The United States is home to more than 700 counties classified as rural, and in recent years, most have seen their population decline. But a recent Wall Street Journal report shows surprising findings hidden in that location data—the kind astute business planners will use to gauge where and how to serve changing communities.

From 2010 to 2020, while most rural populations shrank, 162 rural counties grew, according to the WSJ report. For those that expanded, nearly 19 percent of new arrivals in the median county were 55 or older—a gray wave that contributed to rural revival.

Analyzing such trends through a geographic lens can reveal new business opportunities, as an influx of active retirees spurs economic momentum in some rural counties. Flush with free time and disposable income, seniors could become key customers for real estate professionals, investment advisers, restaurateurs, tax planners, and apparel retailers.

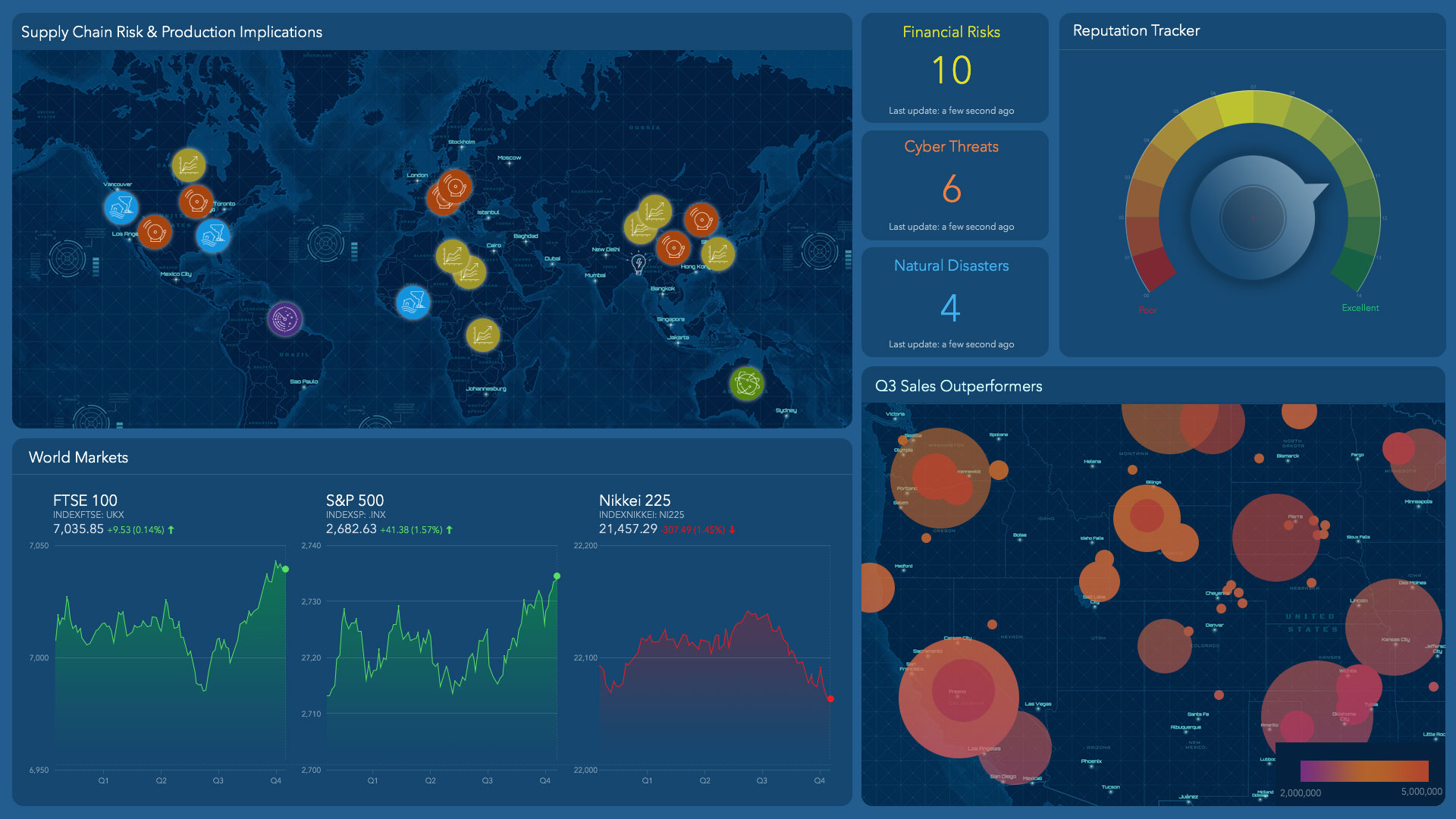

Business planners and real estate committees are increasingly relying on geographic information system (GIS) technology to uncover these market changes. By analyzing five-year demographic projections and human movement data, for instance, savvy business leaders gain awareness of where consumers shop and which products and services they value.

Data Fuels Business Strategy

By 2030, one in five people in the US will be over the age of 65, and baby boomers, born between 1946 and 1964, will maintain their status as the country’s wealthiest generation, according to the Deloitte Center for Financial Services.

GIS-based predictive analysis deepens this insight, revealing counties where the senior population is likely to rise in the next several years. With that location intelligence, a national home builder might adjust its location strategy, a home security company might begin marketing franchise opportunities in new markets, and a tax firm might consider launching a cluster of satellite offices. Some of the world’s best-known retailers have long used location analysis to build their brands in profitable geographies.

Finding Meaningful Connections

In rural counties, suburban areas, and High Street shopping districts, location intelligence brings clarity to where customers are located, where they’re moving, and how to reach them.

For Dale Sanford and his team at Mortenson Dental Partners, each expansion into a new geographic region is guided by a detailed GIS-based analysis. The company provides general and specialty dental services in nine states and 100 communities, and has come to depend on location intelligence.

“We look at things like population density, population growth rates, average annual incomes, education levels,” Sanford, the vice president of development and integration, told WhereNext. “We’ve even, at times, used things like purchases of dental consumer products in the market.”

Global real estate firm Knight Frank uses location analysis to advise clients on population shifts that could disrupt their business—or present new opportunities. A recent WhereNext article on shifts in the senior population explained how:

To identify the right mix of age, income, and personal interests for the investors, developers, and business executives it consults, Knight Frank relies on GIS software that can analyze markets in the context of location. The firm can locate concentrations of seniors bearing a trait that distinguishes them from previous generations: economic clout at retirement age and beyond.

For Ian McGuinness, a partner at the firm, a geographic approach is indispensable. “Spatial analysis finds us the right balance of market and demographic conditions, uncovering opportunities particularly suited to individual clients,” he told WhereNext.

As they plan for retirement, many seniors will choose to live near their adult children or in the same community where they raised families. But as the Wall Street Journal article notes, others will set roots in new areas—some rural—that better match their lifestyles. Companies that harness location intelligence to monitor those shifts will be better positioned to forge customer relationships—no matter how economic conditions change.