Holiday packages delight their recipients—and often cost a bundle to deliver. For instance, while same-day delivery costs the transportation provider as much as $15, most retailers are willing to pay only about a third of that, while customers will shell out slightly less. The challenge for logistics companies is how to lower costs and close the gap.

In this WhereNext Think Tank with Esri’s Brian Cross, logistics expert Rodney Conger explores the supply chain efficiencies, innovation, and location intelligence needed to deliver holiday packages—and year-round purchases—to your door, locker, or car trunk faster than ever.

Brian Cross: With the holiday season upon us, we’re hearing a lot about the pressure retailers face to meet customer expectations. A big part of that is delivering purchases when and where customers want.

Rodney Conger: Yes, and of course it’s not just retailers, and it’s not only around the holidays. In the past five years, consumer delivery options have drastically expanded. Packages are now delivered to lockers, vehicle trunks, or stores for customer pickup. The general trend is to give the consumer more control over where and when a delivery is made.

Every company in the supply chain is thinking about this year-round and adjusting their strategies and operations to meet customer demands. Frankly, some companies aren’t reacting fast enough.

Cross: What are they doing so far?

Conger: Some leading companies have been focused on delivery optimization for years. UPS is a great example. They’ve leveraged location intelligence and sophisticated analytics to optimize nearly every aspect of logistics. It begins with a corporate philosophy. Jack Levis, the force behind the company’s ORION optimization system, calls UPS “a quantitative company and a constant improvement company.” ORION is an example of that—the system relies on quantitative analysis and location intelligence to improve delivery efficiency and save UPS hundreds of millions of dollars a year.

But new demands on last-mile delivery—especially the rising customer appetite for same-day delivery—are pushing companies beyond even those impressive innovations.

No one company has solved the same-day delivery challenge profitably—not yet. Many are working to optimize certain elements of the last mile, but they'll need a holistic approach if they want to succeed.

Cross: It’s a tough position for retailers and delivery providers to be in. The “free shipping” trend has conditioned a lot of consumers to think that shipping is actually free.

Conger: Right, and that perception gap is especially true for same-day delivery. Today, the true cost for executing a same-day delivery has been estimated by industry analysts to be between $12 and $15. Retailers and brands are typically willing to pay less than half of that cost. The person receiving the delivery—who’s been conditioned to expect free shipping—will only chip in a small portion. That leaves a delivery company less than halfway to recovering its cost.

Venture capital [VC] firms are helping to fund the gap, pouring investments into startups that manage the last mile. But most of the companies are applying brute force—paying drivers to make on-demand deliveries, for instance. Or they’re only optimizing one piece of the supply chain, like bikes that can make deliveries in urban areas.

They’re eating up a lot of operating capital in the process. It’s going to take ingenuity and efficiency to do it profitably.

Cross: Based on your experience, what’s the best strategy for closing that gap and making last-mile delivery profitable?

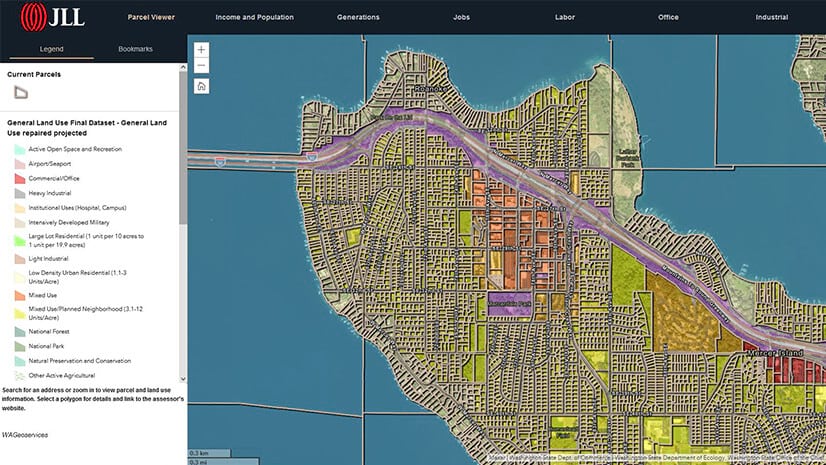

Conger: For the companies we consider industry leaders, it begins with a network strategy, which is basically the governing model for how goods move through the system. They map and model their entire delivery network to understand what happens when and where. In essence, they create a digital twin of the delivery network, using a modern geographic information system [GIS].

With GIS-based smart maps, the company can see how the entire network functions. How does freight move from location to location, and at what intervals? Where does sorting happen? How many methods of last-mile delivery does the company use? How is customer demand changing for certain SKUs in certain locations?

GIS-powered location intelligence reveals suboptimal patterns, network weaknesses, and risks. That understanding is critical to establishing the right network strategy.

Cross: What comes after an optimized strategy?

Conger: To make the last mile profitable, you also need to optimize the first thousand. Companies that do this well use two major tools. First, they employ an approach that’s similar to lean manufacturing—they look for waste in every nook and crevice, every process in the supply chain. And second, they rely on the location intelligence they get from GIS.

We’ve seen companies create competitive separation by applying those tools nearly everywhere in the delivery chain:

- Merchandise planning—Advanced retailers and manufacturers are combining AI [artificial intelligence] and location intelligence to predict customer buying patterns and stage inventory in the distribution center closest to its ultimate destination.

- Airplane maintenance—One Fortune 50 logistics provider uses GIS to manage maintenance for hundreds of its planes worldwide every day, ensuring that they’re ready to fly on schedule.

- Yard management—Logistics companies use GIS to track trailers in the yard, orchestrating their movement so that shipments never wait at the loading dock.

- Robot orchestration—Autonomous robots rely on GIS-based indoor maps to navigate efficiently through the distribution center.

- Route optimization—Industry leaders use GIS and analytics technology to choose the best routes for their delivery fleets. This can save companies millions of dollars a year.

- Track and trace—Pioneering companies are using geoblockchain—a combination of GIS and blockchain technology—to track products through their journey to the customer. That visibility eliminates costly guesswork.

- Mobile workforce—With a cloud-based GIS and handheld tracking devices, mobile workers are now one of the most efficient parts of the supply chain, moving orders quickly through last-mile delivery.

Cross: You mentioned that many companies use brute force for last-mile delivery, which suggests they’re using delivery as a loss leader to build customer loyalty. Are some companies taking a more scientific approach?

Conger: It runs the gamut. Some are applying better engineering. French startup K-Ryole invented a self-propelled trailer that holds more than 500 pounds [250 kilos] and attaches to a human-pedaled bike for urban deliveries.

Some companies are creating turnkey last-mile delivery businesses that can be sold or franchised to operators. They include the delivery vans, the technology to manage deliveries, handheld scanners, and more. But those are big investments, and we haven’t seen much profit there yet.

Others are using artificial intelligence and machine learning to power autonomous delivery bots. That includes companies like Starship Technologies, Nuro, and Robomart. They’re getting a lot of attention—and VC funding.

Just as a good network strategy is the foundation of any successful logistics company, location intelligence is a cornerstone of a winning network strategy.

Cross: Amazon’s another example—they made a big stir when they began experimenting with drones for last-mile delivery.

Conger: Right, and while some of the drone hype has died down, Amazon continues to improve the method. They just filed a patent for a single camera that attaches to a drone propeller blade and can gauge distance to avoid collisions, gauge landings, etc.

I’ll be the first one to say that autonomous solutions are fascinating, and they’re probably the future for last-mile delivery. KPMG just predicted that by 2040, autonomous delivery vehicles will travel 78 billion miles each year. For perspective, today UPS covers about 3 billion miles per year.

But if we go back to the original premise of this discussion—creating efficiency in last-mile delivery—we still have a lot of work to do.

Cross: What does that mean?

Conger: I think we might be getting a little ahead of ourselves. Most companies haven’t done the groundwork to make robots, drones, or even human couriers truly efficient. Again, it’s all about the foundation. UPS, FedEx, and other leading companies are very good at the fundamentals of location. They use sophisticated mapping technology to do things like optimize addresses. That may sound boring, but it’s essential. If a delivery person shows up at the wrong door of a large warehouse or can’t find the right turnoff on a rural road, it can add 10 minutes or more to a delivery attempt. If that happens a few times a day, the cost in lost productivity and late deliveries is significant.

If a company doesn’t have the geospatial system to see an exact address, flashier inventions like an AI-infused robot might not do much good. What happens when your robot tries to deliver a package to the loading dock instead of the receiving door? Will someone take it by its robot arm and walk it to the right location?

Cross: So, which companies will win the last-mile race?

Conger: It will likely be the innovative companies that pay attention to the fundamentals. A lot of the cost in the delivery chain is related to time. Drivers with fundamental location intelligence don’t waste time because the system gives them the best routes to take. That eliminates a lot of cost.

I know the startup mentality is “move fast and break things.” But in last-mile delivery, that only gets you so far. In almost all cases, top-notch location intelligence will take a company further than VC money.

In a world where same-day delivery is becoming table stakes, inefficiency is incredibly costly. Those companies that succeed in that environment will have the tools and the location intelligence to avoid self-imposed errors and close the gap between what customers want and what companies can provide—profitably.