Selling through a middleman is so old school. In search of growth, brands and manufacturers are taking their messages right to consumers and selling direct, some for the first time. By engaging consumers on their own terms, online as well as in brick-and-mortar stores, brands are delivering personalized shopping experiences.

Spurred in part by the example of agile young brands such as retro clothier ModCloth and mattress upstart Casper, many established manufacturers and consumer-packaged goods companies are interacting directly with consumers. Brands including Lay’s, Dyson, M&M’s, Levi’s, and CoverGirl are opening everything from stand-alone, in-retailer, and pop-up stores to showrooms and e-commerce sites. Most emphasize shareable, fun experiences that can’t be had anywhere else: “Create your own potato chip flavor!” or “Try on makeup in the beauty play-room!”

Top apparel brands including Ralph Lauren, Under Armour, Nike, and Steve Madden are now seeing an increasing portion of their revenue coming from direct-to-consumer (D2C) channels.

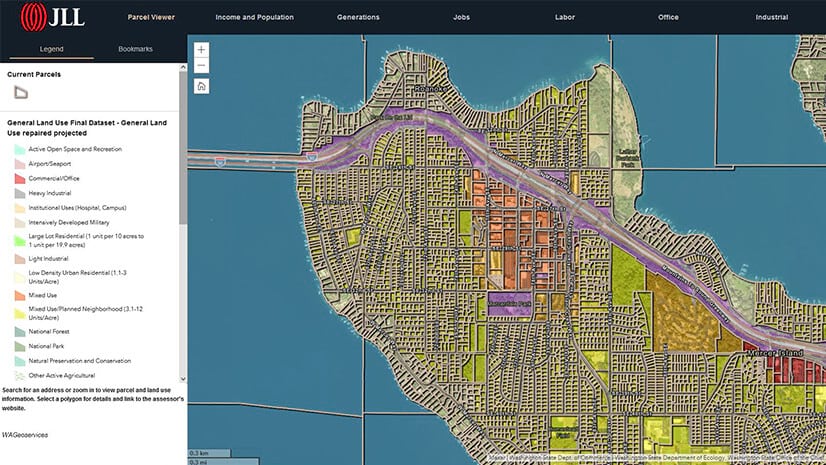

Companies going D2C are adopting long-standing retail techniques, including the use of location intelligence, to target the right consumers, validate placement of brick-and-mortar stores, identify the best sales partners, understand the competition, and assess market potential.

Many brands are also engaging customers in personalized experiences through loyalty programs, which have evolved far beyond simple discount offers. NikePlus members, for instance, can shop at certain Nike locations before the store opens to the public. Members of Dyson’s Owner Rewards program can call a VIP hotline for product support and visit Dyson service centers for complimentary preventative maintenance. Through such programs, brands benefit from increased loyalty and earn the potential for greater spend as they gain a better understanding of customer needs.

With its direct pathway to consumers, D2C affords brands more control over customer experience and helps them gain insights while reaping the profits traditionally earned by distributors and retailers. Nike, for example, recently enjoyed a stock price surge as analysts touted the company’s D2C success.

If other manufacturers can get D2C right, revenue growth is within sight. That’s important, as the retail landscape continues its move away from traditional formats. Take Warby Parker, which disrupted the way consumers buy eyeglasses when it came online selling D2C in 2010. The upstart achieved profitability in 2017, raised another $75 million in funding, and is reported to be on its way to an IPO.

A Wealth of D2C Options

Traditionally, manufacturers and brands have relied on intermediaries—distributors and retailers—to sell products to customers. While some first-movers embraced D2C years ago, the cost of entering the consumer market has dropped significantly thanks to online shopping. The trend of brands creating D2C channels, both online and in physical locations, keeps growing. A modern geographic information system (GIS) plays a key role in helping brands plan their strategy for D2C channels. Brands use GIS-powered location intelligence to understand customer personas; see where promising concentrations of those core personas live, work, and spend time online; assess where and when to open brand stores rather than sell through a partner; understand the competitive landscape in certain locations; and gauge market potential.

These are some of the D2C channels manufacturers/brands are exploring:

- Self-branded stores. High-profile brands—Tesla, Amazon, CoverGirl, furniture catalog retailer Ballard Designs—that have never ventured into traditional retail are now taking the plunge. Securing real estate carries risk, especially in urban areas where commercial space is tight and rents are high. But location intelligence contributes to growth by helping companies choose the locations most likely to be visited by their core customers.

- Store-within-a-store. This option lowers risk by allowing the manufacturer or brand to leverage the infrastructure of an existing retailer. Notable cases include Dyson, Samsung, and Microsoft at Best Buy (which has forged an impressive turnaround in recent years). The retailer benefits by outsourcing store presentation and, in some cases, department staffing. Levi’s recently opened a major in-store shop called the Levi’s Tailor Shop inside Nordstrom Men’s Store NYC—two retail concepts in one (read on for more detail).

- Pop-up/pilot stores. Temporary shops, often tied to an event or season, provide another way to lower the risk of a long-term real estate commitment. Vintage-inspired clothing site ModCloth has its first pop-up in San Francisco with other US locations coming soon. Club Monaco, owned by Ralph Lauren, is another clothing brand using the pop-up format to show off consultative and experiential shopping opportunities.

- Showroom-only stores. Brands are using the showroom format (traditionally used by furniture stores and car dealers) to let consumers get a feel for merchandise and then opt for home delivery. In this way, brands avoid the expense of warehousing inventory while encouraging experimentation. Established brand Kohler joins clicks-to-bricks e-tailers Boll & Branch, Madison Reed, Bonobos, and Warby Parker in this trend.

- E-commerce. Online stores are now a legacy D2C format. Brands must have them, even for goods that would previously be unthinkable to ship, such as mattresses. An e-commerce site is table stakes for manufacturers, and many are experimenting with other D2C options in pursuit of new growth.

- Social media. Closely related to e-commerce, many brands including Nordstrom and Tiffany & Co. are using social media sites, including Facebook and Instagram, to promote products and drive prospects with a direct link to buy via their e-commerce site. Tiffany uses these platforms to showcase celebrities who wear its high-end jewelry.

A More Personal Spin on Shopping

When going D2C, it is not enough to merely provide consumers with a direct path to buy. The experience must offer something more—unique products, exclusive access, added convenience, a “wow” factor. Brands are using data-driven commerce to understand what their customers want, tailor experiences to their tastes, and place those experiences where customers are known to visit.

Levi’s has long been a pioneer in personalization, selling customized jeans directly to shoppers before the days of e-commerce. With a long tradition of selling in its brick-and-mortar stores, Levi’s is now adding branded stores-within-a-store, as with the Levi’s Tailor Shop. There, consumers can purchase an item in-store or bring in their own Levi’s gear from home to be embroidered or hemmed.

Levi’s Tailor Shops are located mostly in urban areas—San Francisco, Manhattan, Brooklyn, Orlando. This comes as no surprise given what data reveals about millennial buyers, a hotly targeted consumer group. Millennials largely avoid living in the suburbs, preferring to locate in major metropolitan areas. New Target stores, for instance, tend to be smaller and located near city centers—another reflection of where young customers now prefer to live.

Location Data: The Foundation of D2C Decisions

Manufacturers and brands that elect to serve customers directly are finding that they need location intelligence to grasp the demographics and psychographics of their core customer, as well as to understand competition and evaluate markets. The brand’s core customer might be different for each D2C channel and segmentation, so it is critical to get this piece right.

For manufacturers looking to open stores and displays, demographic segmentation shows where core customers live, work, and play, pointing to the best site location to reach them. The picture is more complex than it might appear. Location factors to be taken into consideration include demographics, consumer purchasing data, foot traffic, traffic generators (points of interest such as malls and conference centers), daytime population, and competitor locations. Some retailers have become so sophisticated in their use of GIS that they have algorithms to project how much revenue each prospective location will generate. (Stay tuned to WhereNext’s Growth Insights series for the story of a food retailer doing just that—on a massive scale.)

Once a manufacturer or brand identifies the appropriate general area for site selection, it can pinpoint the precise location by analyzing factors such as lease costs, space availability, square footage and accessibility, and the relative proximity of competitors.

After identifying its core customer (and the segments within that group), a manufacturer or brand can use location intelligence to find those people and determine which marketing channels make sense—whether it’s social media, direct mail, or another option.

D2C outlets such as company-owned stores are also a way to market the brand. Some retailers have noticed a halo effect: In cities where they maintain brand stores, total sales, including online purchases, tend to rise.

Reaching New Audiences

Selling D2C sometimes opens doors to completely new customer types. One maker of outdoor apparel recently used a multipronged strategy to broaden its customer base. The company defined a number of new target customers, started manufacturing apparel specifically for them, and created a D2C strategy —with the help of GIS-powered location intelligence—to open stores in opportune areas. The manufacturer had traditionally sold only through business-to-business channels that emphasized an audience of mostly rural workers. Now, with an expanded product mix that includes jeans, T-shirts, and fleece jackets, the manufacturer is reaching consumers directly through stores located in metropolitan areas and an e-commerce site.

The store locations reflect the company’s latest targeted customer segment. Initially, it sold to people who were literally getting their hands dirty on the job by offering clothing built to last. The newer products are more for everyday casual wear. The company is leveraging location data in its bid to become a household name, ensuring that its D2C outlets are located in areas inhabited by people who fit at least one of the new customer personas.

(For more on how to define core personas, visit this WhereNext article on unified commerce.)

Knowing a brand’s detailed customer segments and related demographics is key. And that means understanding the best way to approach a new channel before jumping in—case in point: Amazon’s acquisition of Whole Foods. The online shopping giant arguably knew everything there is to know about e-commerce. But the purchase of Whole Foods meant that Amazon needed to understand things it had never had to worry about, such as a different kind of segmentation and how to run a store. Although most reviews to date have been positive, early stumbles resulted in some product quality issues and general staff unrest. Even titans have lessons to learn when pursuing new D2C channels.

GIS Insight on the D2C Path

In many cases, companies use GIS-driven location intelligence to understand the D2C paths available to them. The technology shows executives not only where their best customers are located but how they prefer to shop, what brand qualities matter to them, and the demographics of their communities. (To maintain privacy, the data identifies neighborhoods or areas—not individuals—where the brand is reaching the right audience.)

That data steers manufacturers toward stronger decisions on how to grow their business. But it’s not about growth alone—it’s about the best growth possible for a particular business. For manufacturers and brands that harness location intelligence to understand their core customers, D2C growth will likely follow.

(To read the opening article in WhereNext’s Growth Insights series, visit “Planning the Best Markets—Intuition Meets Data.”)