’s an acquisition, a new practice, or expansion—and examine other general and specialist dental providers in the area.

- Market demographics—To get a sense of the prospective patient population, Sanford and team enlist GIS to map local population density, growth rates, average income, education levels—even purchases of dental products. For a pediatric dental practice, the analyst might use GIS to measure the population under 18 years of age, along with the prevalence of pediatric doctors or children’s hospitals in the area.

- Dentist ratio—For a practice to thrive, Mortenson needs a certain number of people living within a reasonable driving distance of the office. A dentist-to-population ratio of 1 to 1,600 stretches the lower limits of viability, while 1 in 2,000 is a much healthier level. Sanford and team use GIS drive-time studies to determine the ratio in each market.

- Traffic evaluations—Mortenson enlists traffic analysis for two purposes: to gauge the hustle and bustle around a prospective location and, once a site has been selected, to identify prime locations for billboard advertisements that will reach prospective patients.

- Cannibalization studies—Sanford and team have developed a robust GIS model to understand patient behavior around current offices. “We try to predict if we drop a new site in, what’s going to happen to those existing sites,” he explains.

Location Intelligence in Practice

A recent growth opportunity in Texas put many of these activities to the test. Mortenson was already operating a dental office in Lubbock when a retiring pediatric dentist offered to sell his practice to the company.

“It was a great opportunity,” Sanford explains. “But since we already had a practice in the immediate market, we debated how to purchase and relocate the retiring doctor’s practice a little further south into a rapidly growing area of Lubbock.”

Our executive leadership team is very visual, so we'll plot maps with locations and drive times and patient population pins. When we're ready to propose a project, we use that data stream from the GIS tools and orchestrate those visualizations to help them understand what we're seeing.

Executives suspected the acquisition and relocation could be profitable, but wanted to confirm it and identify the right location. First, analysts created a map of the retiring dentist’s patients to determine where they were coming from. Then they developed a GIS-based heat map showing areas of Lubbock with a high prevalence of residents under 18, and another heat map showing areas where that population was projected to grow in coming years. That data helped executives pinpoint the best geographic area to relocate the pediatric practice.

“We know we’ll experience some leakage of patients,” Sanford concedes. “However, our assumption is that if we locate in the right area, we can minimize patient leakage and even offset it by attracting net new patients.”

Instilling Confidence to Grow

For the leadership team at Mortenson, GIS-powered location intelligence has helped create “an increased level of confidence when we’re making investment decisions to grow our organization,” Sanford says. The company’s president of dental teams, William Becknell, echoes the point. “Analytics are critical to Mortenson Dental Partners to ensure our location strategy is based on empirical facts, ultimately impacting access to oral health care in the communities we serve.”

As innovative business leaders across every sector wrestle with the persistent challenge of growth, they are aggressively fusing advanced data and intuition. Now, with modern GIS and location intelligence, successful executives say they have a new view of business opportunities, and the result is greater clarity and opportunity to better serve their customers.

For insight on avoiding the overlooked perils of data analysis, read this article on the data-driven business.

Photo courtesy of Charles Forerunner