Consumer behaviors and interests are changing too fast for historic “set it and forget it” market analysis to keep up. Companies stay relevant during changing times by excelling at sensing trends and creating new products and services to answer emerging needs.

Whatever the industry, spotting trends and responding effectively to those signals requires the right mix of data, analysis, and business agility. Location intelligence generated by geographic information system (GIS) technology adds an important dimension to that practice, enriching an organization’s decisions with a broad scope of consumer data and the ability to reassess market conditions wherever, whenever.

Imagine antennae smart enough to capture how customer needs and preferences are evolving from week to week or from month to month. Then, picture decision-makers enhancing experiences and product lines in response to those signals. Unlocking that potential starts when organizations design the right blueprint for change.

Customer Understanding Must Be Current and Local

Some innovative companies already zero in on consumer signals to predict demand for new businesses and service lines. Consider Airbnb, which added monthly stays to its offerings when the pandemic fueled interest in lodging for workcations and other creative alternatives to the monotony of home confinement. DoorDash grew its provider base by launching a white-label delivery solution geared to small, local restaurants—a response to the growing demand for take-out food options. Both companies listened to the changing needs of customers and suppliers, then adapted quickly.

Other businesses are using location intelligence generated by GIS to reveal changing customer interests in certain locations. A GIS analyst can cull data on foot traffic patterns, for instance, to discern the demographics and psychographics of people who frequent the area. Product- or service-based businesses have used that insight to establish new locations, plan store merchandise, and dynamically shift pickup and delivery options. Now industry leaders are using it to develop entirely new offerings at a pace that matches the market.

Wherever a company falls on the digital spectrum, layering location intelligence into an iterative approach to business growth provides a new way to understand consumers.

Digital-First Companies Seek New Data Sources to Spot New Business Opportunities

The digital enterprise is inherently grounded in data. From their founding, these organizations have maintained connections with customers via websites, apps, social media, email, and other channels. Through those touchpoints, digital-first companies sense trends even as they’re taking shape. They see when customers gravitate to a new style of eyeglasses on an augmented reality app, for example, or when social media chatter indicates growing interest in a new type of service. Even so, that system is only as good as the data feeding it. Listening to additional information channels can help digital enterprises further personalize products and services.

That ability counts for a lot. While 93 percent of companies rely on survey-based metrics to measure customer experience, only 6 percent of leaders are confident their system is actually enabling strategic and tactical decision-making. For some digital organizations, the answer may be to rely on not just information gathered through existing connections, but also a wider range of data, on a more frequent basis. Additional capabilities like location intelligence help reveal nuances in customer preferences that can lead to valuable business opportunities.

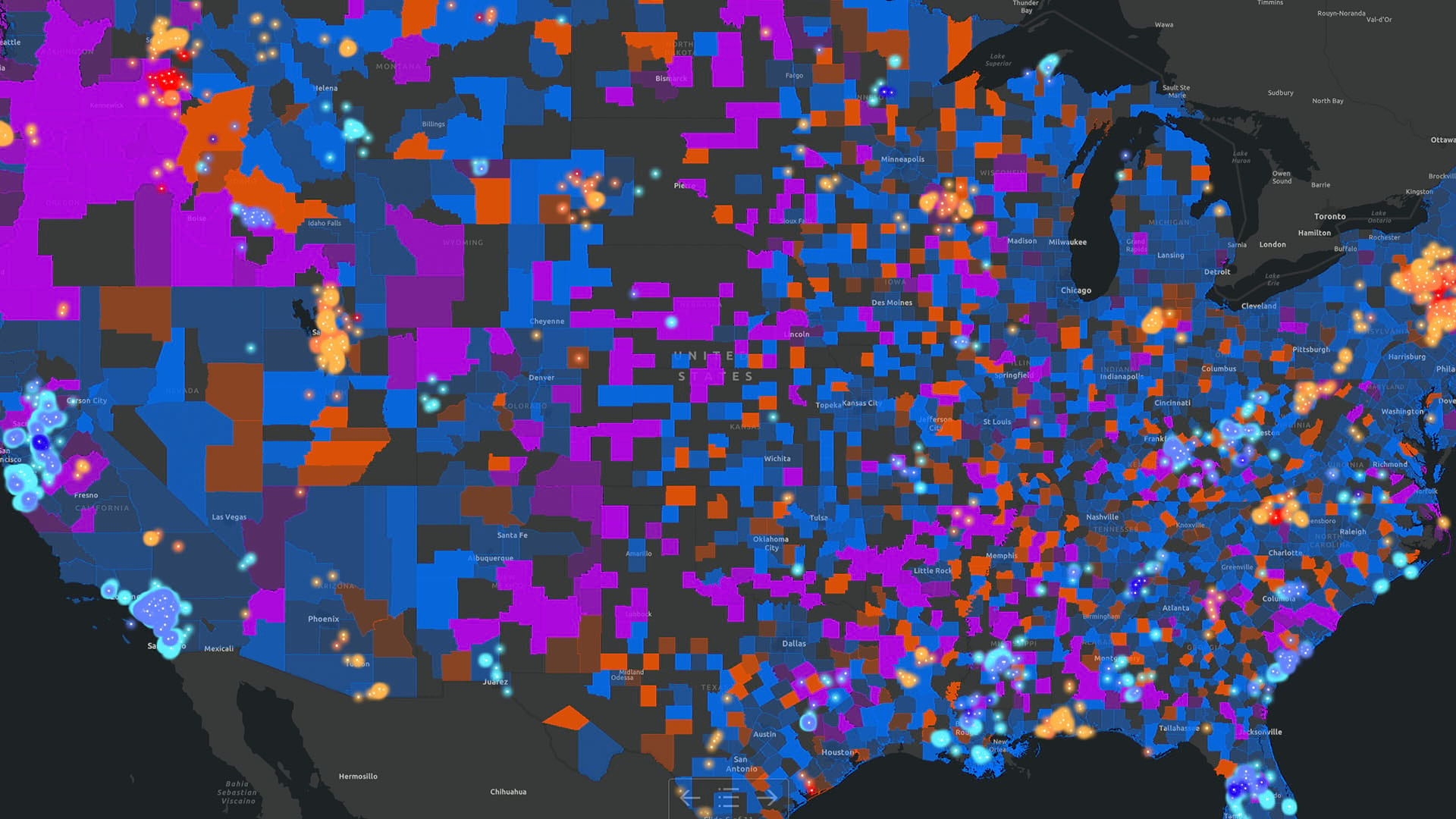

Through GIS technology, companies can capture and analyze data to evaluate where their consumers are coming from and what their interests are. By mining online searches or social media feeds, for example, the founders of an upcycled apparel brand might identify hidden demand for fair-trade beauty products in certain geographies and develop a line of skin care products to complement their apparel business.

A GIS analyst can create smart maps of emerging demand patterns, buyer preferences, demographics, and psychographics to assess any market—not just during a company’s initial foray into the market, but on an ongoing basis. By reading those geographic signals on a more frequent basis, a company can stop being reactive and start adapting based on what’s likely to happen next, deepening connections with customers and prospects.

The ability to sense the market direction helps even the most digital enterprise continue creating customer experiences that strengthen engagement, engender loyalty, and differentiate brands.

With location-based insight, businesses can tailor service and product offerings to emerging interests in specific markets.

Brick-and-Mortar Operations Tap into New Levels of Understanding

The days of assessing a trade area or addressable market before moving in, then putting that analysis on the shelf, are long gone. Effective selling now requires an understanding of where customers are best engaged as well as how and when to interact with them in meaningful ways.

Brick-and-mortar or omnichannel companies that rely on traditional market analysis now have access to new sources of data around human movement, location intelligence, and consumer transaction trends—as well as the technology to assess that data seamlessly.

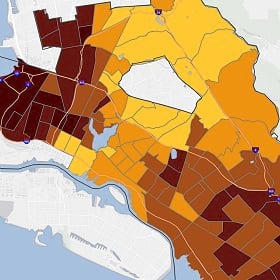

This doesn’t mean businesses must unlearn everything they know. Instead, companies can build on a foundation of demographic and psychographic data by incorporating more digital capabilities that round out customer understanding through location intelligence. When a store uses GIS to analyze and visualize information, it can in turn offer more tailored experiences that deliver exactly what people want, exactly where they can derive the highest value from it.

During the pandemic, executives at a company that provides vehicle services may have sensed customers’ reluctance to visit repair shops. With the help of location intelligence and an agile team, the executives could launch a mobile business delivering at-home services like oil changes or minor repairs. The analytical capabilities of GIS allow innovative companies to plan service and delivery networks so that employees travel efficiently through the workday and reach customers when they’re expected.

The GIS team at a beauty supply chain might analyze recent foot traffic data and discover that store customers often visit a salon before or after their shopping. To capitalize on that demand, the company might pilot in-store salons in geographic markets where the trend is most pronounced.

GIS-backed location intelligence shows brands where customers are located along with what people in those areas value, how they prefer to shop, and how preferences change across months or years.

Meeting Consumers on Their Journey Begins with Better Data

For digital leaders, reliance on data from direct customer interactions—whether a sales transaction history, in-app behavior, or human movement—is giving way to a more holistic approach.

Well-rounded, recurring market analysis allows organizations to grow faster than market average by continually adding more tailored products and services that capture the interests of new and existing customers. Wherever a company falls on the digital spectrum, its analysts and decision-makers can respond better to customer interests and innovate offerings by incorporating a location-specific customer understanding into their business planning.