A foodborne illness outbreak is perhaps the ultimate nightmare for food service executives.

In the early, information-starved moments of a contamination crisis, food industry leaders are typically trapped between two unknowns: where in the supply chain the tainted item originated, and how far it has circulated through the distribution network.

The longer it takes to answer those questions, the greater the public health danger and reputational risk to the companies involved and the deeper the financial impact from product recalls.

A new tool built on geographic information system (GIS) technology could help companies quickly isolate potential outbreak sources. By employing spatial analysis to uncover patterns hidden in data, the insights of GIS, known as location intelligence, help companies future-proof their networks and lower the risk of food safety incidents.

Tracing Foodborne Illness through Complex Relationships

The US Centers for Disease Control and Prevention (CDC) estimates that around 48 million food safety instances occur each year. In 2018, such events cost the American economy $17.6 billion, according to the USDA’s Economic Research Service.

Identifying the source of a foodborne illness often poses a significant logistical challenge to restaurants, wholesalers, and distributors, especially if they lack the digital technologies needed for traceability.

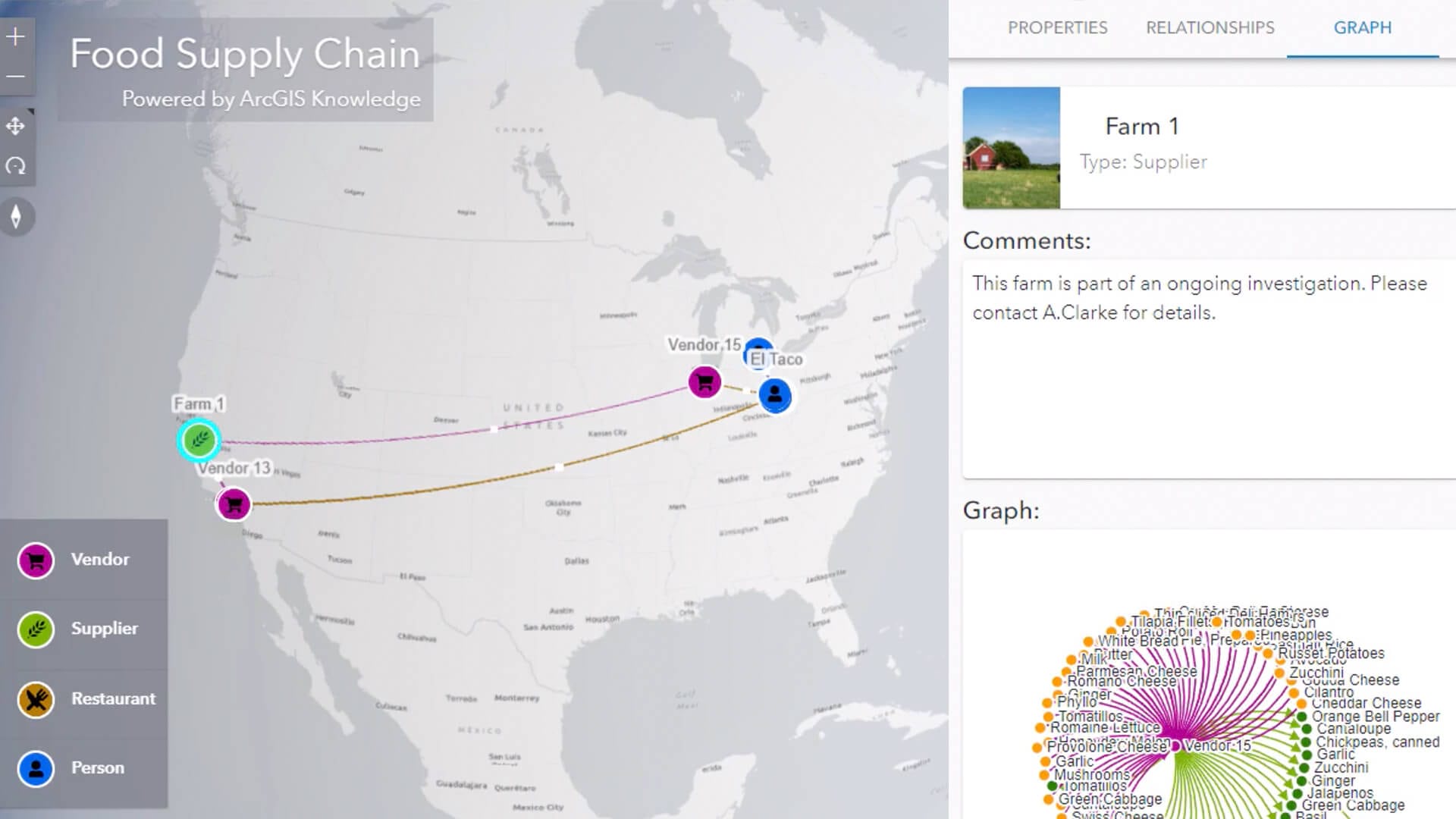

This video demonstrates how location intelligence identifies connections in the web of variables associated with the foodborne illness outbreak described below.

In this speculative but realistic scenario, the city of Columbus, Ohio has experienced an outbreak of cyclosporiasis, an intestinal illness caused by a parasite. A dashboard displays the geographic proximity of the sick diners. By clicking on individuals, a public health outbreak investigator can view data showing which restaurants the affected diners visited, which menu items they ordered, and when.

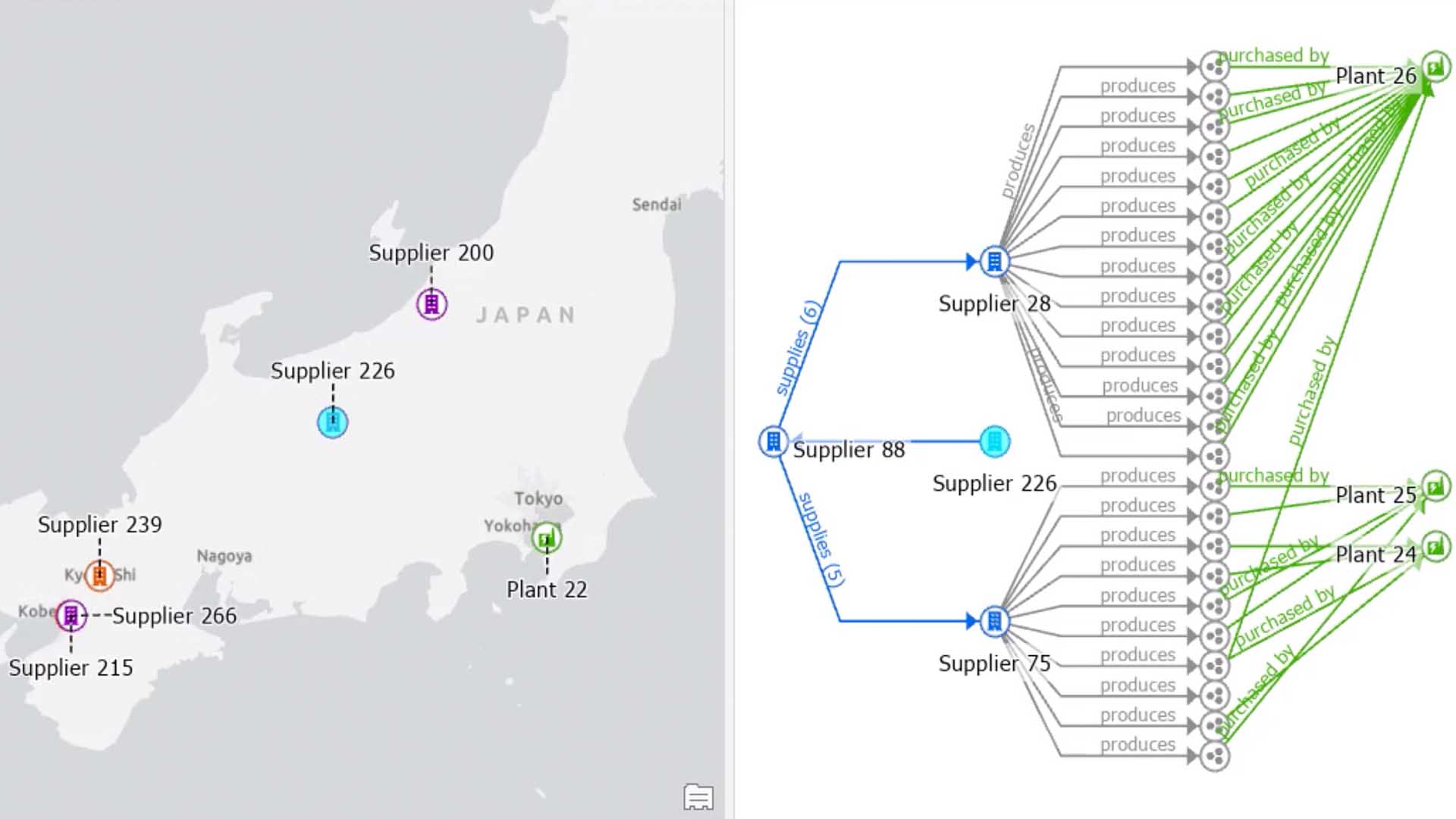

To find the common denominator among the afflicted residents, investigators need to examine the prior distribution tier: restaurant vendors. This web of companies is supported by an even wider network of national and international suppliers.

Visualizing their relationships brings into focus how even a single meal depends on a vast, interconnected global economy. In this example, a person who ate at 3 restaurants consumed ingredients brought to market by 11 vendors, who purchased raw food from 74 suppliers. Multiply those lines of distribution by numerous diners, and it becomes clear that the processing power required to quickly locate the origin of a pathogen easily exceeds human capability.

The GIS-based program analyzes the data in less than a second, identifying the common denominator: romaine lettuce supplied by a single farm, sold by two vendors to a series of restaurants.

Anticipating Risks before They Happen

The discovery path described above, which would entail gathering data and interviewing diners, is typically managed by a public health or regulatory agency. Businesses, however, could use the same mapping capability to anticipate problems, evaluate food safety risk, and take proactive measures, all through the lens of location intelligence.

With a supply chain dashboard, executives can see how partners throughout the food industry are connected, and flag which organizations have safety violations, compliance issues, or face auditing by regulatory agencies. Viewing these companies in a geographic context can help business leaders decide which suppliers to work with or avoid.

Similarly, mapping data on variables like climate change, pesticide use, water quality, and livestock density could inform food distributors of local conditions that might contribute to foodborne illnesses.

The same traceability technique could apply to other industries in which malfunctions or errors in the supply chain trigger cascading consequences. An auto manufacturer or tech company, for example, would benefit from the ability to monitor supply networks for a faulty semiconductor or transmission component.

Given the realities of today’s global economy—complex tiers of suppliers and distributors—sophisticated analysis technology like GIS helps businesses stay ahead of threats and contain risks, keeping nightmare scenarios off the C-suite docket.

For a deeper look at business risks, including how companies assess and address them, sign up for this WhereNext webcast featuring panelists from Lockheed Martin, Fannie Mae, and Bouwinvest.