Office-to-residential conversions aim to solve two challenges at once: underused office buildings and a persistent housing shortage. Based on the growing number of conversions in the pipeline, developers are beginning to like the concept.

Turning office space into apartments or condos, though, is no easy task.

Developers must first find a location with sufficient housing demand and the right zoning. Then they face the architectural and engineering hurdles of transforming the structure. A corner office doesn’t always make for a cozy bedroom, after all. And sprawling office floors may not yield the natural light required for residential living.

A recent Wall Street Journal story showed just how complicated the process can be in New York City, and how developers are getting creative in their conversions. The lessons aren’t necessarily unique to New York City, nor is the demand. Metro areas in Charlotte, North Carolina; Jacksonville, Florida; Omaha, Nebraska; and Boston, Massachusetts, have seen office conversion projects double in one year, helping drive the national backlog of office-to-retail conversions to 71,000 units, according to RentCafe.

To overcome the challenges of converting an office into a home, developers must understand everything they can about a target property, from who might live there to how the sun will shine through the floor space. Location analysis factors prominently in this due diligence.

Finding the Right Location for Office-to-Residential Conversions

Conversion costs vary widely depending on factors such as government incentives, labor, materials, and the extent of retrofitting required to create living space.

Some estimates show that office-to-residential conversions cost anywhere from $100 to $500 per square foot; others say $250,000–$300,000 per unit. Deloitte has forecast that conversions are likely to be profitable by 2027, thanks to shifts in rents, acquisition costs, and government-backed incentives.

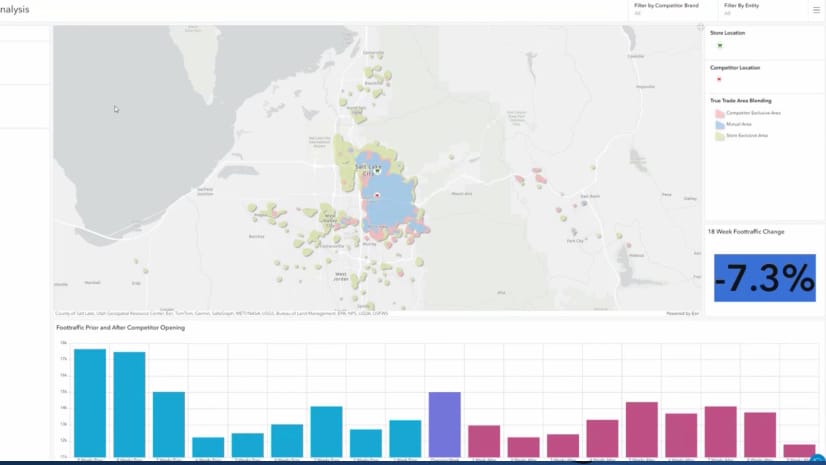

Developers can use the mapping and analytics capabilities of a geographic information system (GIS) to sort through the possibilities. With GIS analysis, they can learn more about a target property and its environs, including prospective renters or buyers.

As a WhereNext article on adaptive reuse noted:

By analyzing data on foot traffic, demographics, and psychographics, GIS reveals population characteristics—from age, income, and household size to interests, values, and behaviors—in large communities or on a single city block.

In addition to understanding local buyers, developers can examine information about comparable sales to gauge the market, along with information about utilities access, zoning, and tax incentives. Other map layers could include information on local school districts and proximity to grocery stores—two factors that matter more to would-be homeowners and apartment hunters than to office workers.

Through these layers of insight, a map explains the economic potential of any office-to-residential project.

Creating the Right Space from the Inside Out

Even if market indicators are favorable, the right office building in the right location may not be right on the inside. As the Wall Street Journal reported, developers are getting creative to ensure that apartment dwellers will get enough sun and air—in some cases demolishing entire sections while leaving the rest of the structure standing.

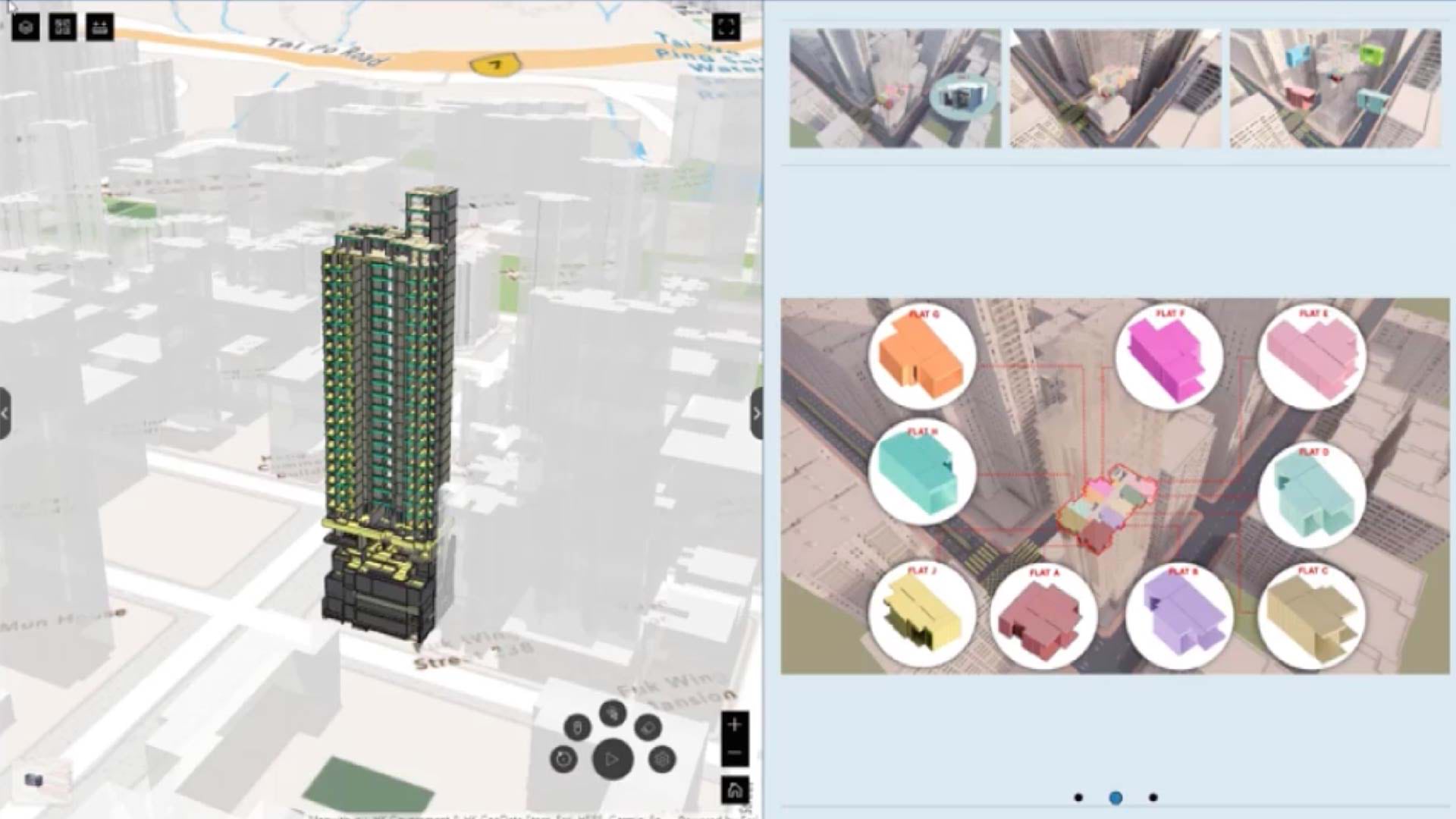

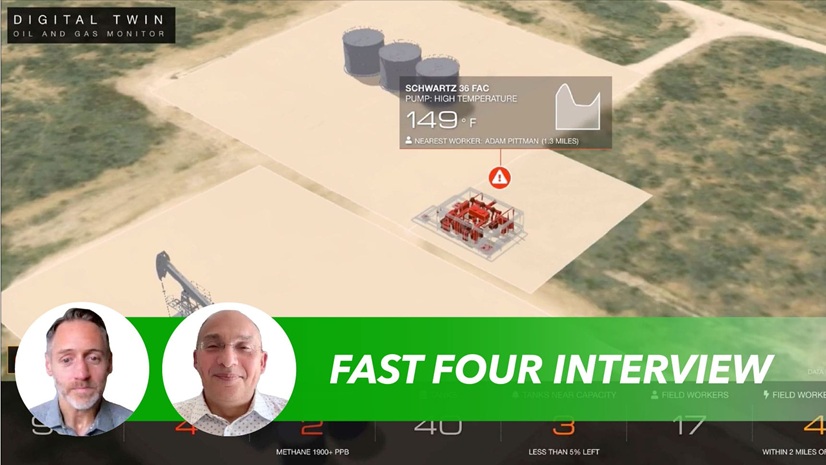

The GIS software that helps developers assess a housing market can be combined with building information modeling (BIM) technology to create the 3D model, or digital twin, of a target property. This allows all project stakeholders to see what the structure looks like inside, how it will be transformed with residential amenities, and how it will interact with sunlight and surrounding buildings. Line-of-sight views within the digital twin reveal what residents are likely to see from their windows.

The technology that makes this perspective possible for developers has also helped the US Air Force optimize office space at Mountain Home Air Force Base in Boise, Idaho. It has allowed King County, Washington, to manage hundreds of thousands of square feet of facility space. And it’s how the European Organization for Nuclear Research (CERN) decides who works where on its 540-acre campus above the subterranean Large Hadron Collider.

An accurate, detailed indoor view is saving these organizations time and money. For developers assessing office-to-residential conversions, mapping and analytics allow them to evaluate markets and test designs in a virtual environment, pointing the way to projects worth their investment.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

January 6, 2026 |

November 18, 2025 |

November 24, 2025 | Multiple Authors |

September 23, 2025 |

July 25, 2023 |