Most recent

Beyond Epi Info: Embracing the Next Generation of Public Health Analytics with GIS

As CDC sunsets support for Epi Info, we explore what the next generation of public health analytics will be.

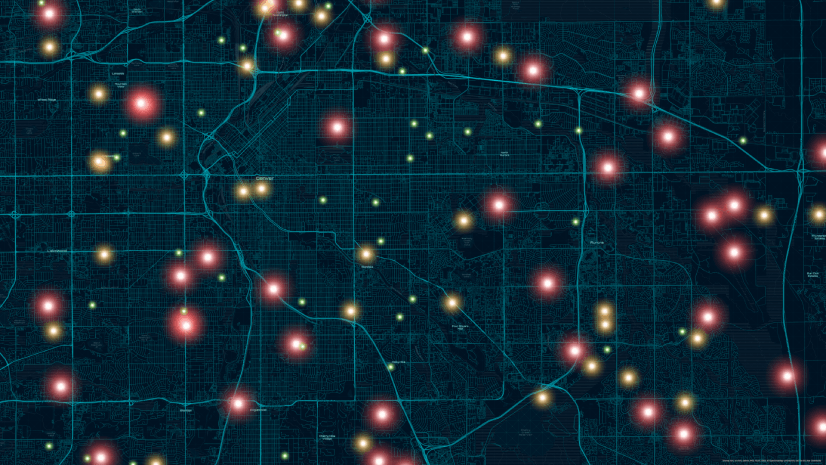

Mapping Accountability: A Geospatial Approach to Combating Fraud, Waste, and Abuse

Fraud happens somewhere. GIS reveals where—and why—so agencies can prevent loss, protect resources, and promote accountability.

Inside the Dashboard: A Look at Real-Time GIS for Tailings Management

Real-time GIS dashboards transform tailings monitoring with sensors, drones, and field apps—enabling smarter, safer decisions.

Shaping the Future of Energy with ArcGIS

Energy Resources GIS Conference Recap

Streamlining Stormwater Outfall Inspections with GIS Solutions

GIS-based solutions modernize outfall inspections and lead to more efficient and transparent work across the City of Rockford.

Conway Corp Powers Up with ArcGIS Utility Network

Conway Corp has used Esri’s products for more than two decades. Now has migrated to ArcGIS Utility Network

Jio Delivers AirFiber Across India leveraging the Power of GIS

Jio leverages Esri's ArcGIS to deploy AirFiber, providing reliable and affordable broadband connectivity across India

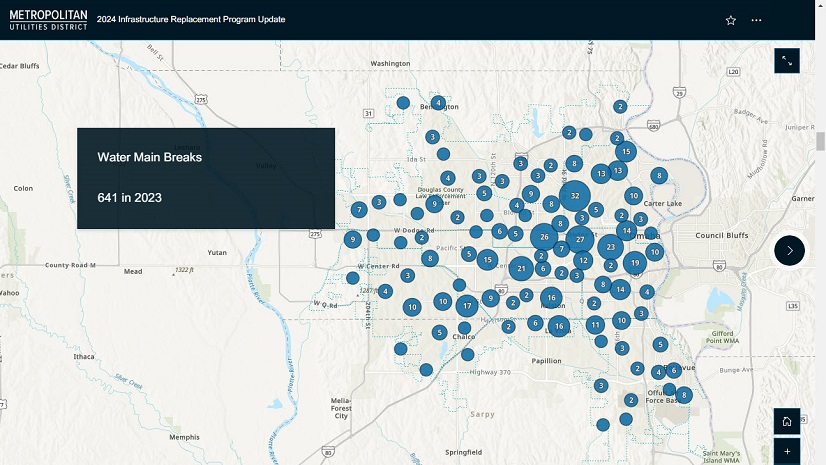

Advancing Public Works With Real-Time GIS

Public works use real-time data and GIS tech to boost efficiency, transparency, and service delivery.

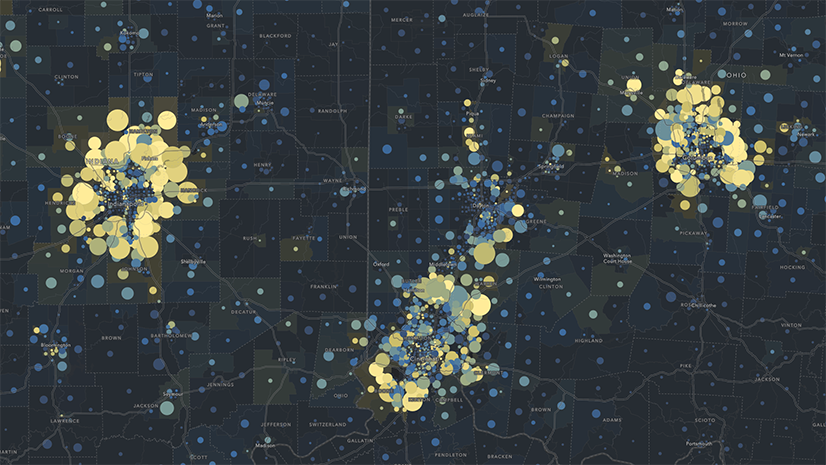

Four Takeaways from the Equity and Social Justice Seminar

Learn what was shared at the recent Esri Equity and Social Justice Seminar.

Global Events, Local Threats: A Geospatial Approach to Safety and Security

From stadiums to summits, learn how GIS powers smarter planning, real-time awareness, and rapid response for critical event security.

Scalable and Maintainable Solutions for Vertical Asset Management

Milwaukee Metropolitan Sewerage District implements sustainable solutions for vertical asset management using BIM and Esri’s technology.

Public Works Meets AI: Takeaways from APWA’s First AI Summit

AI Summit by APWA in Jan 2024 educated public works professionals on AI definitions, ethics, training needs, and practical applications.

Tracing Ancestral Footprints: A New Chapter for the Grand Canyon

The Grand Canyon Trust and the Grand Canyon Tribal Coalition’s work was recognized as a finalist in the 2024 ArcGIS StoryMaps Competition.