In a holiday travel season crimped by COVID-19’s spread, a group of business experts and travel industry veterans predicts that business air travel could remain down by more than a third even when the rest of the economy rebounds.

In an analysis that stretched over months, Wall Street Journal columnist Scott McCartney sifted data and insight from airline industry veterans and landed on a prediction with deep economic implications across sectors. After COVID-19 retreats, there will likely be 19 to 36 percent less business-related air travel than in the prepandemic era, he found.

If that prediction holds true, consequences for the airline industry will be profound. Other sectors that benefit from business travel could suffer as well. For hotels, convention centers, and meeting spaces; restaurants; retailers with airport locations; consulting companies; and service providers that cater to traveling business professionals, a decline of this magnitude demands new thinking and new tools to support smarter location strategies.

One Overlooked Cause of Less Travel—The Net Zero Effect

With COVID-19 vaccines now on their way to people worldwide, some business forecasts have improved. Analysts at Goldman Sachs expect economic growth of more than 5 percent in 2021. But for pockets of the economy—including those affected by business travel—sales likely won’t return to previous levels.

McCartney says travel reductions will be driven by classic business influences such as efficiency and cost. One factor he doesn’t mention is the corporate push toward net zero carbon emissions. As more CEOs pledge to go net zero by 2050 or earlier, they’ll take a dim view of business activities that contribute to emissions, including travel by airplane. (Flights tend to be a “dirtier” form of travel than other means, according to a recent analysis.) Earlier this year, health-care provider Bupa Global found that a quarter of business executives plan to reduce international travel in the post-COVID era to lessen their carbon footprint.

Regardless of their motivation, 91 percent of CEOs in a May Fortune survey said they expect business travel to be less frequent [subscription]. If such predictions pan out, companies that rely on business travelers will face a planning challenge. They’ll need to understand where people consume products and services, and use that insight to create a profitable location strategy for stores, offices, warehouses, and other facilities.

Business travel makes up 21 percent of the nearly $9 trillion worldwide travel and tourism market, and a less-than-healthy rebound will create a smaller pie for service businesses to capture.

Long-Term Location Strategy Meets Short-Term Consumer Shifts

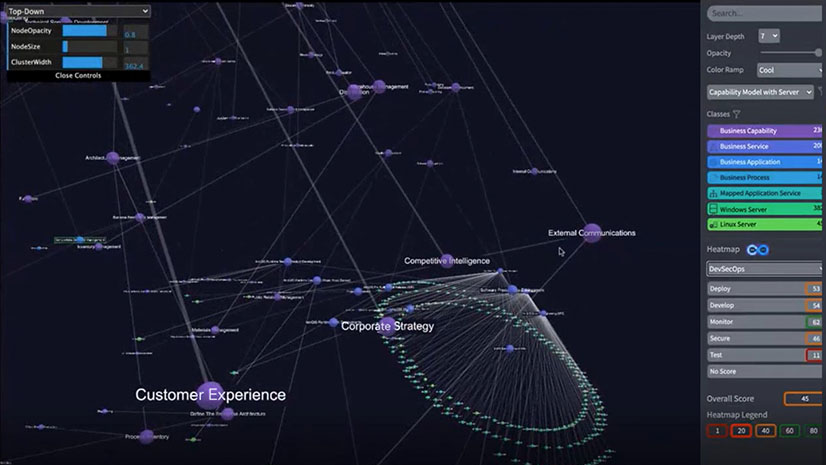

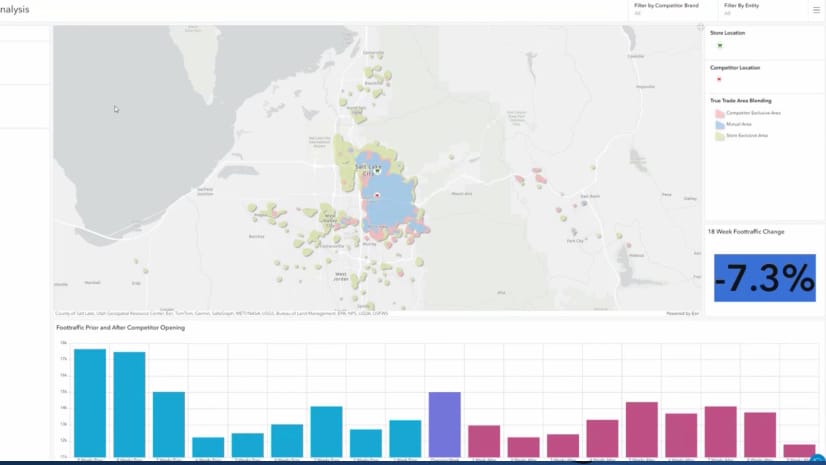

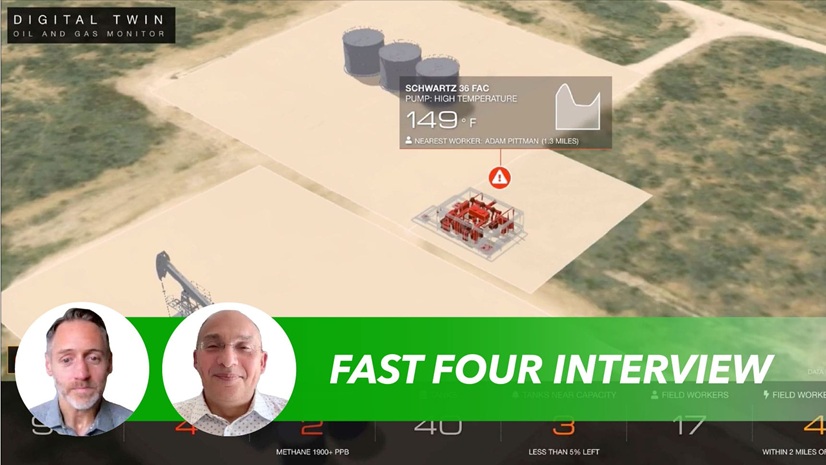

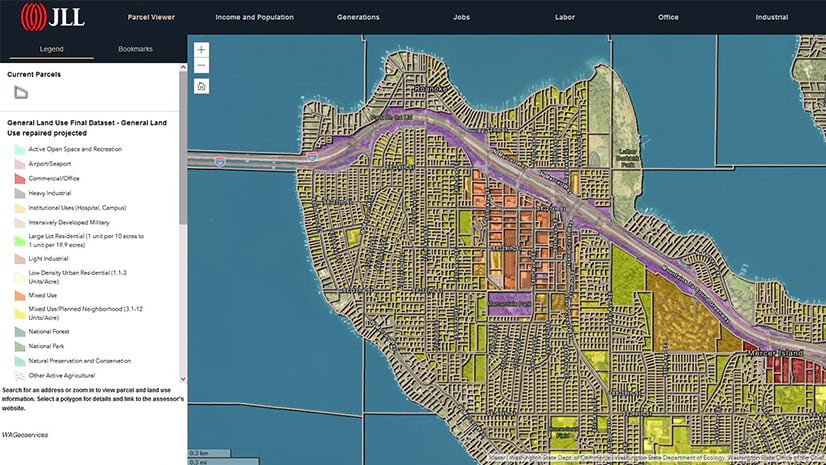

To adjust to significant economic shifts, industry leaders need fast and accurate location insight. In the digital age, that’s more accessible than ever. With anonymized information on where consumers are and no-code technology like a geographic information system (GIS) to illustrate changing patterns, company leaders are locating new business opportunities.

Executives are making those adjustments faster than they used to. Traditionally, decision-makers set location strategies for the long term, weighing where to sign multiyear leases for stores and offices or build manufacturing facilities and warehouses. That began to change prior to the COVID-19 pandemic, as CEOs sensed changes in shopping patterns and pushed for shorter commercial real estate leases. During the pandemic, the trend has accelerated. The average lease length in the US fell by 15 percent during the first five months of this year, according to JLL.

The most obvious reason for this decline is the uncertainty created by COVID-19. Business leaders are now more sensitive to unforeseen events, and need to adjust location strategies for factors like lockdowns, work from home, and business travel declines.

Shorter leases are a means to that end—a tactic to help companies become more agile. But understanding how to put that agility to use—how to change business plans as economic realities change—requires location intelligence.

Reliable information is key to understanding current customer needs and possible future customers. Demographics including age, gender, income, and spending habits can be linked by GIS technology to a physical location or catchment area, helping brands identify opportunities and define actions.

Location Intelligence: See Changes Sooner

One indispensable tool for understanding changing economic patterns is a smart map. As Swarovski’s Richard Bezuidenhout wrote recently in WhereNext, companies that use smart maps to fine-tune their location intelligence are more likely to weather disturbances and spot new business opportunities:

With smart maps, business leaders can zoom in to a region or city and take the temperature of stores there through indicators such as customer relationship management (CRM) data, survey data, and demographic information.

GIS-based maps help business planners see where people are spending time and buying products and services. With millions fewer business travelers moving through the country during any given week in the future, companies that contextualize this kind of location data will make adjustments that competitors won’t anticipate, Bezuidenhout notes:

Location technology can highlight microtrends specific to one city avenue where a shop is located, or industry-wide changes that shape an entire national network.

The COVID-19 pandemic will be remembered for its profound impacts on human health and its quick reshaping of the economy. In addition to decreased business travel, it has accelerated trends such as carless cities and remote work, forcing business executives to plan in a fluid environment. Those who do so with the help of location intelligence may find an advantage in a volatile world.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

January 6, 2026 |

November 18, 2025 |

November 24, 2025 | Multiple Authors |

September 23, 2025 |

July 25, 2023 |