Environmental, social, and governance (ESG) concerns and the role of data analysis are two of the primary preoccupations of manufacturing executives, a recent PwC survey found.

To compile the “Manufacturing COO Pulse Survey,” the professional services firm talked to 600 manufacturing executives in China, Germany, Japan, the UK, and the US, asking which issues, technologies, and goals were top priorities in coming years.

A geographic view of the survey findings reveals important nuances that global executives in all sectors can use to navigate regional variations.

Across the board, leaders acknowledged that creating more efficient operations often means making them more sustainable. Yet longer-term environmental concerns around carbon reduction took a back seat to more immediate resilience efforts. And while firms signaled the importance of technologies like cloud computing and analytics, executives in certain countries emphasized or downplayed those priorities according to their digital maturity.

Global Concerns, Regional Priorities

In the aftershocks of the COVID-19 pandemic, manufacturing executives have found themselves pressured from all sides. Hobbled by a slowed global economy, firms are suffering from supply shortages triggered by widespread delays in raw materials. These supply chain chokepoints have strained balance sheets. At the same time, manufacturers face overwhelming demand from certain sectors as consumers fuel interest in everything from bike parts to medical equipment.

Still, global generalizations are hard to make at a moment when China’s manufacturing industry is grappling with power outages and Germany is implementing a law forbidding the use of suppliers that employ child laborers. Understanding the state of manufacturing requires a fine-tuned geographic approach.

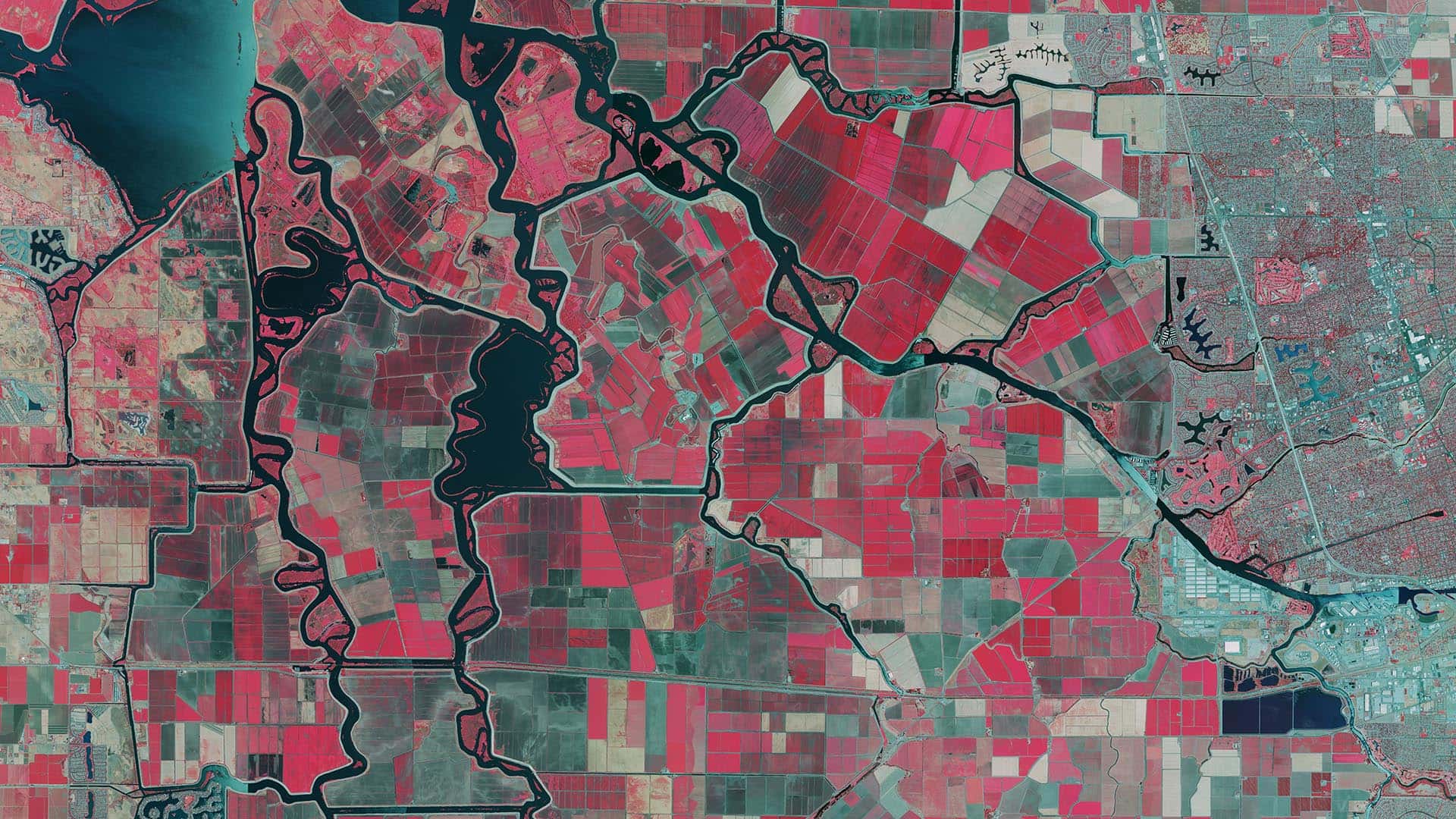

Such spatial business insight—known as location intelligence and generated by a geographic information system (GIS)—can help technology firms, ESG consultants, suppliers, and retailers understand the forces shaping the future of manufacturing.

A Complicated Portrait of ESG Priorities

When asked which ESG objectives they were measuring in their operations, manufacturing executives overwhelmingly named energy efficiency their top choice. The range extended from 84 percent of executives in Japan to 77 percent in Germany.

The focus on energy efficiency was even more pronounced among executives in the engineering and construction sector of manufacturing: 100 percent of those executives in China and the UK said they were focused on energy efficiency.

Such agreement among business leaders in countries with vastly different economies and cultures reflects a new consensus that modern business continuity requires sustainable resilience. Making a company more energy efficient means cutting waste and saving money while reducing the use of natural resources.

At the same time, executives in the industrial manufacturing and equipment sector in China, Germany, and Japan gave some of their lowest overall marks to the importance of the supply chain carbon footprint. Similarly, manufacturing executives were generally more emphatic about measuring energy efficiency than greenhouse gas emissions. This may reflect a triage mindset that views cutting greenhouse gas emissions as less urgent at a time when companies are trying to rescue their bottom lines.

Digital Maturity in the Postpandemic Era

For UK respondents in all manufacturing industries, the lowest-ranking concern was cybersecurity, with just 33 percent of UK executives naming it an operational area prioritized by the board directors.

Similarly, when identifying which supply chain practices their company would prioritize over the next one to two years, just 38 percent of US manufacturing executives listed demand forecasting as a major focus—the lowest answer given by American firms in the survey.

On the technology front, US manufacturing leaders are more bullish on data analytics (50 percent) than their counterparts in China (39 percent) or Japan (37 percent). Meanwhile, cloud computing is a greater priority for manufacturers in China and Germany (both 53 percent) than for those in the US (39 percent).

Regardless of where they operate, companies that achieve competitive advantage don’t compromise on key technology practices. One US insurance company, for example, increased revenue by hundreds of millions of dollars in part by following a data-driven strategy focused on four A’s: advanced analytics, cloud architecture, artificial intelligence, and automation.

While many manufacturing firms embrace innovation and are adept at collecting data from shop floors and factories, creating a data-driven company that outpaces its peers demands a level of technology savvy that some surveyed firms haven’t yet embraced.

Getting Ahead of the Pandemic Curve

These challenges highlight the valuable role location intelligence can play in the path forward for global manufacturing firms. The PwC study reflects regional and national differences that businesses must capitalize on to compete. Smart maps can organize and analyze spatial data to surface trends on both supply and demand, helping manufacturing executives apply resources to areas of need. A modern GIS uses AI and cloud technologies to help executives contextualize and visualize huge reams of data.

Eventually, the manufacturers of the world will get ahead of the pandemic curve. Reaching that point, however, will require a stepwise strategy that incorporates modern technology and acknowledges the strengths and priorities of regional partners and competitors.