To see how a business is performing, a CFO might conduct a four-wall analysis, examining factors inside a location that impact profit and loss, including labor costs, sales, and the cost of goods sold.

The exercise might explain internal dynamics—but it neglects important context. To plan effectively, C-suite leaders must interpret the far more complex, fluid landscape surrounding their operations. But shifting trade routes, environmental regulations, tax incentive zones, and geopolitical trends don’t fit neatly into spreadsheets.

“You can’t separate business from its location because that space defines its people, its cost, its customers,” says Tom Schenk, managing director of analytics at KPMG.

Businesses often turn to consulting firms like KPMG for guidance on adapting to the fluctuations of the global economy. Now, Big Four advisory firms are augmenting their strategic expertise with geographic information system (GIS) technology.

With in-house geospatial capabilities, consultants develop guidance tailored to clients and the locations where they operate.

Through the business insights generated by GIS, known as location intelligence, a Big Four firm like KPMG can match a real estate portfolio manager with a qualified opportunity zone to invest capital gains. A KPMG consultant can create a smart map with demographic and zoning data to help an e-commerce company find not only the best city for a brick-and-mortar store, but the best shopping district and street.

“Almost every single engagement we have, whether it’s a financial due diligence project or if it’s a buy-side or sell-side strategy, there’s a locational aspect to it,” says Dennis Latto, the company’s director of analytics and head of GIS.

Location Awareness among the Big Four

KPMG incorporated GIS as an enterprise technology last year to deepen the expertise it offers to high-powered clients including private equity firms, departments of the federal government, and Fortune 500 companies.

The geospatial technology platform helps KPMG consultants extract value from the roughly $5 million of third-party data the organization invests in each year. Insights derived from geographic patterns in credit card transactions or 5G cell phone towers help clients strategically position themselves in fields such as real estate analytics or electric vehicle (EV) infrastructure planning.

We can understand the full chain because we can understand what’s happening around the four walls, because location is key to understanding business—and increasingly so.

Turning to Spatial Analysis to Answer the Why Questions

When it comes to assessing location options, the business mindset has broadened, Latto says. “Now it’s, Why is it good? Why is it bad? What are the drivers affecting our business outside of the box of the location that we’re at?”

Spatial relationships define much of a business’s value chain, whether it’s the distance between a supermarket chain and its competitors, or the layout of a supply chain. Location software brings key relationships to light and unpacks the implications for decision-makers.

When an artificial Christmas tree company wanted deliveries to reach 99 percent of customers within two days, KPMG’s GIS team helped optimize the distribution network, balancing delivery times with the lease rates and labor costs in different locations.

For a client assessing a site for a solar project, location analysis could surface several parcels with a similar grade of land, and identify one that provides a special tax abatement to expand the size of the project.

The Changing Landscape of Big Four Consulting

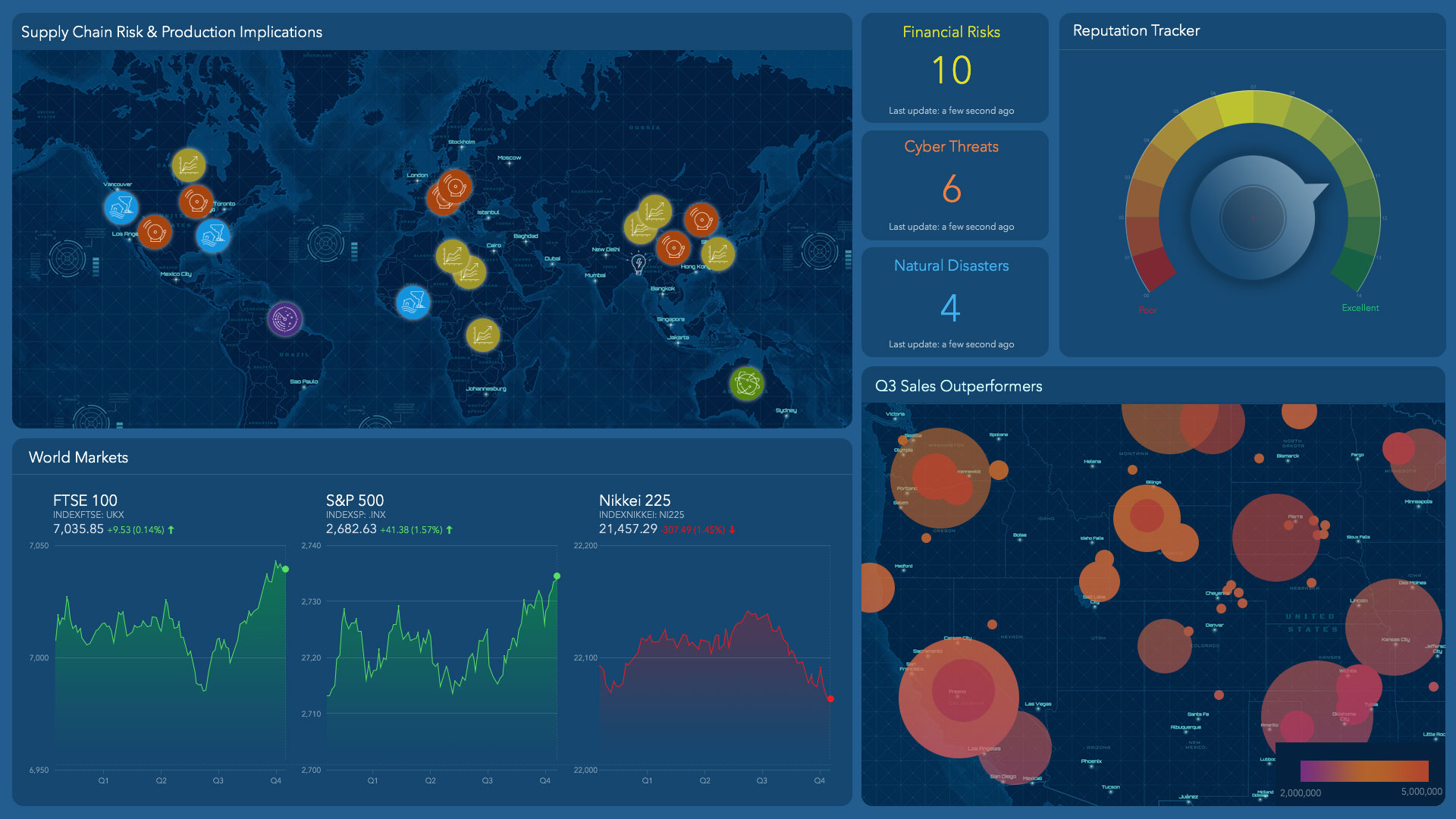

Today’s business leaders are building more sustainable and equitable organizations. As they do, they expect new forms of guidance from Big Four consultants. This includes deliverables like interactive maps and dashboards that are more dynamic than the slide decks that have been consulting’s lingua franca for a generation. Specialists in data technologies like GIS and AI are in demand.

Mindful of those changes, Schenk, who oversees an advanced analytics team that combines GIS with data science and software development, pushed KPMG to enlarge its geospatial capabilities. “It’s going to allow our business to interact with information and data like they haven’t been able to before,” he says.

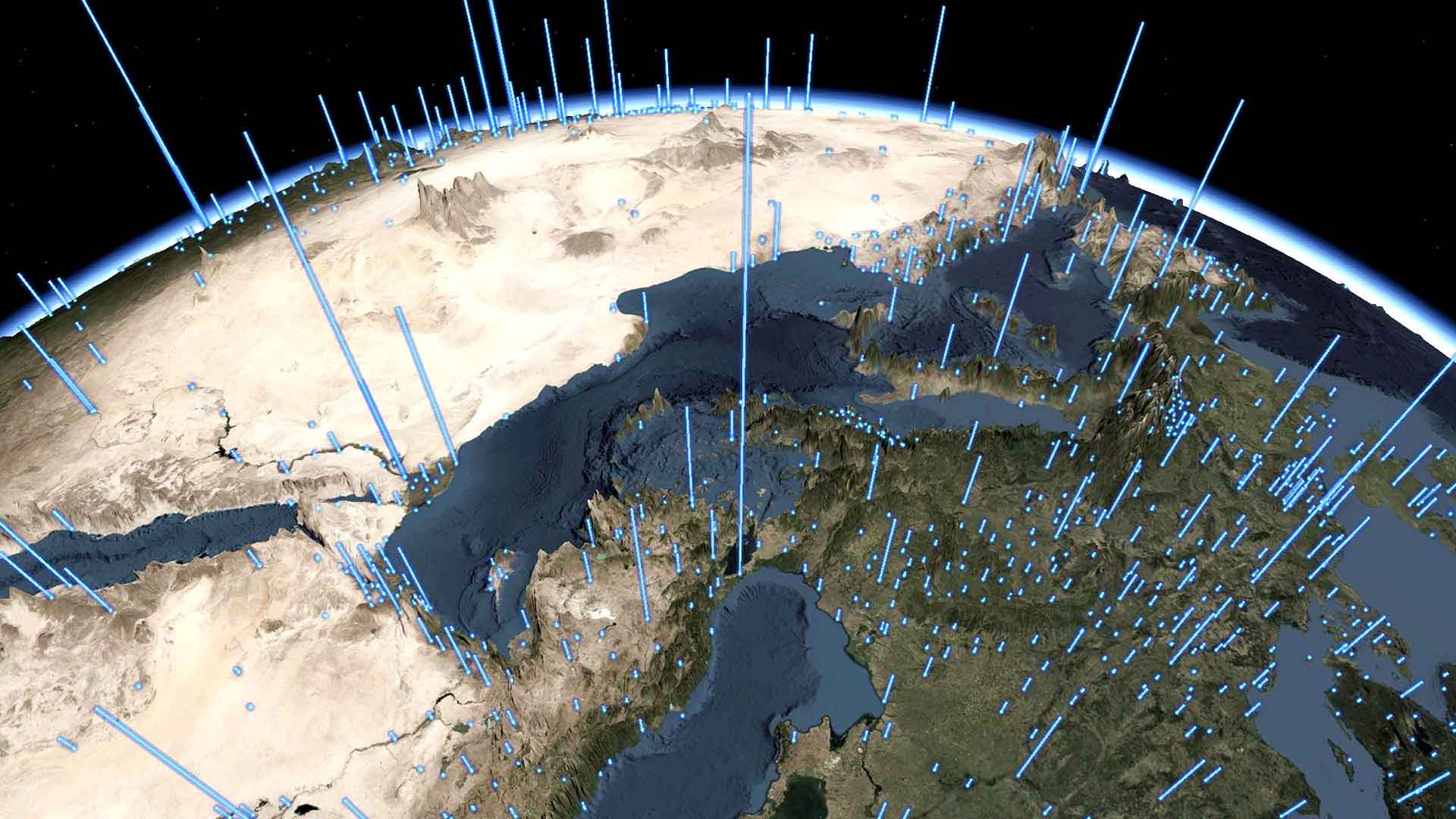

Schenk first realized the potential of geospatial technology in his former role as Chicago’s chief data officer. His department created a situational awareness platform as the city prepared to host NATO and G8 members.

“We needed to understand what was happening everywhere,” Schenk says. “Geospatial became crucially important.”

GIS software wove together data on 911 calls, weather reports, the location of city-owned vehicles, and other metrics to provide a real-time picture of event management.

At KPMG, Schenk manages a team of data scientists, GIS and AI specialists, mathematicians, engineers, software developers, and business intelligence analysts. Schenk and Latto, who led the effort to build the organization’s geospatial platform, have already seen GIS enhance collaboration among data scientists, deal teams, and KPMG leadership. Instead of employees manually editing a slide deck, a location-aware dashboard brings trends to life by displaying and updating data visually, streamlining the flow of information.

“The prevalence of location data is so far and broad, it can’t be treated as a specialized form of analytics anymore,” Schenk says. “The landscape has completely changed.”

The value of working in a firm like KPMG is the analytical horsepower we could bring to the market and to our clients. We have integrated geospatial analytics and data science to support this effort.

Consulting on the EV Gold Rush

Thanks in part to an influx of federal funding, Big Four consulting firms are seeing ballooning demand for strategic expertise in the EV market.

The IIJA, for instance, allocated $7.5 billion to build a national network of electric vehicle chargers, and the IRA and CHIPS and Science Act include provisions to boost electric vehicle development. Over the past year, EV and battery makers have committed to investments of at least $52 billion in North American supply chains.

“We kind of call it the gold rush right now,” says Michael Stacey, a KPMG director based in Cleveland, Ohio, who consults on infrastructure and climate. Stacey teamed up with Latto and Schenk to leverage GIS technology in developing KPMG’s electric vehicle infrastructure insights platform.

With this platform, consultants can cater to state department of transportation planners as well as private developers. Location technology makes sense of drive patterns, demographics, and electric power transmission networks. Stacey calls GIS “the analytical horsepower behind a lot of what we do in our infrastructure practice.”

The decision-makers overseeing EV charger placements need to factor in elements like access to power, where chargers are most likely to be used, return on investment, and service to disadvantaged communities.

The spatial framework of KPMG’s insight platform helps address classic questions of where to play and how to win, as well as newer equity-related concerns. “To be able to inform those decisions, a GIS tool is going to be critical,” Stacey says.

Consultants: The New Data Innovators

As the use of GIS spreads among KPMG consultants and data professionals, its value lies in making sense of what Schenk calls “blobby data”—data from networks of roads, sensors, trade areas, and other areas of the built environment. Tables can’t capture the growth of those networks. But with GIS, Big Four consultants can combine multiple layers of information and find the patterns that unlock business value for clients.

Data aggregators are important, but the value they deliver can be limited, Latto says. “We are data innovators, blending different data sets to create something unique. A new perspective or new insights for our clients is one of the big driving factors that we work on every day.”