The ongoing US-China trade war has driven one of the world’s largest corporations to reevaluate its production strategy. Nikkei Asian Review reports that Apple is mulling plans to move 15 to 30 percent of its manufacturing capacity from China to Southeast Asia.

As trade tension roils global markets, companies that nimbly adjust supply and production to minimize tariff costs can gain a competitive edge. Prominent global companies like GM and UPS have proven location intelligence to be a key driver of agile supply under any circumstances, given its ability to create visibility that helps edge out global competition.

Visibility Begets Agility

The protracted trade duel between the US and China serves as a reminder that supply chain visibility is a coveted but slippery goal for global companies. According to Kate Patrick of Supply Chain Dive, a 2017 survey by Geodis revealed that visibility was the third-highest priority among supply chain executives, but that only 6 percent of respondents had full visibility into their production life cycle.

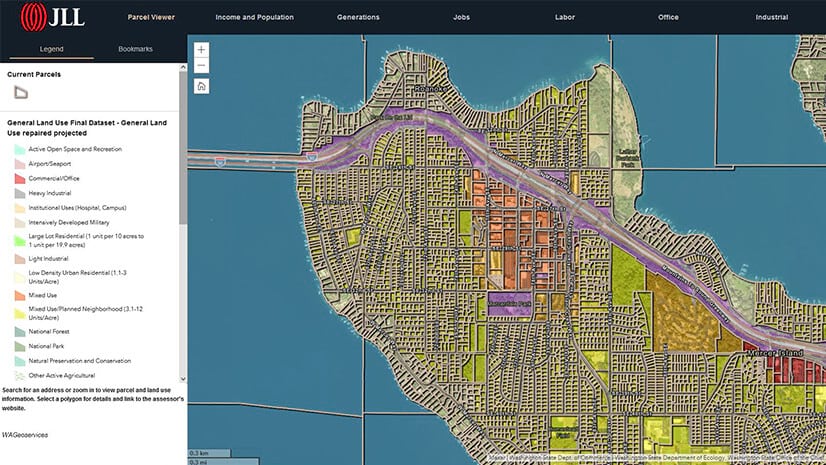

The nature of modern supply chains complicates the challenge. Where once they were linear and manageable, most today are fragmented and frenetic. They cover ever wider areas, requiring real-time data and analysis to understand the movement of goods and interdependencies among suppliers. Leading brands and manufacturers are using location technology such as a geographic information system (GIS) to create a digital version of physical supply chains, supported by continually refreshed data and cloud-based analytics. Companies with that level of supply chain awareness can adjust more quickly to changes in political, regulatory, or customer dynamics.

Yet moving production from one geographic region to another isn’t just a physical migration of assets. Executives must weigh transportation, labor, and other operational costs before making such a significant move. GIS-powered location intelligence facilitates if-then scenarios that guide those strategic decisions.

Global Operating Picture

According to SAP’s Matt Zenus in his podcast Creating the Insightful Enterprise: How Location Intelligence Strengthens BI, companies with strong operational visibility will be less affected by tariff wars and other phenomena that threaten to disrupt operations. Companies that can monitor place-based events such as weather, natural disasters, and political unrest can better see the impact of those events on raw material supplies and product movement. That has direct impacts on lead time in the supply chain, Zenus says:

If they’re normally expecting a part in 30 days, now they see some other event that’s happening. They now need to recalculate and say, “You know, because of this risk, it’s now going to be 60 days.” That’s a big deal because now they have to recalculate safety stocks [. . .]. So it’s taking into account all this information, everything from the purchase requirements to delivery and everything in between, and looking at how other ancillary events can actually impact your supply chain.

Through location intelligence, companies can peer into production and analyze complicated logistics scenarios when global realities change. As prominent manufacturers and brands continue to learn, such visibility is the first step toward the ultimate goal of supply chain agility.