With the recent rise in inflation, consumer buying behavior is shifting, and retailers are rushing to adapt. But a strategy that overlooks the role of location risks leaving customer demands unanswered.

Retailers are using in-store bargains, less-expensive store brands, and rewards programs to entice shoppers looking to save money wherever they can, according to the Wall Street Journal. Big-box retailers are shuffling inventory to reflect buying behavior, increasing the supply of private label items and modifying the sizes and quantities they sell. That might include stocking bulk packages of rice and beans and half gallons of milk.

Those adjustments are a response to recent data showing that over 80 percent of American consumers plan to reduce their spending by buying cheaper or fewer products. To anticipate how and where to adjust store shelves—and the supply chains that feed them—retailers and their supply chain partners turn to location intelligence, powered by geographic information system (GIS) technology.

Understanding and Adjusting to Consumer Buying Behavior

When consumer spending habits change dramatically, executives feel pressure to make smart decisions quickly. But aggregate numbers can hide regional variations in demand for certain product categories. Location intelligence adds clarity to that data.

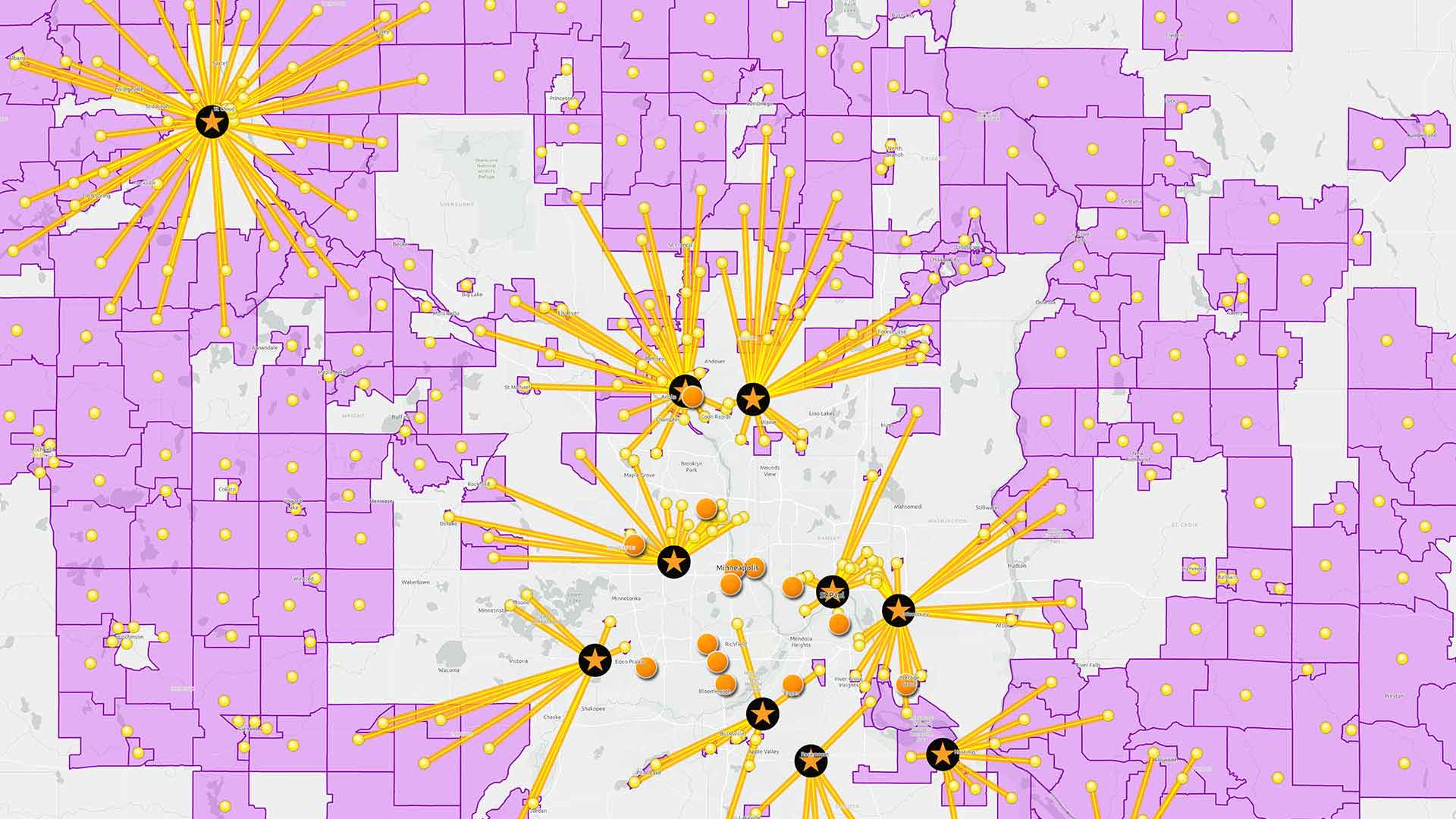

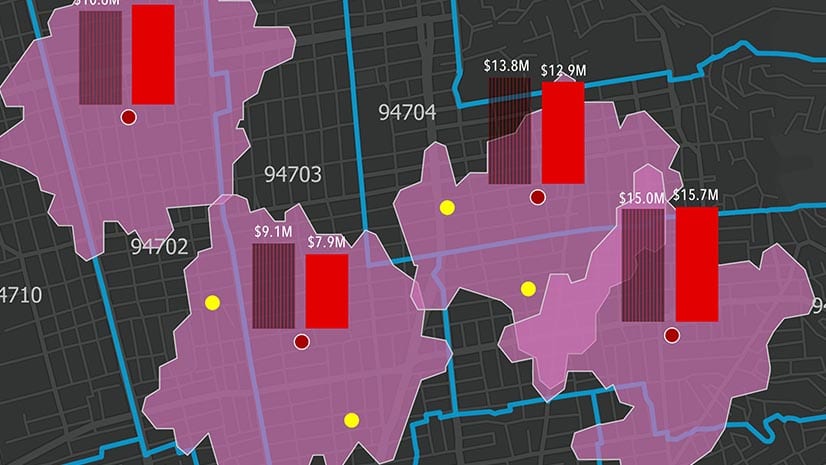

For a retailer with multiple stores, a GIS-based dashboard fed by CRM data and other consumer insight can reveal demand spikes for certain products in certain geographies. A map-based view can even uncover subtler patterns in buying behavior, showing a correlation in shopping habits, for instance, among stores with similar demographic profiles.

A retailer, manufacturer, or distributor can use the analytical capabilities of GIS to test supply strategies, assessing how to adjust the merchandise mix for customers in certain locations. Planners can weight variables such as transportation cost, delivery time—even how certain distribution routes will affect a company’s Scope 3 emissions and net-zero goals.

Visibility into the Supply Chain

Once a retailer understands how the merchandise mix should change to accommodate consumer buying behavior in specific locations, the next step is planning how to deliver the right inventory to shelves quickly. Merchandise planners need to know where alternate suppliers are located and how soon they can deliver products, or which distribution center should process those goods.

Viewing the supply chain on a map answers critical questions by revealing all the entities in the network—plants, multiple tiers of suppliers, distribution centers, and store locations. This helps companies see relationships, anticipate disruptions, and create contingency plans.

A digital map of the supply chain can also inform the best strategy for getting merchandise where it needs to go by revealing the most efficient and cost-effective combination of distribution centers, stores, and distribution routes.

One major US food producer recently discovered the benefits of that approach. As described in a recent WhereNext webcast, when the company’s GIS team analyzed the supply chain, they uncovered a significant number of mismatched routes. GIS analytics suggested ways to recalibrate the network, and the adjustments improved time to market and saved the company 50,000 gallons of diesel fuel, among other benefits.

Weathering Changing Consumer Demands

Business executives know well that many factors influence consumer buying behavior, including inflation. Location intelligence generated by GIS software shows companies not only where and how spending patterns change, but how new merchandise strategies and supply chain practices combine to satisfy consumer demand.