The reality of a more flammable world is showing up in corporate reporting. According to the CNBC article, “A Rising Number of US Companies Are Flagging Wildfire Risk as Suppression Costs Climb,” increased wildfires have forced more corporations to add wildfire risk to their investor disclosures. With the economic toll of climate change predicted to grow significantly, risk-conscious companies will need to mitigate the impact of related disasters, such as wildfires, on the corporate balance sheet.

The Business Costs of a Growing Risk

Structural fires caused by faulty wiring, errant machinery, and other factors have long been noted in corporate reporting. Companies that work with disparate supply chain partners know too well how disruptive and costly those incidents can be. Now companies are adding the growing threat of blazes that can consume thousands of acres within hours—a reality that darkens the risk profile for modern businesses.

As wildfires have increased in the last decade, real estate and insurance firms have been most likely to include such risk in their financials. This year, however, Marriott, Monster Beverage, and 12 other companies in the S&P 500 specifically noted the threat in 10-K filings, according to CNBC. If current trends continue, more companies may follow.

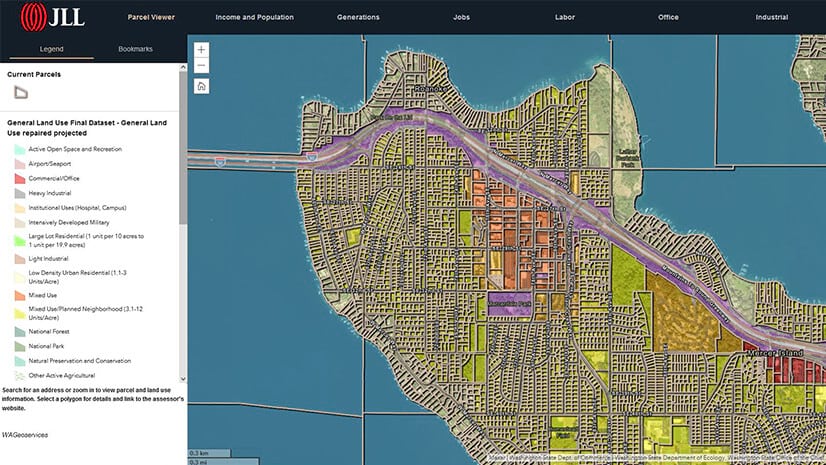

In a related article, Changing Hazards Prompt Insurers to Rethink the Location of Risk, Andreas Siebert of Munich Re explains how the global reinsurer uses geographic information system (GIS) technology to evaluate the vulnerability of insured properties:

“More transparency means a better understanding of what the industry is insuring these days,” Siebert explains. “We have to learn more [about building] construction types, occupancies, the age of buildings—a lot of additional data. We have to bring it together to have the full transparency when we are doing risk assessment.”

Location intelligence, generated by GIS, brings that vast pool of data into a “single pane of glass” to help decision-makers prepare for and in some cases avoid the cost of losses. (See the sidebar “The Data behind Risk Mapping” for more detail.)

A Model to Follow

An established form of business intelligence, location intelligence is used by executives and other leaders to surface unseen patterns, trends, and predictions.

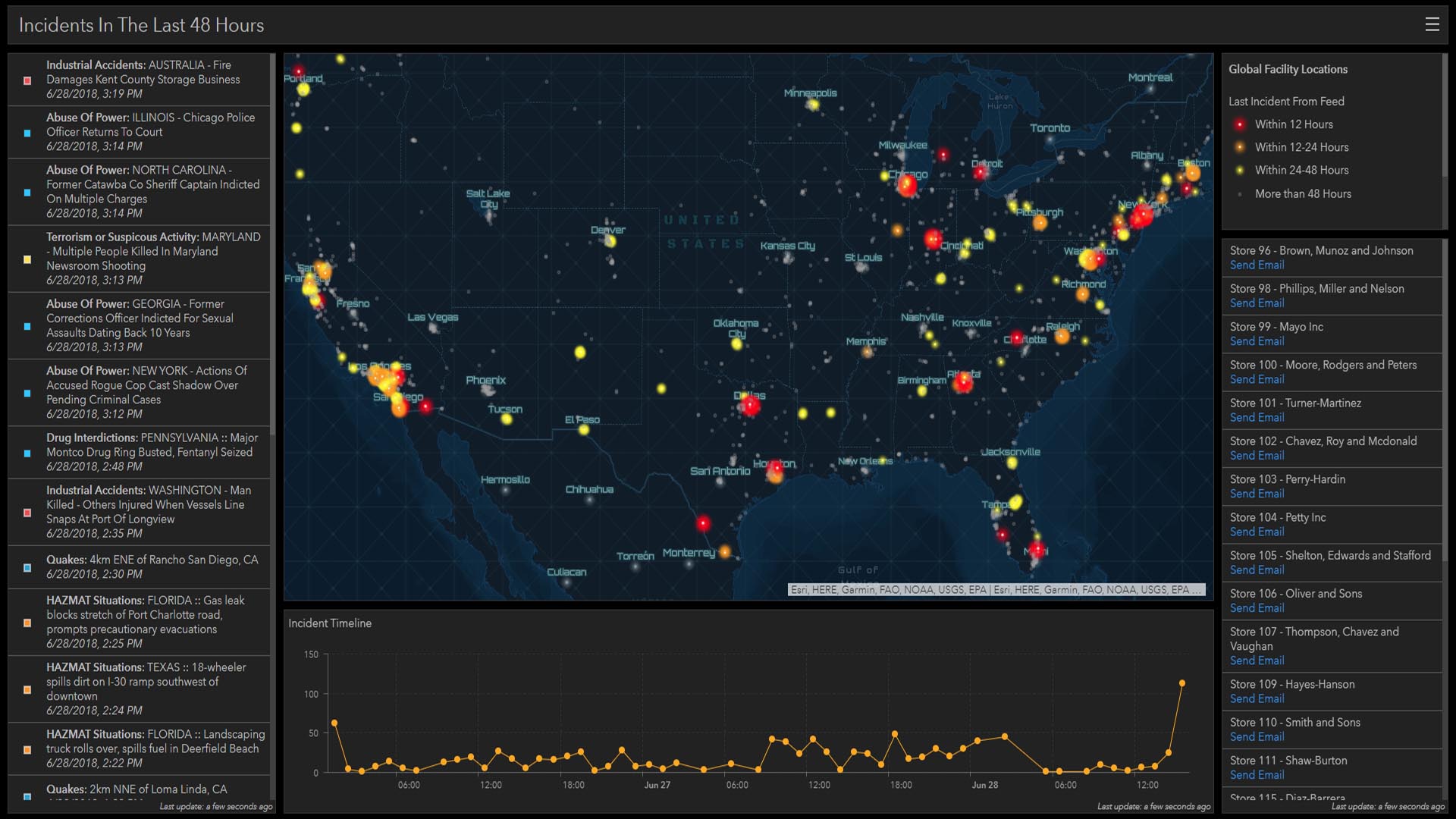

Common applications of location intelligence include risk management—when decision-makers need to understand where and to what degree facilities, employees, and partners are vulnerable to wildfire risk and other threats.

Executives who see risk mapped—with profit and revenue figures attached to each risk—can prioritize adjustments to the company’s asset portfolio. For expanding businesses, GIS can also identify less wildfire-prone regions where they might build facilities or take on new suppliers.

As the size of wildfires continues to outpace historical averages, industry analysts predict the emergence of more innovative and economical monitoring measures. According to CNBC, Sempra Energy and Southern California Edison this year deployed a network of HD cameras that broadcast live video of fire-prone areas. The next logical step is to more accurately predict the movement of blazes.

In October, cybersecurity company Splunk partnered with wildfire science startup Zonehaven on software that combines controlled burn data with live weather feeds. That mashup could inform fire simulations and detailed evacuation maps for residents and first responders.

As more firms recognize the rising threat of these disasters and the urgency of creating operational awareness, location intelligence will become a more prominent resource for fortifying companies against the epidemic of wildfires.