As shoppers continue to embrace e-commerce, many executives overseeing brick-and-mortar retail strategies have enlisted an old maxim of business survival: If you can’t beat ‘em, join ‘em.

Brands are equipping clothing stores, convenience stores, and restaurants with in-store technology and sensors that mimic the advantages of online shopping. AI-assisted self-checkout options aim to speed up transactions, while Bluetooth-enabled shelf labels let shoppers view product reviews on their phones. “Smart” mirrors even offer personalized fit and style suggestions.

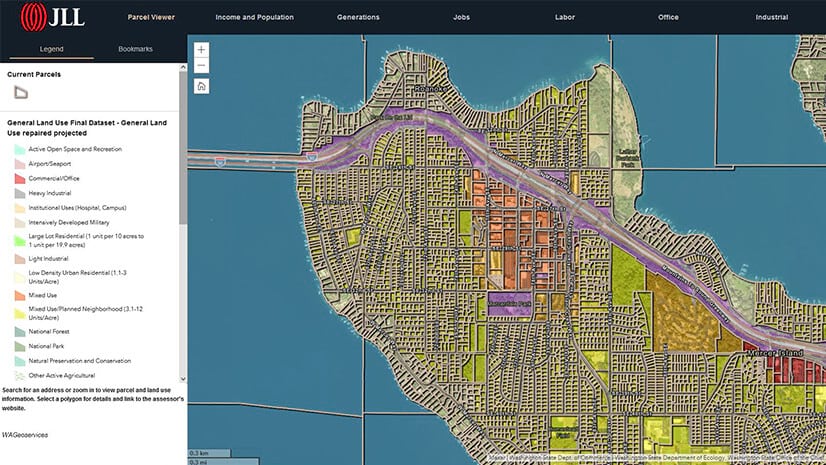

These in-store technologies are generating new data that could rival the information that helps online retailers customize content and offers to consumers. Through a geographic information system (GIS), executives add crucial location context to raw data.

GIS-powered dashboards can monitor how new retail technology is performing, revealing location intelligence that helps business leaders sharpen their strategy and improve customers’ store visits.

In-Store Technology and Profit Margins

According to analysis by McKinsey, creating a store of the future that incorporates digital technology into the in-person experience can double a retailer’s EBIT margin. In 2019, CB Insights found that investments in in-store technology jumped 60 percent, reaching $3.7 billion.

Alimentation Couche-Tard, the parent company of convenience store chain Circle K, recently invested in 10,000 innovative self-checkout systems which will be installed in stores in Europe, the US, and Canada over the next few years, according to Retail TouchPoints.

Rather than making the customer scan each item, the in-store technology uses AI-based software to streamline the process: a camera snaps a shot of all the customer’s items, identifies them, and tallies the cost—in less than a second, according to the company. The system is expected to improve customer checkout time by 400 percent.

Assessing Performance by Location

Shoppers might rejoice at shorter lines, and company executives could glean insight from the results. After introducing the new machines, a COO could consult a GIS map of the five stores with the highest ratio of self-checkout sales to cashier sales. By highlighting these locations, the executive could analyze commonalities between them and determine how surrounding factors might contribute to the performance of in-store technology.

High usage of self-checkout stations in downtown areas might indicate that those consumers are more rushed than suburban or rural customers, or that they are more apt to be early adopters.

Retailers that already use GIS to understand customer demographics can deepen their analysis with the new data, uncovering patterns among consumers who respond most enthusiastically to in-store technology. Company leaders could use this location intelligence to identify the optimal stores for future installations and avoid pouring resources into ZIP codes where machines are less likely to be used.

A New Wrinkle in Omnichannel Strategy

GIS-based smart maps could also help business leaders contextualize the role that in-store technology plays in balancing a brand’s brick-and-mortar sales and its online sales. Counter to some assumptions, a thriving physical store doesn’t usually cannibalize online shopping or vice versa—the two channels can be mutually reinforcing, a phenomenon known as the halo effect.

A map that shows the relationship between physical stores and digital channels might reveal that increased use of self-checkout machines corresponds with a bump in online sales, a sign that the new technology is driving brand loyalty.

By combining CRM data with GIS, business leaders can build buzz around the deployment of in-store technology. A digital marketing team might send an email to tech-savvy loyalty customers, alerting them to the rollout of AI-powered systems at a nearby store, and the time savings the technology can deliver.

A Data-Rich Shopping Landscape

This is just one example of the in-store technology that’s increasingly greeting consumers who shop in person. Adding sensors, digital kiosks, cameras, or even augmented reality tools will create a more complex picture, but also a data-rich tapestry from which location-savvy executives can draw crucial retail lessons.