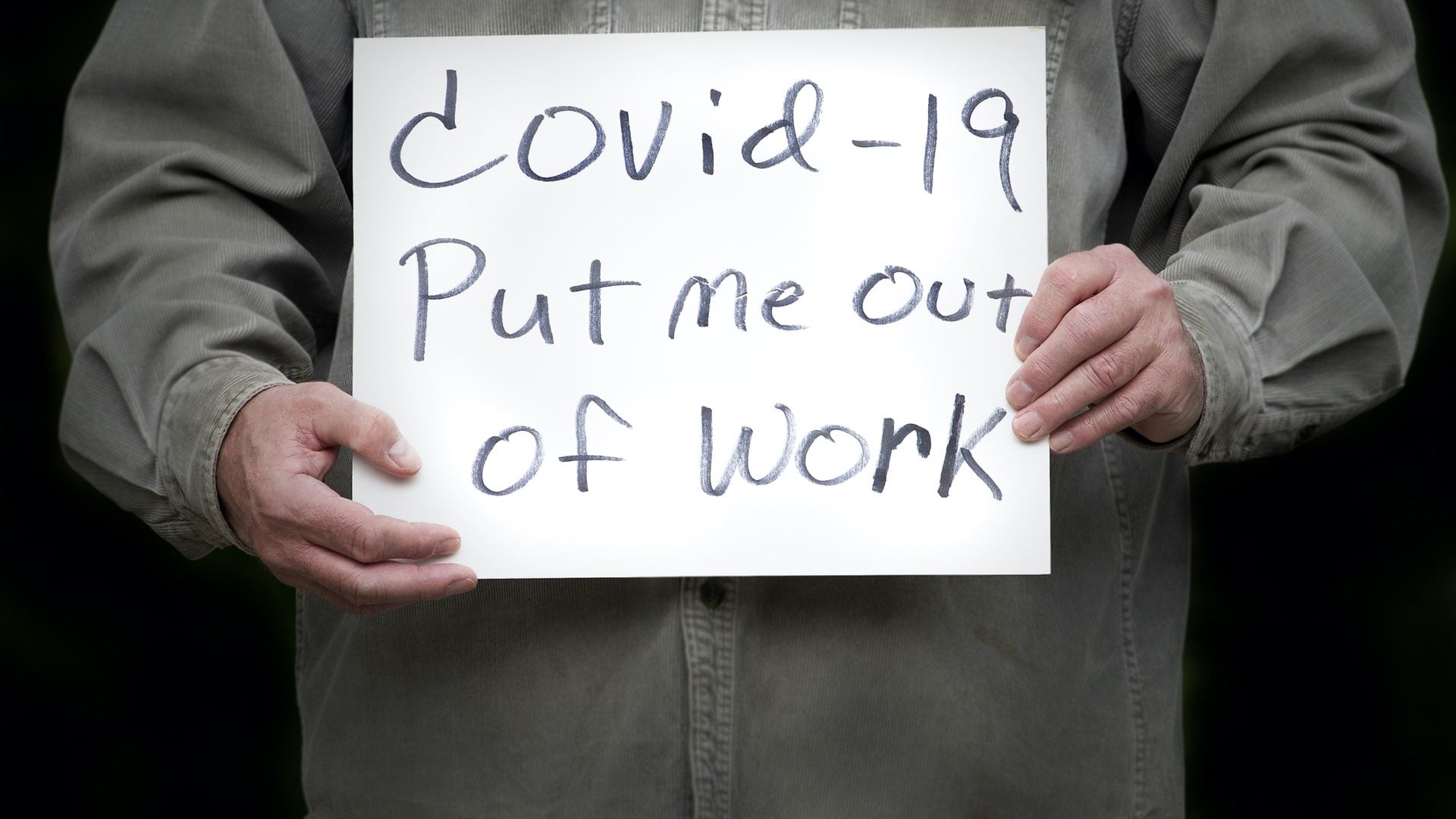

Across the country, America’s 31 million small businesses have largely borne the brunt of the economic pain COVID-19 has inflicted on the private sector. Employing nearly half of the business workforce, small enterprises like shops and restaurants face mounting bills and rent payments even as profits plummet and savings are squeezed by quarantine measures and new ways of shopping and eating food away from home.

According to data from the software platform Womply, roughly one in five businesses that were active in January 2020 have ceased all transactions, with many expected to close permanently.

A new report from Opportunity Insights, a nonprofit based at Harvard University, makes it possible to map geographic patterns in small business closures by state and region—an important piece of location analysis for big businesses that often rely on small enterprises as suppliers or trend finders.

The health of small businesses is one indicator corporate executives can track to inform decisions in a global economy scrambled by the pandemic. Some business leaders are turning to dashboards backed by geographic information system (GIS) technology to monitor the location data affecting their operations. State regulations, virus patterns, changing consumer shopping habits, and other measures all hint at what the future holds.

The location intelligence these dashboards yield can be crucial to divining the web of market forces at play from Main Street retail floors on up to the C-suite.

Measuring Small Business Performance, Coast to Coast

By viewing the report’s data laid out across a map of the nation’s states and cities, executives can home in on signals about the virus’s effects on local communities and businesses.

It’s evident at a glance that the repercussions of COVID-19 have been unevenly distributed. According to the study, San Francisco, New Orleans, and Honolulu have been particularly hard hit; in those cities, the percentage of small businesses still open has dropped by 49 percent, 45 percent, and 41 percent respectively. Meanwhile, in the heart of the Midwest, Omaha has seen only a 13 percent falloff in small businesses operating and just 15 percent in Wichita and Kansas City.

A seafood producer or marina owner who derives revenue from small businesses in, say, the Pacific Northwest and Florida’s First Coast region might make decisions based on the regional differences indicated by this data. The fact that Seattle and Portland have seen small business declines of 28 percent and 34 percent respectively, while Jacksonville has seen a drop of just 18 percent could influence an executive’s decision about inventory or where to invest or divest.

A smart map helps make sense of such economic shifts by highlighting them against other location-specific trends. The high rate of small business suspensions in San Francisco has largely come about due to the dominant tech sector switching almost entirely to remote working. With that shift, Bay Area white-collar workers emptied out of restaurants, bakeries, dry cleaners, bookstores, and lunchtime cafés that once shaped their daily routines. With tech companies signaling that such workplace changes may endure post-COVID-19, local economies and communities may be impacted for years to come.

Small business closings in Honolulu and New Orleans, on the other hand, are tied more to the cratering of the tourism and hospitality industries those cities rely on. With a return to some degree of normalcy in the months ahead, commercial activity in those destinations could tick back up to pre-pandemic levels. But businesses large and small will need survival strategies to help them hang on till then.

Business leaders can use the report’s data as a signpost for where to dig deeper into local markets, examining metrics such as foot traffic patterns, number of credit card transactions, applications for PPP loans—or even applications to start new businesses, which have been increasing in some places. A GIS-backed dashboard can reveal commonalities across the tides of commerce, helping executives spot opportunities and dangers that others miss.

All in This Together

It’s common in some circles to view the aims of small business and big business in opposition—a zero-sum game where a gain for one is a loss for the other. The reality is much more complex, with both levels of organization reliant on each other in many ways. Corporations look to entrepreneurs to surface innovative ideas and nurture burgeoning customer bases; in turn, small businesses benefit from demand generated by big clients, who can enlarge and enliven markets on a wider scale.

One recent American Express study based on a survey of 500 small and midsize companies found that many small companies get up to 30 to 50 percent of their profits from larger companies. More than 80 percent planned to increase sales to corporations over the next five years. These examples show the interdependence of large and small businesses, as well as local and regional markets.

Especially in disruptive times like these, industry leaders need location intelligence to see and understand the most relevant and informative facts in one place and tailor decisions to the realities on the ground.