The US Federal Reserve recently announced plans to create a real-time payment infrastructure that will cover the country by 2024. Dubbed FedNow, the service will extend instant payment transfers to any banks that use it, including rural institutions, many of which don’t yet have access to the technology.

As American Banker notes, the announcement confirms that the Federal Reserve will take an active role in modernizing the US payment system, rather than deferring to big banks and others in the private sector.

Small and midsized banks and credit unions stand to gain the most by having better services to offer their customers. Bank executives can use location intelligence to identify current and future customers that would benefit from instant payments, and create a strategy to reach more of the underserved in their communities.

A Big Opportunity for Smaller Banks

FedNow will compete with similar instant money services the largest banks are already developing and offering. It will also compete with others in the private sector, including tech giants angling to enter the financial space. Facebook, for example, recently announced plans for a cryptocurrency named Libra that facilitates near real-time exchanges.

The Fed’s new service gives small banks a leg up by democratizing a capability that previously only the big banks could offer. The Federal Reserve views this as a positive development, predicting that added competition will keep service rates low for consumers. Regardless of whether banks use FedNow or a privately developed service for instant transfers, the move could open new markets.

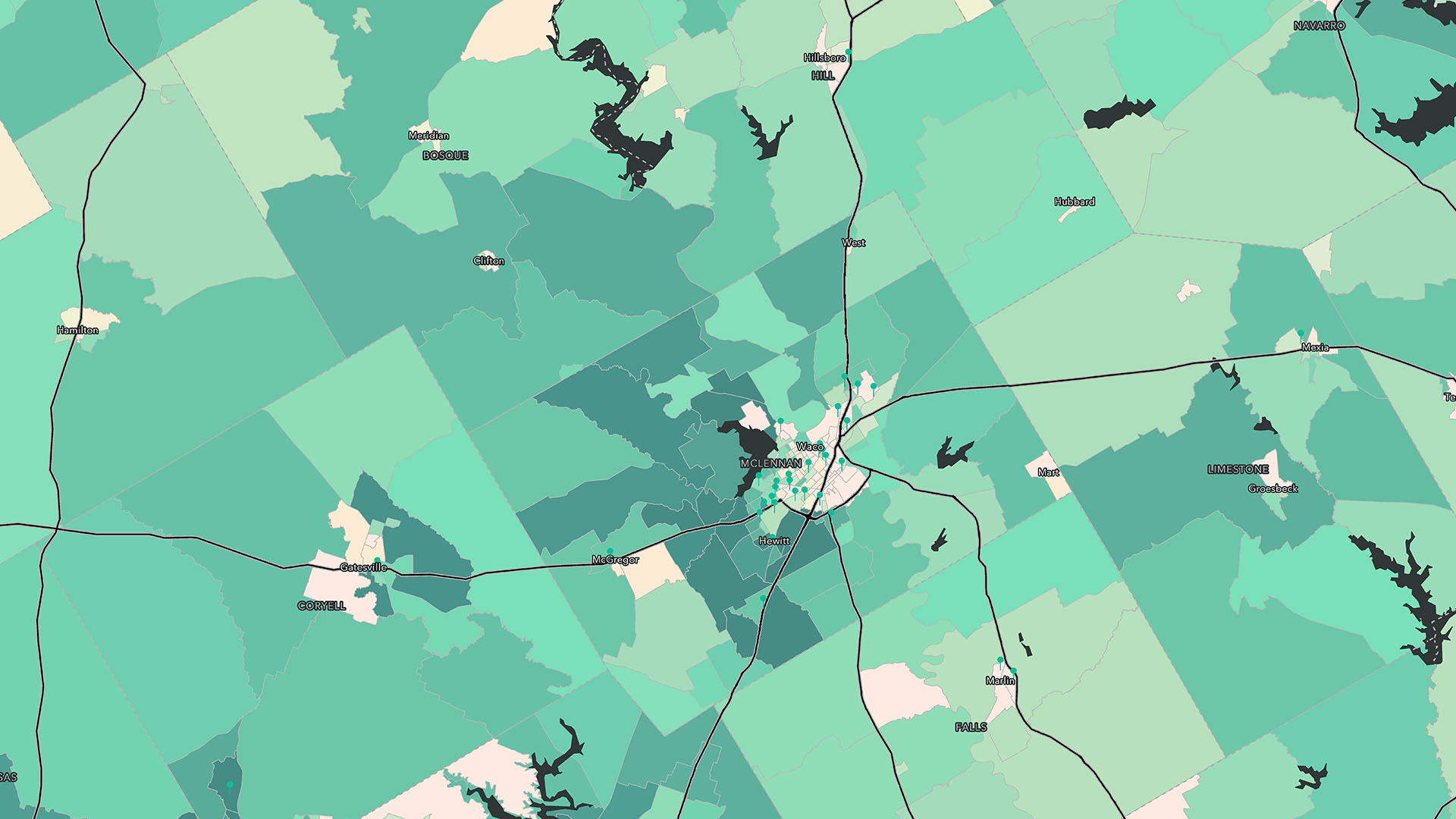

Today, individuals and businesses who rely on ACH, debit cards, and checks often wait days to access funds. Federal Reserve Governor Lael Brainard noted in a statement that for small businesses or people living paycheck to paycheck, such delays can trigger a reliance on predatory payday loans or other expensive short-term financing. In particular, people in agrarian areas, sparsely populated swaths of the US, and low-income populations sometimes struggle to obtain the financial services they need.

When everyone has instant access to their funds as the Fed envisions, the market may experience a shift. Consumers who previously relied on payday loans—often referred to as the unbanked or underbanked—could become a new market for traditional banks and credit unions. Small businesses might be able to keep more of their profits, producing a knock-on effect of economic growth in rural areas.

Locating New Markets

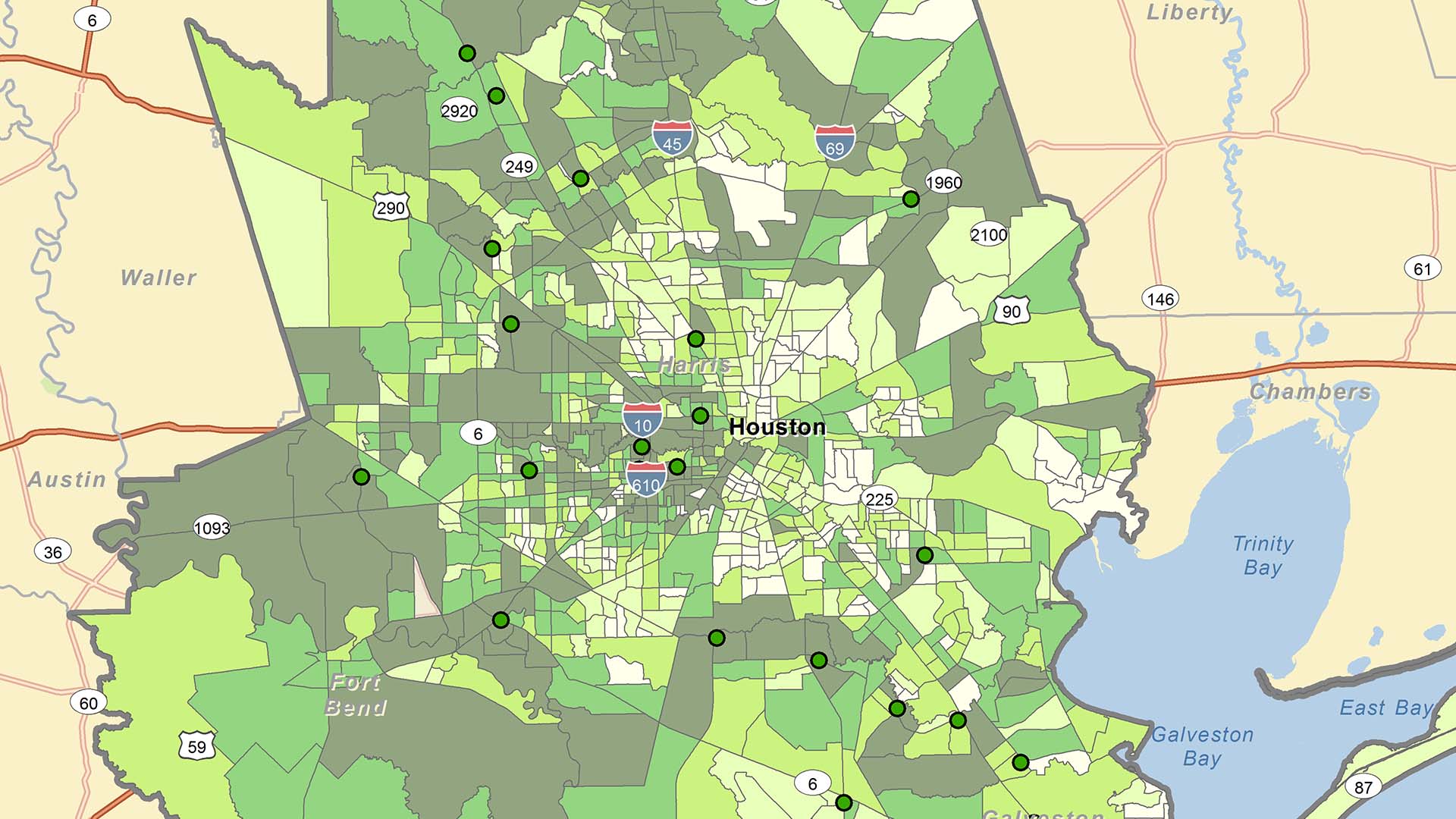

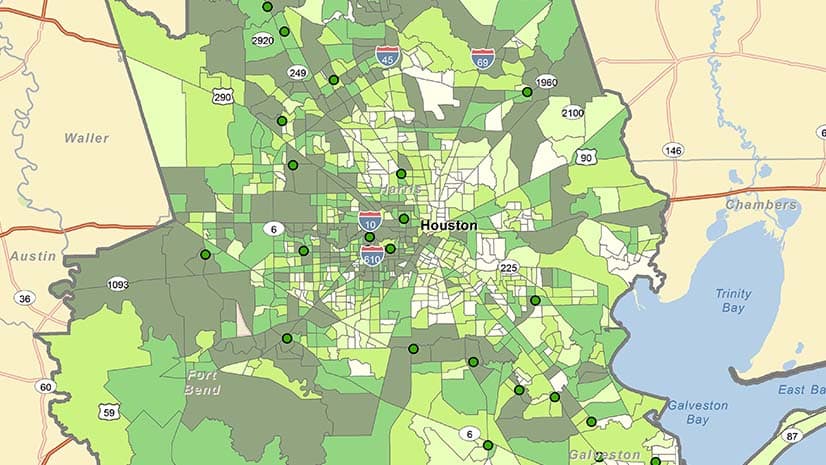

For banks, sensing where these shifts will happen is key. Using a modern geographic information system (GIS), decision-makers can analyze where opportunities exist based on the characteristics of each market—its demographics and psychographics. This business data about customer behavior informs marketing decisions, such as the best way to reach potential clients.

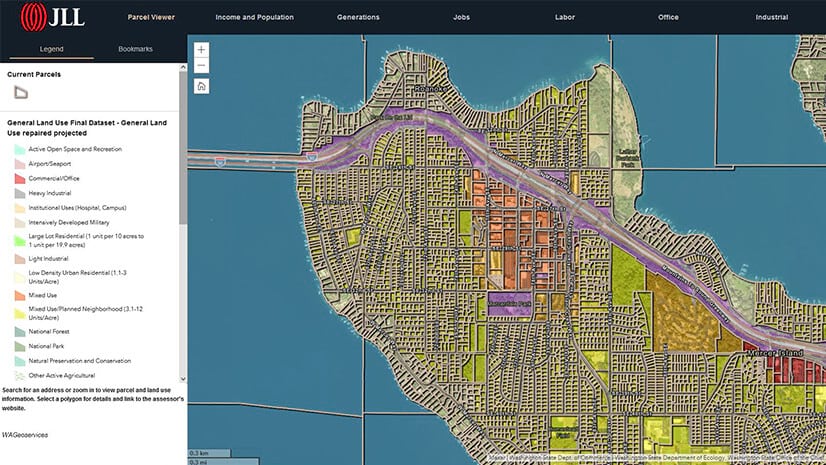

Geographic data such as loan rates, homeownership, and spending habits can reveal underserved areas. Mapping the locations of check cashing and payday loan businesses—and the geographic areas they serve—provides another starting point.

Consider the case of Regions Bank, headquartered in Birmingham, Alabama, that relies on GIS-powered location intelligence to identify underbanked areas:

At Regions, location analytics technology allows the branch-siting team to ensure that the bank is serving underbanked communities, while keeping an eye on internal performance and external competition. The team uses digital maps layered with low- and moderate-income census tracts and other key data to run scenarios that measure the impact of opening or closing a branch. The scenarios quickly reveal whether a change would reduce service in needy neighborhoods.

Leveling Up with Location Intelligence

Instant payments aren’t without risk to the financial institutions that adopt them. When money is transferred in near real time, an errant transaction can cost millions of dollars in losses. According to the Association of Certified Fraud Examiners’ annual report, banking and financial services companies suffered the most cases of fraud of any industry in 2018. One potential countermeasure is to combine location intelligence with artificial intelligence (AI)-based models to automatically detect transaction patterns or outliers that might signify fraud.

Regions found location data useful across the organization after it first enlisted digital maps for risk management and compliance. Today, its location analytics group supports decision-making in market development, real estate, and other areas of the business.

Accurate, comprehensive location intelligence helps bank leaders avoid costly investment errors and make smart business choices—including where to open a new branch, how to deliver marketing messages, or even where to source talent for an expansion.

Learn more about how innovative financial firms use location intelligence.