A paradox lies at the heart of consumer attitudes toward data sharing, according to a recent study containing important insights for business executives who shape data-driven strategies. In a survey of more than 10,000 respondents across 10 countries, HERE Technologies found consumers as anxious as ever about potential data abuses, with 53 percent reporting concern about sharing personal information digitally, up two points from 2018.

Yet more than two-thirds of consumers, or 70 percent, signaled a growing willingness to share location data, a metric that rose in every country surveyed except Germany. The openness to sharing is more common for services related to mobility, like ride-share apps, connected cars, and mapping platforms.

A close parsing of the study’s findings reveals a clear path forward for organizations that employ business and location intelligence to inform decision-making: companies stand a much better chance of accessing and deriving value from data when they are transparent, trusted, and demonstrate benefit to the consumer.

With the usefulness of location data being well-established in finding and mastering new markets, companies in retail, insurance, banking, and other industries do stand to gain, but must allay customer worries about how their data is used.

Location Data Has Never Been More Important—or Sensitive

Concerns about data privacy have been top of mind in recent years. One cybersecurity report found that within just the first six months of 2019, over 3,800 breaches exposed access to more than 4.1 billion records. Massive data breaches like Yahoo’s hacked user accounts and Marriott’s compromised reservation system continue to capture headlines. Meanwhile, new regulatory regimes like the European’s Union’s General Data Protection Regulation and the California Consumer Privacy Act have made data privacy a political issue. In general, consumers are simply more aware of how coveted their data can be, with 48 percent agreeing that their data is valuable to many collectors, according to the HERE study.

These facts have prompted companies to more carefully address communication and transparency around the use of consumer location data. At the same time, the speed of the information economy has made location intelligence a linchpin of market planning and competitive advantage. As noted in a Forbes piece on the topic, “the McKinsey Global Institute indicate[s] that data-driven organizations are 23 times more likely to acquire customers, six times as likely to retain those customers, and 19 times as likely to be profitable as a result.”

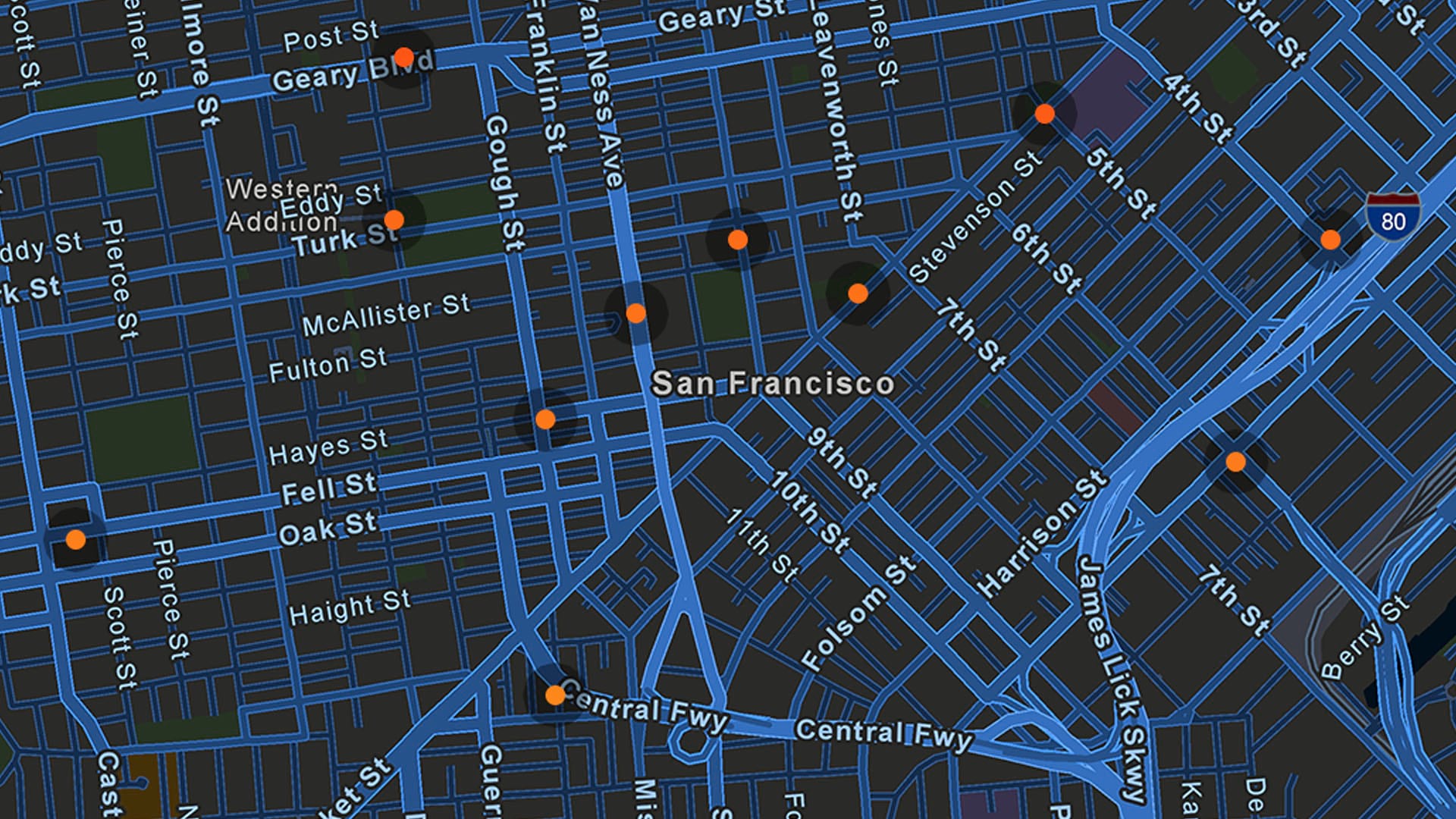

Location data—gleaned from smartphones, social media, IoT-equipped devices like fitness trackers, even dating apps—can be immensely beneficial to companies planning growth strategies. Plotting out movement trends on maps over time, executives can create location intelligence that reveals where certain groups of consumers are now and, more significantly, where they’re likely to be in the future.

Myles Sutherland, founder of the consulting firm One Degree North, has coined a term for these moving masses of location data points: human weather. “Imagine being able to track the patterns and impact of human activity like a meteorologist tracks weather fronts,” wrote business development strategist Jim Young in an article on the topic. This kind of insight could be invaluable to a retailer assessing the foot and car traffic near potential new sites, a restaurant chain determining whether to add a new late-night menu, or a real estate developer looking to acquire buildings in the next hip neighborhood. The powerful ways companies can leverage this kind of data underscores why organizations must assure consumers that their information is not being misused.

How Attitudes toward Data Use Are Shifting

Trends in data sharing vary by region—a notable fact for companies with an international presence. The HERE study found that data sharing was highest in China, with 90 percent willing to share, followed by India, Brazil, and the UK. The United States, where many data-sharing apps have originated, actually landed in the middle of the pack, with 71 percent agreeing to share location data. Japan, Germany, and France reported the lowest levels of trust and frequency in data sharing. The biggest rise in sharing frequency occurred in Brazil, up seven points from 2018.

Still, despite consumer reservations, openness to sharing location data is fairly common across the board, according to the study. That willingness rose sharply when doing so was seen as necessary or working to the consumer’s benefit, with 75 percent of respondents more apt to share location data when it contributed to safety or security. Enabling a service, saving money, gaining financial rewards, saving time, or increasing convenience were among the other top motivations that led to greater consumer tolerance for opening up their data.

Not surprisingly, six out of 10 consumers were more likely to share data when the collector was well-known. And a full 79 percent reported being likely or very likely to allow navigation or mapping services to access their data. This helps explain why public transportation and ride-hailing services saw the greatest gains in consumer trust, as did car manufacturers, with more consumers linking their phones to their vehicles. In these cases, the consumer saw clear value in sharing data, and the collector was an established brand or company whose reputation assuaged privacy concerns.

For business executives, these findings signal a blueprint for creating a data-sharing understanding with consumers. By creating trust, emphasizing transparency, and showing how location data will play to the consumer’s advantage as well as the company’s, business leaders can use that data to accelerate growth and bring key customers along with them.

(Find out more about how companies use market and customer analysis to expand.)