As business leaders roll out AI adoption strategies, they’re undervaluing one key area, according to a new survey by Fortune and Deloitte. While more than 75 percent of surveyed CEOs expect AI to automate manual operations and increase efficiencies, just 31 percent expect it to improve risk management. But the right data and AI capabilities can be invaluable for assessing risk quickly, precisely—even years in advance.

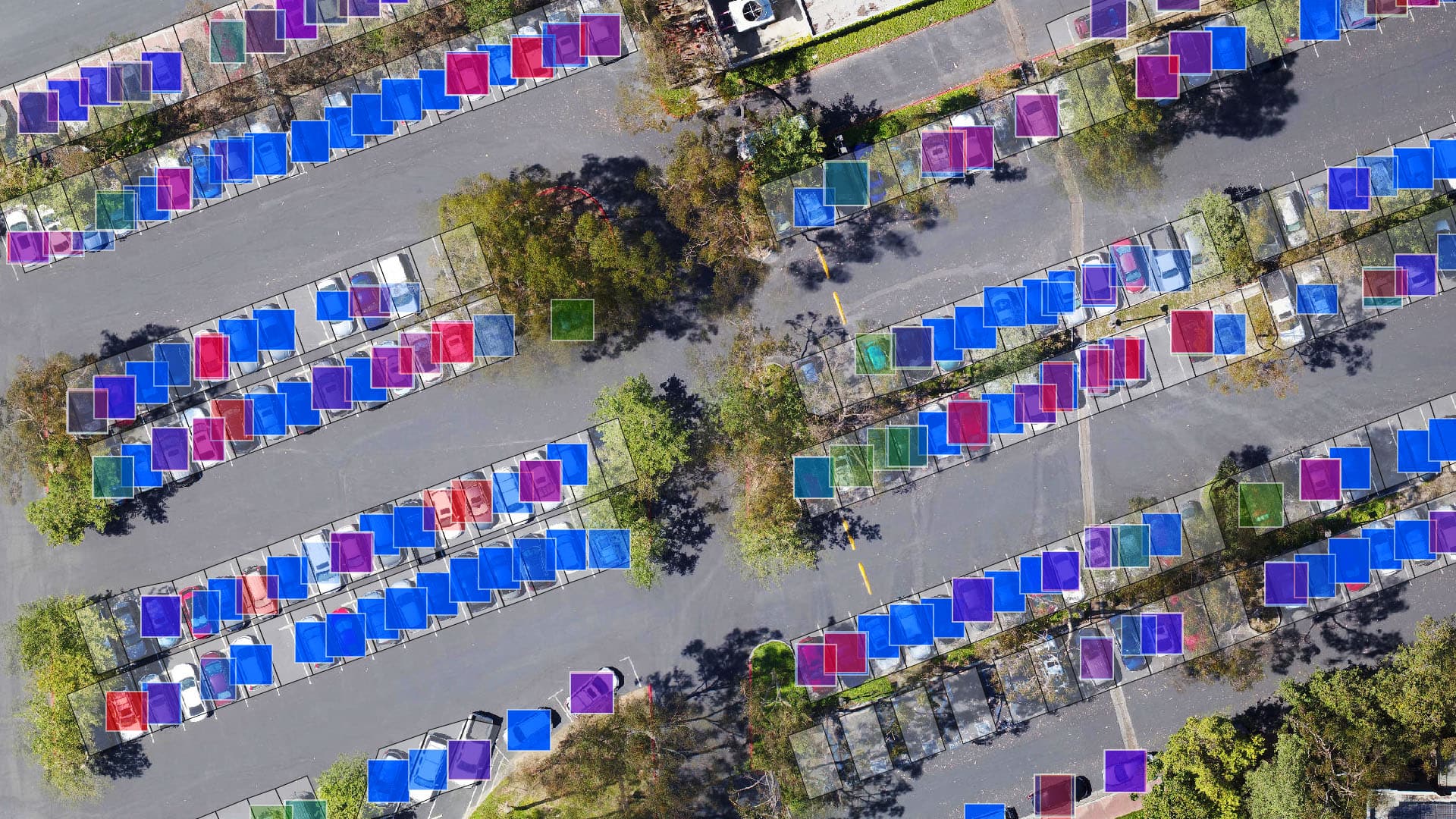

Imminent physical risks, like cracks in airport runways, can be identified through imagery and object detection models. Future physical risks, like property loss due to wildfires, can be anticipated with historical data and predictive models. Investment risks, like building retail sites in unprofitable locations, can be simulated by analyzing product sales and variables like customer demographics.

These risk management practices rely on a form of artificial intelligence called geospatial AI, or GeoAI. Modern geographic information system (GIS) technology includes GeoAI, which detects and forecasts patterns in any kind of spatial data—imagery, weather, asset locations, buying patterns, and more.

Physical Risk Management, Today and Tomorrow

Physical risk management, like repairing equipment or protecting facilities from storm damage, benefits immensely from GeoAI. Physical risks are inherently geospatial, since each asset has a location. That location determines which risks the asset might encounter, the likelihood and extent of operational impacts, and the speed and cost of mitigation.

In one example, a global energy provider uses drones, imagery, and GeoAI to spot offline or damaged solar panels. With near real-time feedback about which panels need servicing, operations managers can calculate the cost of repairs, direct repair crews to the affected panels, and keep productivity loss to a minimum.

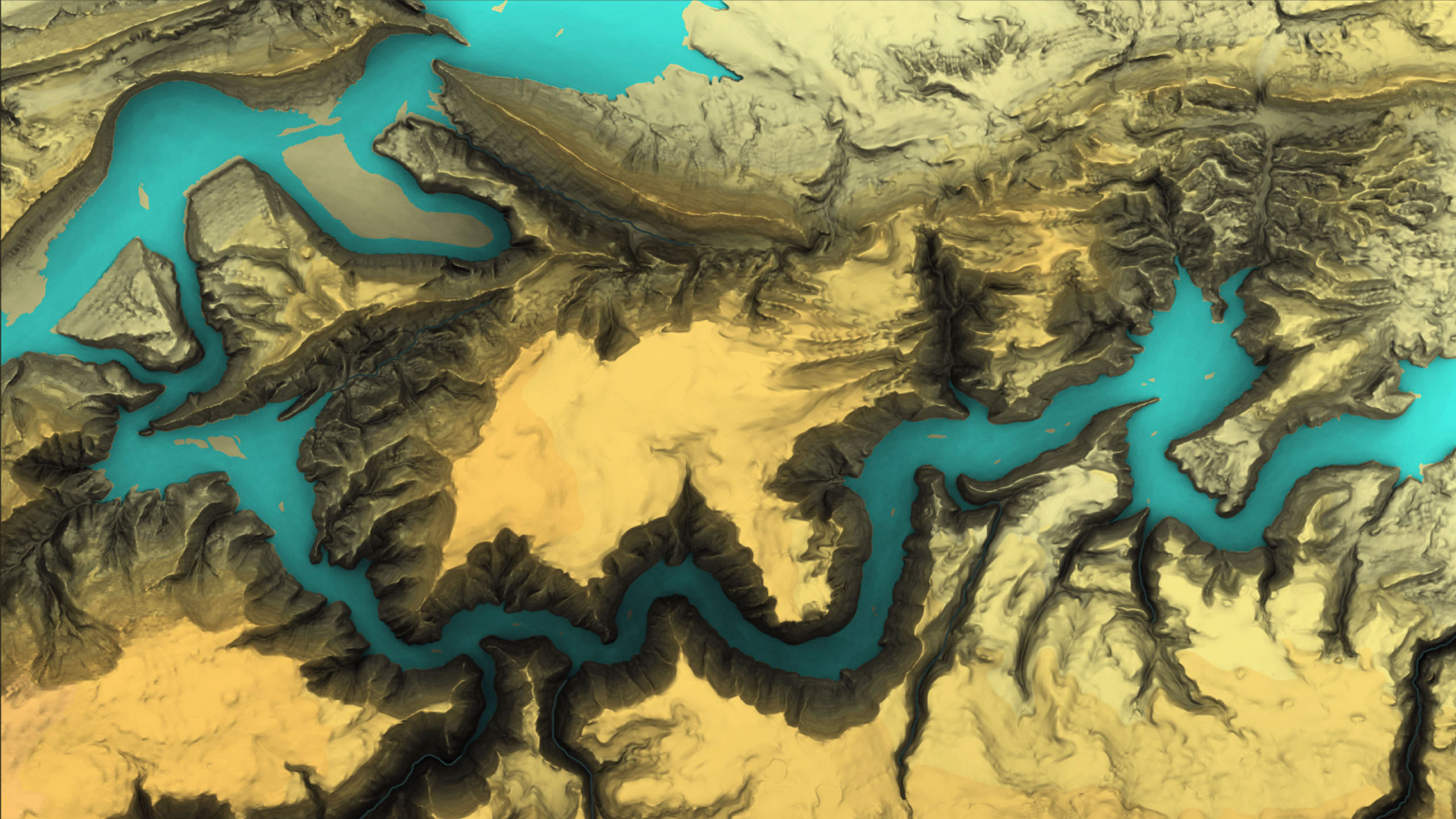

To manage future physical risks, Netherlands-based real estate firm Bouwinvest uses predictive models to forecast climate impacts to 2050. A GeoAI-backed climate dashboard shows the severity of impacts in each region where the company owns assets and drills down to show decision-makers whether individual properties are resilient against physical risks like waterlogging, wildfires, or extreme heat.

Seeing Investment Risks and Opportunities

Predictive models like those used by Bouwinvest also uncover investment risks. Understanding the likely impact of physical risk across a portfolio can shape decisions about mitigation as well as acquisitions and divestments. Financial leaders can use similar models to analyze whether loans might default due to climate risk, while a COO might spot partner companies whose supply chains are exposed to disaster-prone areas.

Managing investment risk could mean using GeoAI to model revenue at several proposed business locations. One retailer worked with a GeoAI expert to forecast its next decade of sales based on 10 years of transactions. Since those transactions occurred during an economic expansion, GeoAI simulated the risk of a downturn, giving executives a grounded view of each location’s potential. The ability to answer key questions in advance reduces the risk of unprofitable outcomes, pointing decision-makers toward data-backed opportunities.

Understanding the When and Where of Risk Management

On a chart or spreadsheet, leaders can see that risks exist—the dollar amount of potential losses or the percentage of risky assets in a portfolio. On a map created with GeoAI, leaders can see what these risks look like in the real world: where a hurricane could hit mortgaged properties or how supply chain shortages will cascade through a production network.

By pairing AI with GIS, leaders can understand the reality of shifting risks, seeing not only what’s happening, but what could happen and where. It’s an application of innovative technologies that executives shouldn’t ignore in the new era of AI-assisted business.