What began as a technology to evaluate one potential store location against another has blossomed into a system of insight that guides retail strategy for some of the most recognizable names in the industry.

Amid the upheaval of COVID-19 lockdowns and the shifting realities of online shopping, geographic information system (GIS) technology is helping retailers spot patterns in customer preferences—guiding the likes of Swarovski, John Deere, and DICK’s Sporting Goods to the right blend of physical and digital retailing.

In this Fast Four video, Esri’s Gary Sankary explains what’s to come for a technology that has driven key retail decisions for decades.

Watch the video or read the interview transcript below.

Chris Chiappinelli: Welcome to the WhereNext Fast Four series. In these short videos, we explore the past, present, and future of location technology across the business world. Today, we’re talking about the retail sector and the consumer economy. Gary Sankary is here to discuss how companies in this industry are using GIS technology and location intelligence. Gary, let’s go back in time a bit. What challenge were retailers trying to address when they first used GIS software?

Gary Sankary: So the first adoption of GIS really came from the real estate departments. So as companies in the ’90s and early 2000s, especially some of the big names that we see today, were expanding as fast as they could across the country, they needed a really quick way to look at potential sites. They needed to evaluate them quickly. They needed to bring in a lot of the local data in order to understand if these sites were going to perform well . . . They may get three or four proposals in the town, and they want to know that they’re in the best spot.

. . . That is exactly what GIS is designed for—is to take a look at a geographic location and interpret datasets around that particular location to be able to [analyze] whatever thing you might want to look at. In this case, it happened to be market potential, market research, demographics. All of those things were brought to bear in one place, and then they could share them with the REC committee, or real estate executive committee, that made decisions, and they could move quickly on their acquisition or expansion strategies.

Chiappinelli: Got it. So if we fast-forward to present day, can you explain maybe a couple of ways that retailers are using the technology now?

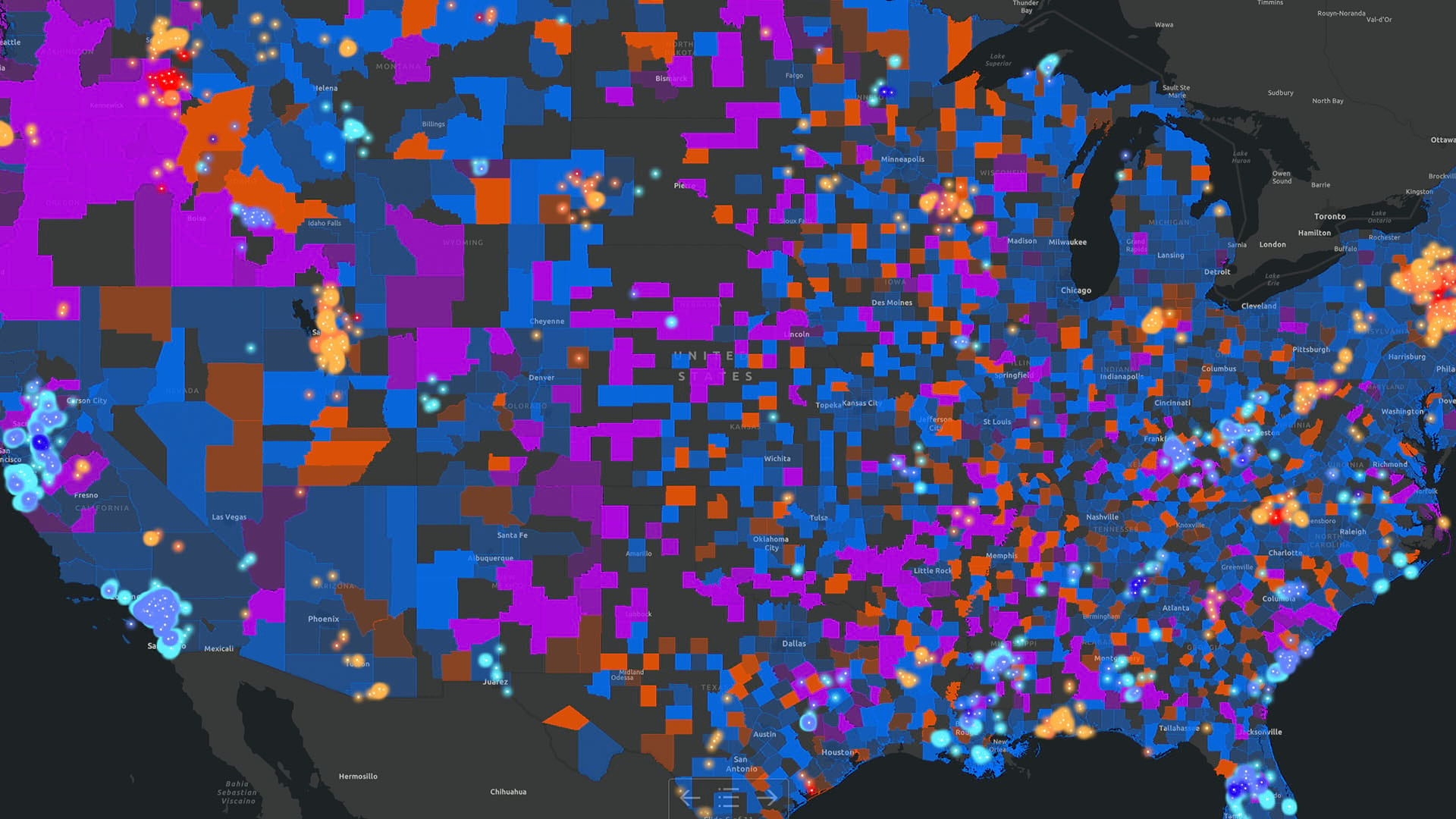

Sankary: Oh, now it’s really expanded, Chris. Now, we tend to see a lot of focus on really . . . instead of looking at individual locations and trying to evaluate a site for profitability, whatnot, today, it’s all about the total market and trying to understand . . . what are the market dynamics? In today’s environment, customers are interacting with retailers across multiple channels. So they’re coming in on mobile devices. They’re coming in online. They’re also looking at stores. [Retailers] also have a competitive presence in the market.

All of those different attributes interplay with each other, and in order to be able to really understand a holistic view of the market, they need to have a location-centric technology that can bring in all of this different kind of data and look at it relative to all of the locations within a given space.

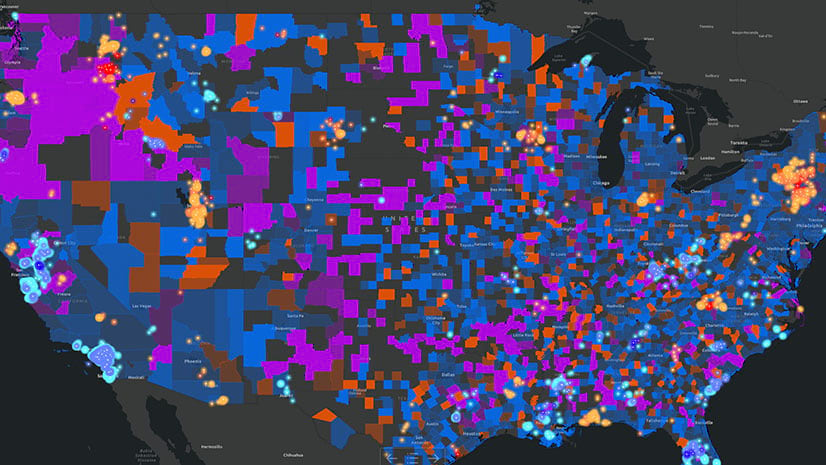

And I think another thing that’s really important is the idea of using correlation within GIS to understand types of customers. So if I know that my best customers tend to be . . . from this sort of a neighborhood or this part of a geography, I can create some attributes around those particular customer types, and I can use that to grow my market. I can find other customers just like them, or when I’m building a new location, or when I want to expand my marketing reach, I can have a higher percent . . . I can have a more favorable outcome if I’m in those types of neighborhoods or trying to address those sorts of customers.

Chiappinelli: That makes a lot of sense. So if you look ahead a bit, is there a challenge that’s maybe emerging today that’s probably going to gain a lot of traction in the next few years?

Sankary: Well, I think, especially here in the US, the days of the massive growth are more or less over. What we’re seeing now is retailers have to do more with the assets that they have in play, the stores that they already have. We don’t see a lot of companies out there opening 300 or 400 stores a year like we did in the past.

But how do I make my four walls more productive? And in order to do that, [retailers] want to get more precise with some of the analysis and some of the understanding of who their customers are in a given location. The better that they can reach those customers, the better that they can be more relevant from a product mix standpoint or from an offer standpoint. Really, the differentiating factor is retailers that are able to support their customers and understand behaviors across multiple channels, brick and mortar, digital, and so forth, and provide services like curbside pickup or home delivery. That’s become a big differentiator for them, and none of those particular strategies can be implemented without a location intelligence tool.

Chiappinelli: Makes a lot of sense. Not a simple time to be a retailer, but that’s really good context to help them out. So thank you for your time, for your insight, Gary. If you’re interested in learning more about retail challenges and geospatial technology, check out the URL on screen. Or if you’re watching us on WhereNext, see the link in the article. For the WhereNext Fast Four series, I’m Chris Chiappinelli. Thanks for joining us.