America’s CHIPS and Science Act was designed to ignite a renaissance in the US semiconductor industry. But before President Biden’s CHIPS Act can realize its vision, industry executives must determine the best locations to support the demands of semiconductor fabrication plants, known as fabs.

The centerpiece of the 2022 landmark bill is a $52.7 billion investment in subsidies to encourage manufacturing of microchips, which power nearly every form of modern technology, from supercomputers to smart wearables.

Fabs require abundant reserves of energy and water, a specialized labor force, and access to rare-metal supply chains. Chipmakers must balance these inputs against concerns about environmental impacts and fierce competition for technical talent.

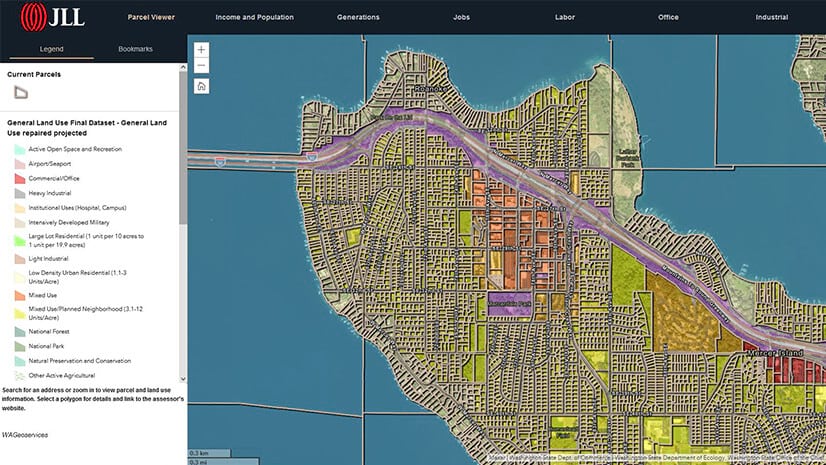

Sophisticated software like geographic information system (GIS) technology will be key to guiding this nationally significant site selection process. Armed with the insights of GIS, known as location intelligence, manufacturing executives can expedite the search for locales that will support long-term growth.

A New Map of US-based Semiconductor Production

In recent years, the concentration of fabs in Southeast Asia has created supply chains that can be vulnerable to climate volatility and geopolitical tensions. Onshoring chip production will result in greater resilience, proponents say.

Texas and Arizona are among the leading candidates for new fab facilities, thanks to production hubs that already thrive in those states. But Ohio, New York, New Mexico, Oregon, and other states are also competing to bring chip manufacturing to their economies.

The choice of where to site fabs will depend on more than tax subsidies. Executives making location decisions must weigh several factors. When it comes to resources, water availability is near the top of the list. An individual fab can use tens of millions of gallons per day for production, cooling, and cleaning. In Arizona, the prevalence of droughts is already on the radar of firms like Intel and TSMC, which plan to add chip manufacturing capacity in the state.

Across the manufacturing industry, firms are turning to GIS-based maps to monitor current water availability for new infrastructure and model how climate change might affect supply in 10 or 20 years. The operational intelligence provided by this geographic context can also help identify sources of water waste or opportunities for reuse.

Energy will be another major consideration for chipmakers. Large fabs can use up to 100 megawatts of power every hour—outstripping the energy demands of many oil refineries and car factories. At the same time, manufacturing executives are increasingly sensitive to energy efficiency, as their end users and customers push toward net-zero goals. Even before construction begins, companies are using GIS models to estimate the carbon emissions of new buildings by interlacing data on power grids, materials, and supply chains. With energy-related emissions differing by as much as 80 percent between cities, location analysis will play a key role in siting fabs to take advantage of the clean energy transition.

Workforce analysis is a major component in determining new chip-making locations. There are currently around 100,000 employees who work in semiconductor production and circuit manufacturing in the US. That number might need to double to meet the demands of the projected new fabs.

With location-aware dashboards, executives can compare pay rates across dozens of cities and determine the most competitive salaries for semiconductor technicians and processors. Location intelligence gleaned from smart maps can highlight talent pipelines like universities or technical schools, and pinpoint regional labor pools whose employees might be reskilled for fab work.

Making the Future of Innovation Geographically Equitable

Geography was front of mind for the authors of the CHIPS Act and other recent federal legislation, not only in boosting domestic production, but ensuring the equitable spread of innovation and economic growth across the country.

Another part of the bill provides $10 billion for the creation of 20 innovation hubs in places that aren’t already leading technological centers. Private-public partnerships of industry-leading companies, research universities, and other organizations can apply to bring these centers to their region.

The Department of Commerce will favor small rural communities and low-population areas when siting and funding the innovation hubs. GIS maps can be effective tools for communicating why a town fits the requirements for federal grants.

It will take time to determine the true impacts of the CHIPS Act. But even at this early stage, it’s clear that geographic context will play an important role in steering the next generation of domestic chipmakers toward success.