What will the green economy mean for international trade? A groundbreaking carbon tax on imports to the European Union (EU), set to take effect this year, might contain some early answers. What’s clear already is that a geographic approach will help executives understand the new law’s implications for their companies.

For global manufacturing firms, the policy shift highlights why executives need a consolidated view of operations to navigate a worldwide economy adapting to climate change.

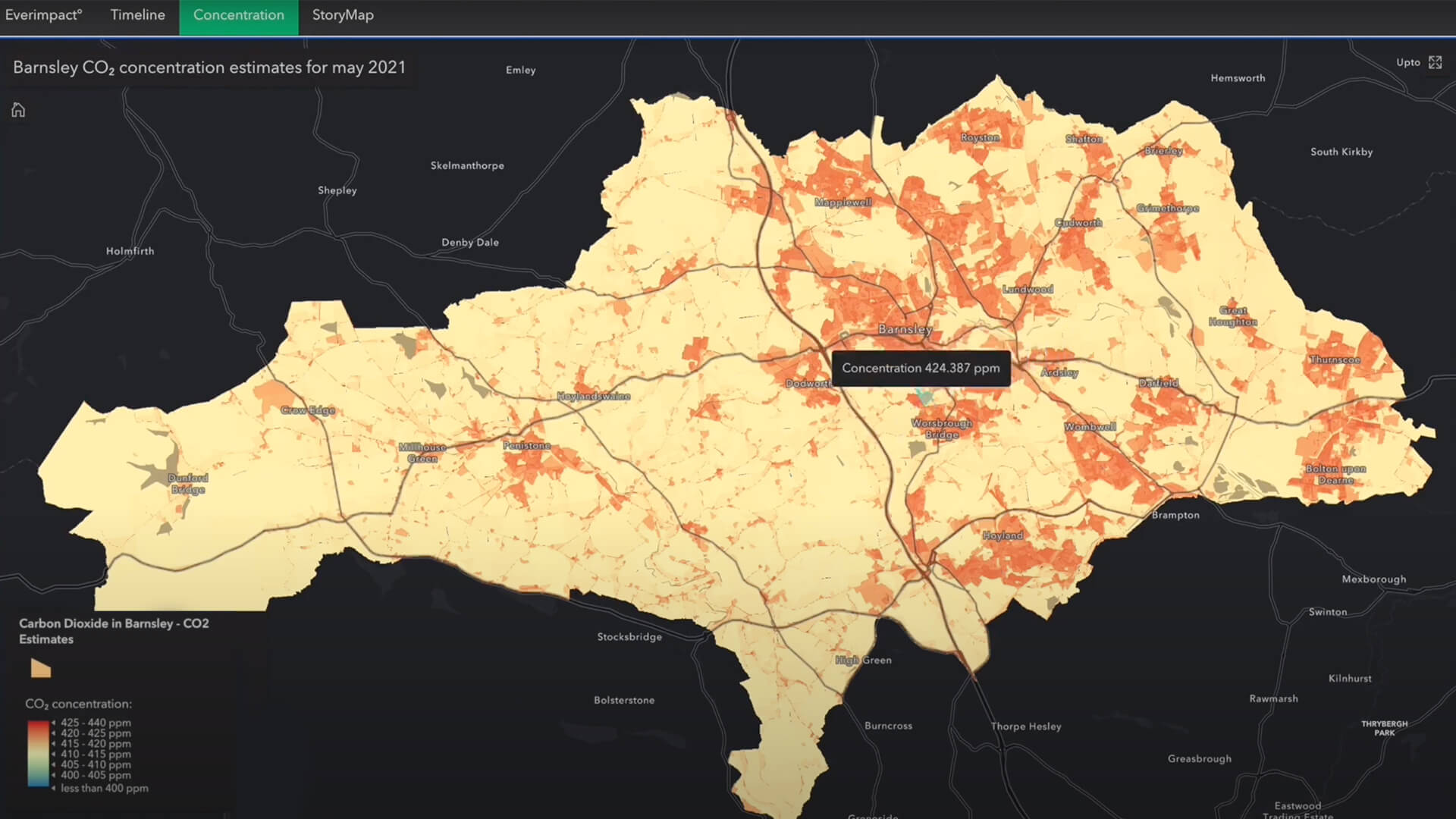

Many manufacturing firms already use a geographic information system (GIS) to gain operational awareness of potential disruptions from extreme weather or knotted supply chains.

Now, the same technology could arm executives with the location intelligence needed to respond to bold new climate legislation.

Navigating CBAM and Future Climate Legislation

The EU’s Carbon Border Adjustment Mechanism (CBAM) is the first of its kind. The law is designed to ensure that companies and countries that sell products in EU nations factor greenhouse gas emissions into the price of their goods, just as bloc members do now.

In the EU, manufacturers must pay for each metric ton of carbon dioxide their operations emit beyond a set cap. CBAM will essentially place the same requirement on producers that import goods into the EU.

Under the current provisional agreement, CBAM’s first phase will go into effect in October 2023 and require trade partners to collect and report data on carbon emissions, with the actual levy to come later. Current guidelines affect only the biggest carbon-emitting sectors—cement, aluminum, electricity, hydrogen, iron, and steel—as well as a few products upstream and downstream of these industries.

Mapping Climate Impacts onto Global Trade

For businesses with geographically complex supply networks, a map that displays the country of origin and country of sale for various products, along with associated revenue, can help business leaders establish priorities and develop a plan. Location technology can also enable executives to monitor sources of emissions throughout the value chain.

In assessing CBAM’s effects, business leaders will need to weigh the cost of the tariff against the cost of lowering carbon emissions, among other factors. With insights from spatial analysis, executives can identify the goods and trade routes that will be most affected by the new EU rules.

For instance, based on the location intelligence gleaned from GIS, a global manufacturing CEO might decide to close aging manufacturing plants with the highest rates of carbon emissions, or sell off legacy assets with poor energy efficiency. Alternately, the CEO might invest in carbon capture and storage (CCS) strategies to reduce emissions and decrease carbon exposure, as many oil and gas firms are now doing.

Some executives might determine that for the time being, paying the tariff is necessary until they can formulate a comprehensive plan to deal with climate impacts. The scenario planning capability of location technology could help justify these decisions with data.

The Future of Carbon Regulation

It’s likely that the EU’s pioneering legislation is a harbinger of things to come. In the US, a bill introduced by Senator Sheldon Whitehouse called the Clean Competition Act similarly aims to place a carbon tax on goods entering the country. Countries most impacted by CBAM, like Turkey, Bosnia, and Herzegovina, have begun changing practices to move toward decarbonization.

As carbon regulations become increasingly common, companies with an accurate, real-time accounting of where and how they produce emissions will have an important advantage over less-informed peers.

Photo by Olga Subach