Behind the headlines about retail crime—from the latest smash-and-grab event to takedowns of organized theft rings—are employees, managers, and customers who are concerned about safety, says Gary Sankary on the latest WhereNext Fast Four.

Shrink is the retail term for merchandise that disappears without being purchased. It’s a broad, almost breezy label for what has become a multibillion-dollar problem. And while theft by employees accounts for nearly 29 percent of shrink, the greater and more visible culprit is retail crime, which respondents to a recent poll blamed for 37 percent of their losses. Of late, those incidents are more likely to involve violence.

Sankary, who spent much of his career in retail management, believes a new approach to documenting and analyzing these incidents can help retailers address the problem more effectively. It all begins with location awareness, he explains.

Check out this brief Fast Four interview—or the transcript below—for details on how a location-centric view of retail crime sets the stage for greater awareness and prevention.

Chris Chiappinelli: Thanks for joining us on the WhereNext Fast Four. Today marks a bit of a shift for the series here. To date, we have brought you industry overviews on AEC, manufacturing, utilities, and other sectors. Now we’re going to focus on specific challenges that business executives face. Some will be related to an industry. Others will cut across the business world. So we might focus on how to keep up with generative AI or how to navigate supply chain disruptions.

Today, we’re talking about a topic that’s been in the press quite a lot lately: retail crime. I have Gary Sankary with us to shed some light on that subject, and also help us understand how location intelligence and GIS [geographic information system] technology can play a role here. Gary, why don’t we start at the beginning? What’s the situation that companies are facing here?

Gary Sankary: Well, Chris, really since the pandemic, retailers have seen a significant uptick in retail crime, theft particularly. If you’ve been listening in on earnings calls, they’re all talking about [how] their shrink rates are higher than ever. They’re losing billions of dollars to theft.

The National Retail Federation polled their members and asked, what are they seeing at the store? And 67 percent have reported not only increases in theft and criminal activity, but increases in violence when these events are occurring in their stores. So their team members and their customers are not feeling safe.

Chiappinelli: Has anything specific changed recently?

Sankary: The general consensus . . . is the organized nature of these crimes. It’s easier than ever to steal goods now and to fence them with all of the online marketplaces that are available. So I think what’s really at play here is that that equation between risk and reward for these bad actors is really out of whack right now.

Chiappinelli: OK. Where does location intelligence, location awareness come into play here?

Sankary: So it is a huge part, Chris. I mean, if you think about . . . All of these activities are happening in a specific place and they’re usually happening for a reason.

I just came back from a conference down at the University of Florida with the Loss Prevention Research Council, which is an industry think tank that the university sponsors, and they’ve been doing deep dives into retail crime for a lot of years. So, a lot of expertise down there. And they’ve created this bow tie model, which I think is really compelling and resonates with me.

If you think about a bow tie, I’ve got two sides and a knot in the middle, and in this particular model, the knot in the middle is what they would call the bang. That’s the event. That’s somebody stealing something. It’s somebody assaulting somebody. That’s the crime.

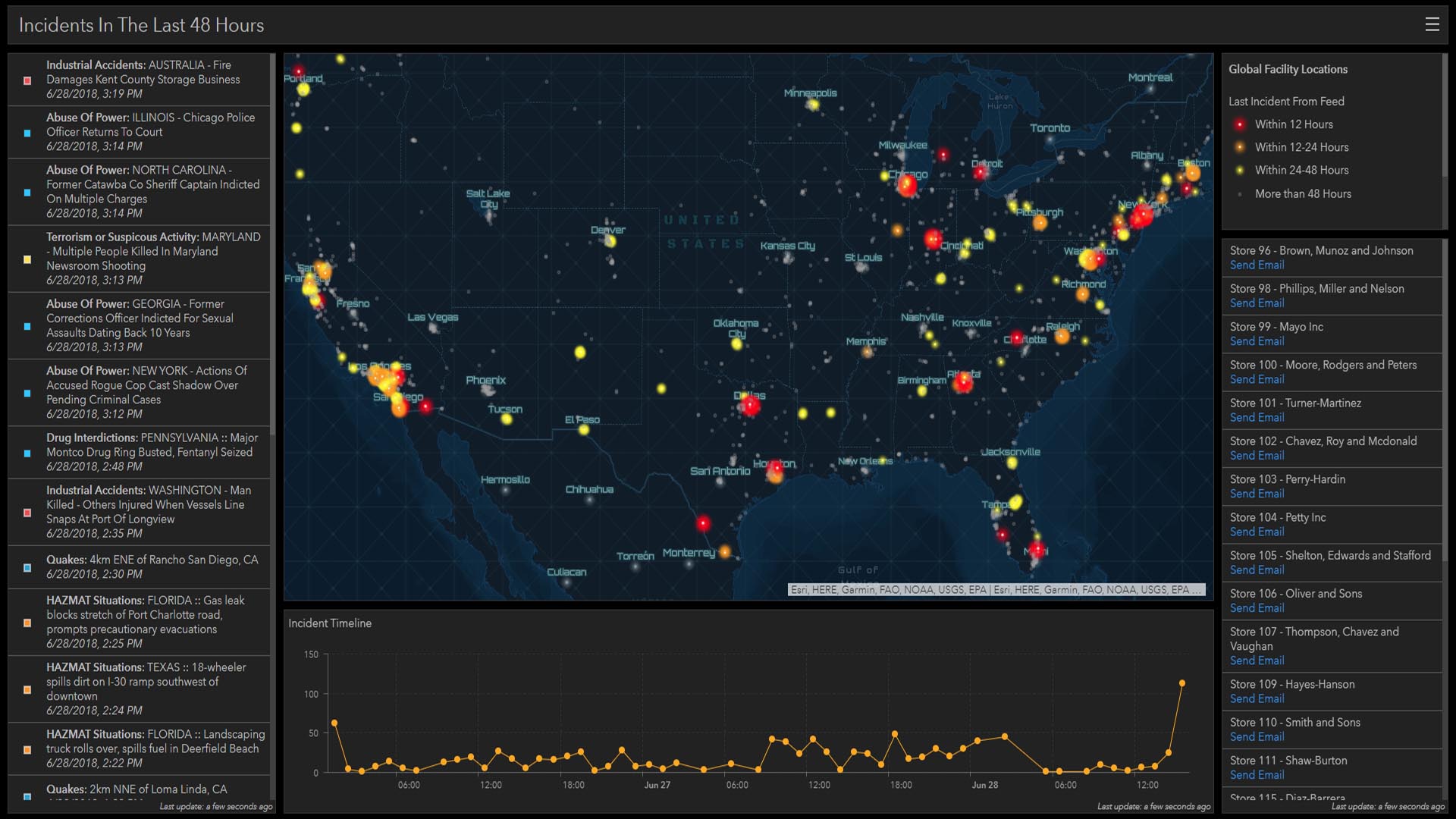

When the event occurs, location intelligence can create that authoritative record of that event: where it happened, what time it happened, where in the store. What was the situation? Was it a busy day? Was the store empty at the time? All of those different data points that are going to come in handy later when we move to the “what do you do after the bang,” which we start to get into recovery and prosecution.

So obviously helping—if there’s a case to be built for law enforcement—having that data is going to be really, really critical.

But also being able to aggregate those events and aggregate those attributes of where the event occurred, which becomes really powerful if I can do it across brands. . . . Thieves are not brand specific or brand loyal, for the most part. They spread that around. But if I can start to say, “These are the events. Here’s all these geographic attributes. Again, this is the type of neighborhood. This is the traffic pattern,” and all of that, you can look for patterns in that data, which goes back to the front of the bow tie. So I can get smarter about prevention and mitigation. So I can now understand stores in a specific area are more likely to see these kind of crimes.

You’re trying to build a robust early warning system at the end of the day, and that is all going to be about location.

Chiappinelli: Got it. All right. Excellent insight, Gary. Tough topic to deal with, but I appreciate the insight from you.

Thank you all for joining us as well. If you want to learn a little bit more about the role of location intelligence in retail, check out the link on the video or in the article. We hope to see you again for the next WhereNext Fast Four.